1040 Ez Tax Form Printable

1040 Ez Tax Form Printable - You had taxable income of less than $100,000. You must have a taxable interest of under $1,500 for the. Below is a general guide to what schedule (s) you will need to file. $0.00 your taxes are estimated at $4,121.00. Enclose, but do not attach, any payment. Web any us resident taxpayer can file form 1040 for tax year 2019. Web $36,150.00 federal income tax withheld:* $0 $1k $10k $100k earned income credit (eic): Web popular forms & instructions; You cannot claim dependents on your tax return. Web free with turbotax federal free edition.

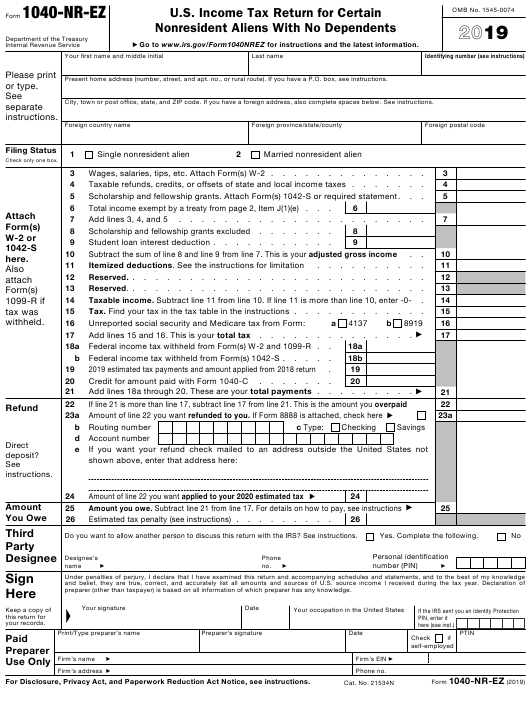

IRS Form 1040 NR EZ Download Fillable PDF Or Fill Online U 1040 Form

Individual income tax return 2019 omb no. Enclose, but do not attach, any payment. Your filing status was single or married filing jointly. Web subtract line 5 from line 4 and enter that amount on line 6. Individual tax return form 1040 instructions;

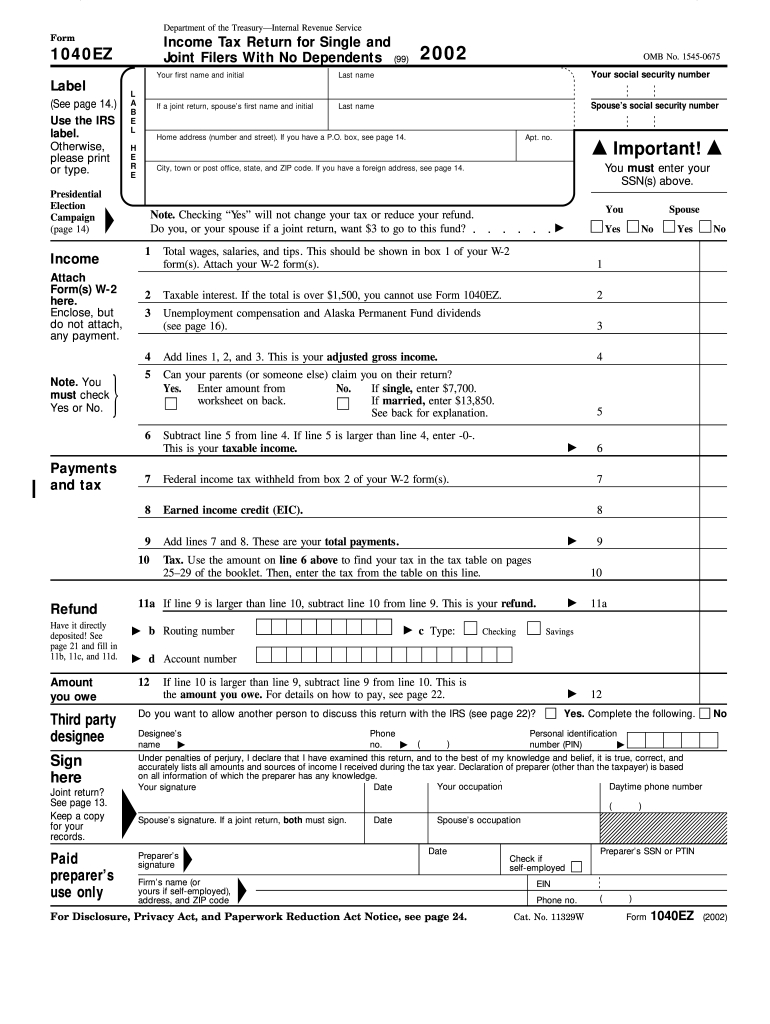

1040 Ez Fill Online, Printable, Fillable, Blank pdfFiller

You only received a w2. You cannot claim dependents on your tax return. Web before recent tax reforms, you could file with form 1040ez if: Do your 2021, 2020, 2019, 2018 all the way back to 2000 The short form 1040a and easy form 1040ez have been discontinued by the irs.

1040ez Printable & Fillable Sample in PDF

If line 5 is larger than line 4, enter 0 (zero) on line 6. The short form 1040a and easy form 1040ez have been discontinued by the irs. Web $36,150.00 federal income tax withheld:* $0 $1k $10k $100k earned income credit (eic): If the amount is more. Web get federal tax return forms and file by mail get paper copies.

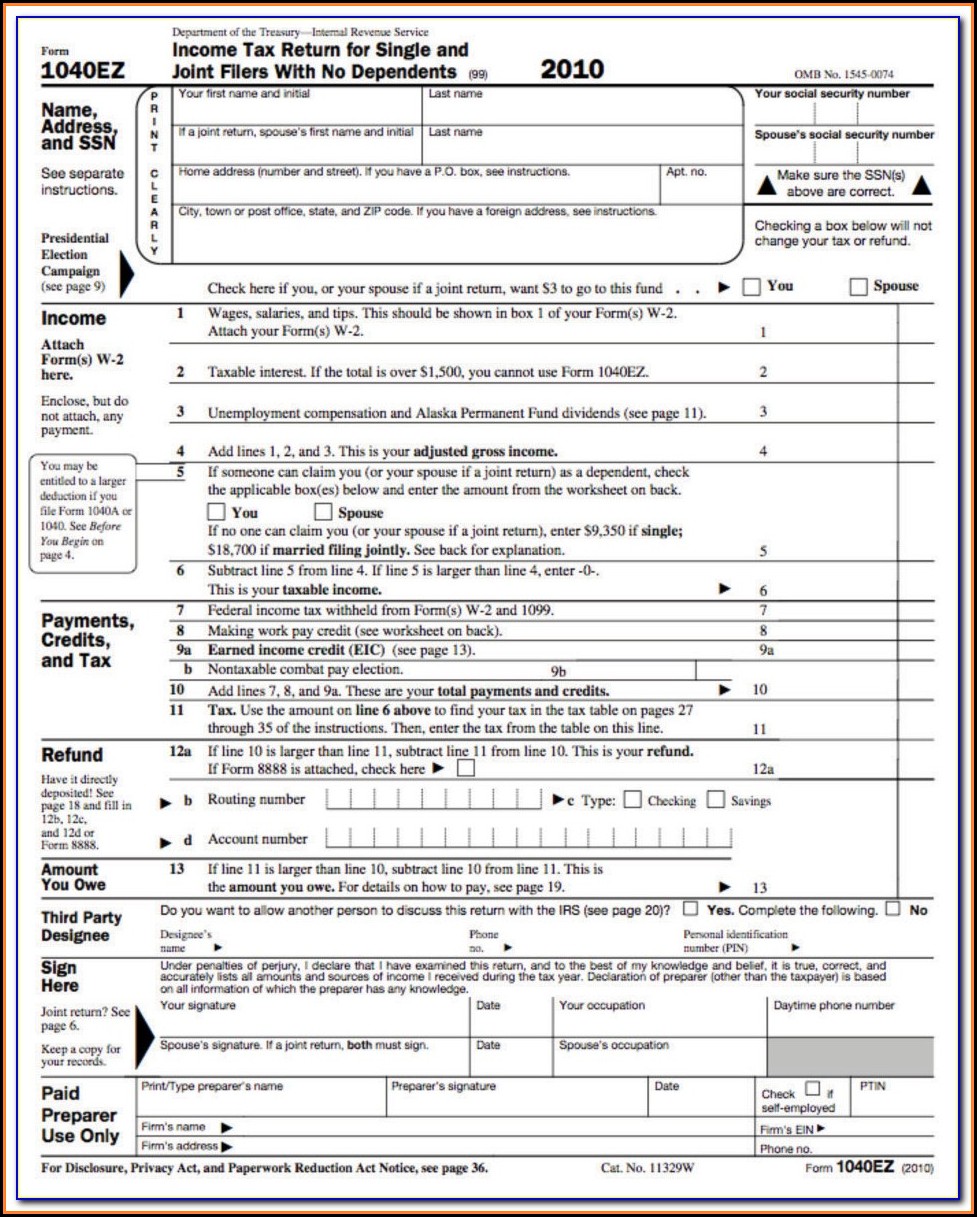

Pennsylvania 1040ez Tax Form Form Resume Examples

You only received a w2. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Web popular forms & instructions; Web subtract line 5 from line 4 and enter that amount on line 6. Individual tax return form 1040 instructions;

2016 1040EZ Tax Form PDF

Web any us resident taxpayer can file form 1040 for tax year 2019. Your taxable income is less than $100,000; You must have a taxable interest of under $1,500 for the. Individual income tax return 2019 omb no. Do your 2021, 2020, 2019, 2018 all the way back to 2000

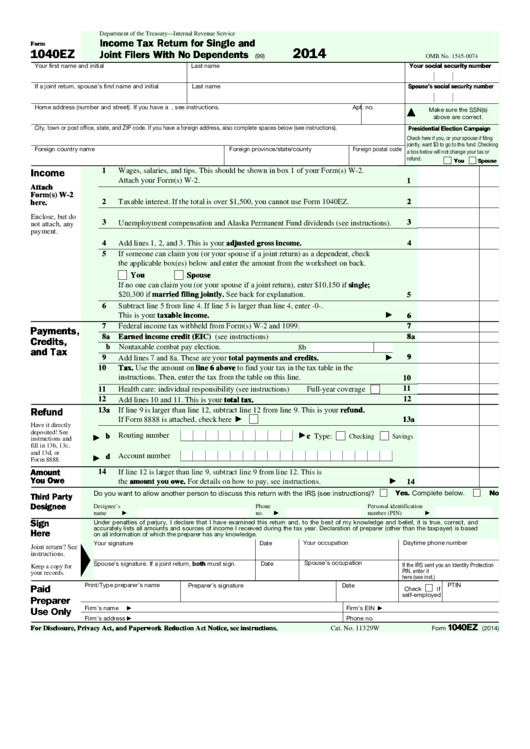

Fillable Form 1040ez Tax Return For Single And Joint Filers

Ad do your 2021, 2020, 2019, 2018 all the way back to 2000 easy, fast, secure & free to try! Web you must have a taxable income for the tax year of under $100,000. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. Individual tax return form 1040 instructions; Web which form to choose:

Printable Federal Tax Forms 1040ez Form Resume Examples e79Qn1gYkQ

Easy, fast, secure & free to try! Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Web popular forms & instructions; Your filing status was single or married filing jointly. Individual tax return form 1040 instructions;

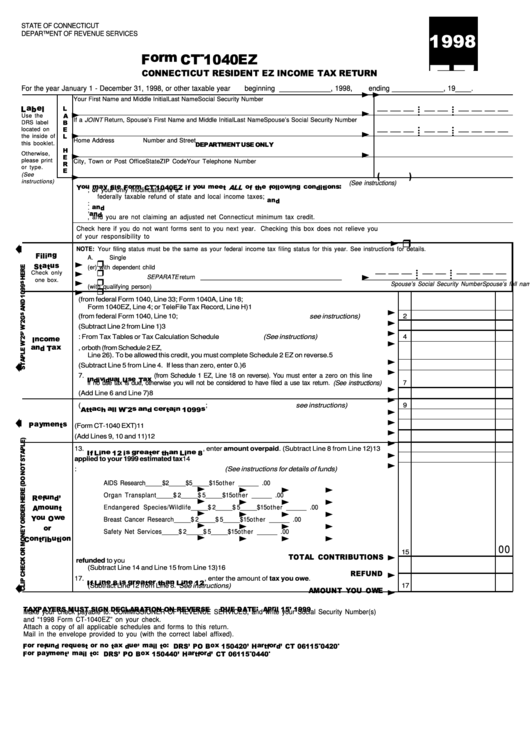

Fillable Form Ct1040ez Connecticut Resident Ez Tax Return

Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. 1 wages, salaries, and tips. Individual tax return form 1040 instructions; Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. This is 8.24% of your total.

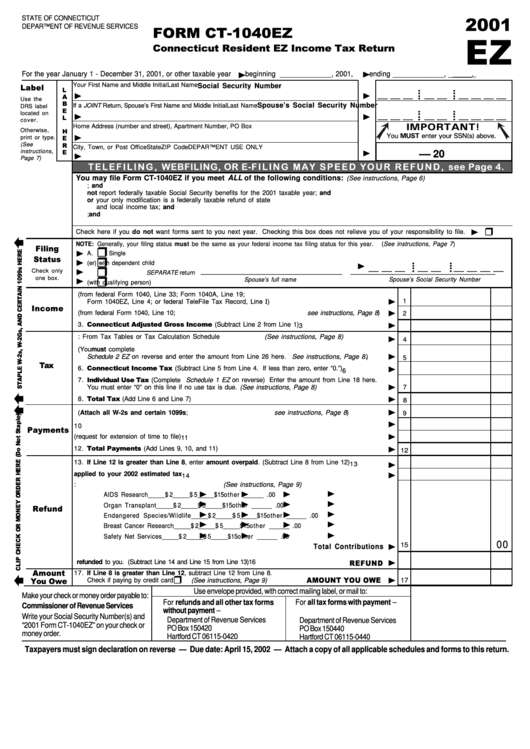

Form Ct1040ez Connecticut Resident Ez Tax Return 2001

If line 5 is larger than line 4, enter 0 (zero) on line 6. Individual income tax return 2019 omb no. Web you must have a taxable income for the tax year of under $100,000. Enclose, but do not attach, any payment. Web which form to choose:

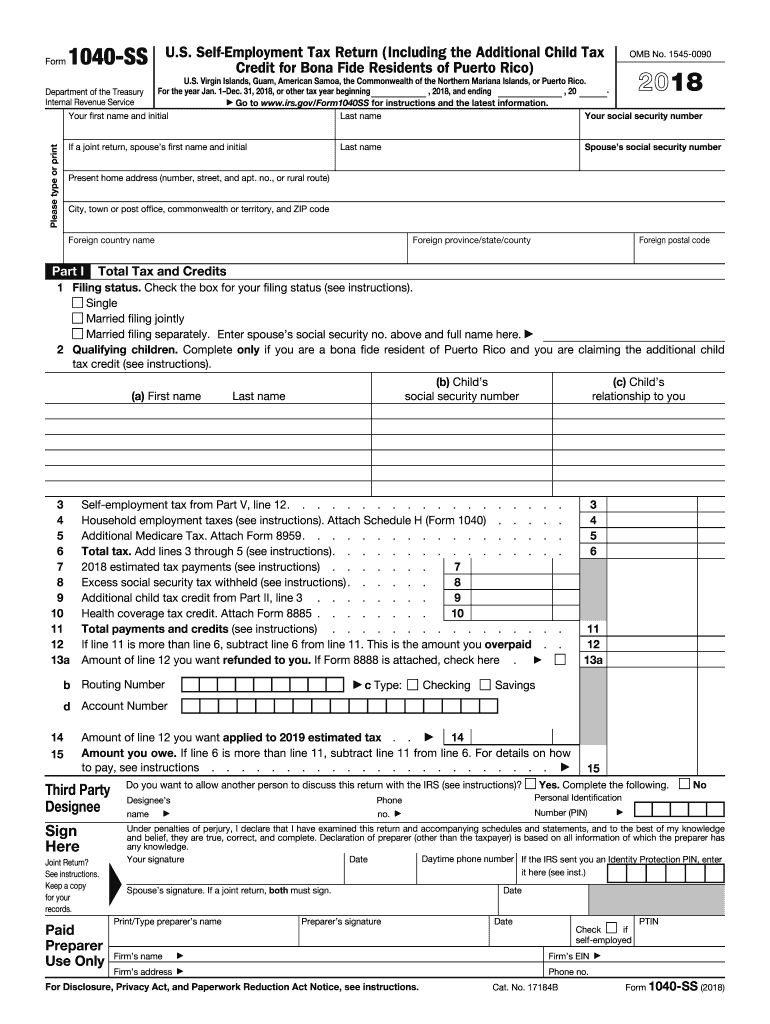

Irs 1040 Form Example 1040 Ez Nr Form Example 1040 Form Printable

Easy, fast, secure & free to try! Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web $36,150.00 federal income tax withheld:* $0 $1k $10k $100k earned income credit (eic): You must have a taxable interest of under $1,500 for the. Individual tax return form 1040 instructions;

You only received a w2. Web before recent tax reforms, you could file with form 1040ez if: You must have a taxable interest of under $1,500 for the. Your taxable income is less than $100,000; Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Your filing status was single or married filing jointly. If the amount is more. 1 wages, salaries, and tips. Below is a general guide to what schedule (s) you will need to file. Easy, fast, secure & free to try! This is 8.24% of your total. Web $36,150.00 federal income tax withheld:* $0 $1k $10k $100k earned income credit (eic): Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web subtract line 5 from line 4 and enter that amount on line 6. Enclose, but do not attach, any payment. Individual income tax return 2019 omb no. Individual tax return form 1040 instructions; $0.00 your taxes are estimated at $4,121.00. You had taxable income of less than $100,000.