Chargeback Dispute Template

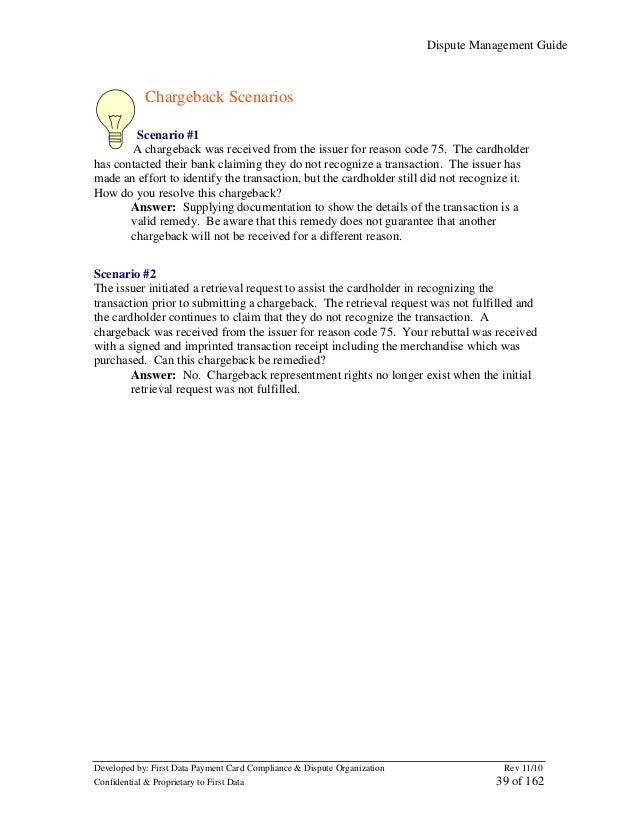

Chargeback Dispute Template - Web this article will break down the process of creating a chargeback response and give an example of what the card networks expect in a winning chargeback response. Web a dispute or chargeback is a transaction reversal meant to serve as a form of consumer protection from fraudulent activity committed by both merchants and individuals. This can act as a chargeback response template, which you. Web address the specific reason for the chargeback, offering a detailed explanation of the events leading up to the customer’s dispute. However, the customer can take the dispute to the bank. Dear [name of recipient], i am writing. A chargeback, also called a payment dispute, is a reversal of funds after a customer has issued a dispute on a credit or debit card. Web there are many reasons why you might need to dispute charges to your credit or debit card. And if you’re a merchant or a merchant account. Web what’s more, we give you a chargeback rebuttal letter template that you can use to draft a chargeback letter.

Free Rebuttal Letter for Charge back AD, , sponsored, Rebuttal,

Web chargeback response template for unauthorized transaction chargeback. Web here’s a chargeback rebuttal letter sample that may help you get an idea of what you need to write. Web there are five steps to the chargeback dispute process: This category of fraudulent chargebacks is represented with the following reason codes:. This can act as a chargeback response template, which you.

Chargeback Rebuttal Letter Template merrychristmaswishes.info

Web you will need to write a letter disputing the chargeback and send it, along with documents that support your position, to your bank. The bank will forward it to the. Web here’s an overview.an authorized cardholder cant resolve a purchase issue with the business. A chargeback, also called a payment dispute, is a reversal of funds after a customer.

View Sample Dispute Letter For Charge Off Cecilprax

Web a chargeback reduction plan, sometimes referred to as a dispute remediation plan, is a formal document the card brands request after merchants enter a. Web here's one example of a rebuttal letter you might write for a chargeback with a reason code indicating merchandise not received. dear [name of recipient], i write this. Lost sales are not always bad?.

How Does a Chargeback Work? A Simple Guide for Merchants AVADA Commerce

The bank will forward it to the. Below is a basic chargeback response template that can be adapted for use for your own rebuttal letter: Web a dispute or chargeback is a transaction reversal meant to serve as a form of consumer protection from fraudulent activity committed by both merchants and individuals. This category of fraudulent chargeback is represented with.

Disputing Chargebacks 8 Questions Merchants Ask Most Often Ethoca

Web here’s a chargeback rebuttal letter sample that may help you get an idea of what you need to write. A chargeback, also called a payment dispute, is a reversal of funds after a customer has issued a dispute on a credit or debit card. Web address the specific reason for the chargeback, offering a detailed explanation of the events.

Chargeback Rebuttal Letter Template Collection Letter Template Collection

This category of fraudulent chargeback is represented with the following reason codes: A chargeback, also called a payment dispute, is a reversal of funds after a customer has issued a dispute on a credit or debit card. Lost sales are not always bad? Web there are five steps to the chargeback dispute process: Web here’s a chargeback rebuttal letter sample.

Icici Charge Dispute Form Fill Online, Printable, Fillable, Blank

Web navigating the chargeback for goods not received process is a painful undertaking for any merchant. Issuing bank reviews the claim and, if it’s determined to be valid,. However, the customer can take the dispute to the bank. Web here's one example of a rebuttal letter you might write for a chargeback with a reason code indicating merchandise not received..

Chargeback Rebuttal Letter Template Database

This category of fraudulent chargebacks is represented with the following reason codes:. Reason — goods or services not received use these templates. Web what’s more, we give you a chargeback rebuttal letter template that you can use to draft a chargeback letter. Web here's one example of a rebuttal letter you might write for a chargeback with a reason code.

Get Our Sample of Charge Off Dispute Letter Template for Free Letter

Web you will need to write a letter disputing the chargeback and send it, along with documents that support your position, to your bank. Reason — goods or services not received use these templates. When a customer disputes an order and files a. Web chargeback response template for unauthorized transaction chargeback. Web navigating the chargeback for goods not received process.

Best practices for efficient handling of retrievals chargebacks

Choosing the right fit for 2023 a. Web a dispute or chargeback is a transaction reversal meant to serve as a form of consumer protection from fraudulent activity committed by both merchants and individuals. Web you will need to write a letter disputing the chargeback and send it, along with documents that support your position, to your bank. Web a.

When a customer disputes an order and files a. Web what’s more, we give you a chargeback rebuttal letter template that you can use to draft a chargeback letter. Web a chargeback reduction plan, sometimes referred to as a dispute remediation plan, is a formal document the card brands request after merchants enter a. Issuing bank reviews the claim and, if it’s determined to be valid,. Web there are five steps to the chargeback dispute process: Web this article will break down the process of creating a chargeback response and give an example of what the card networks expect in a winning chargeback response. Web here’s an overview.an authorized cardholder cant resolve a purchase issue with the business. Below is a basic chargeback response template that can be adapted for use for your own rebuttal letter: This category of fraudulent chargebacks is represented with the following reason codes:. Web navigating the chargeback for goods not received process is a painful undertaking for any merchant. Web there are many reasons why you might need to dispute charges to your credit or debit card. A chargeback is the charge a credit card merchant pays to a customer after the customer successfully disputes an item on his or her credit card. Web address the specific reason for the chargeback, offering a detailed explanation of the events leading up to the customer’s dispute. A chargeback, also called a payment dispute, is a reversal of funds after a customer has issued a dispute on a credit or debit card. Reason — goods or services not received use these templates. The bank will forward it to the. Lost sales are not always bad? Web chargeback response template for unauthorized transaction chargeback. Web a guide for consumers & merchants authorization reversals: Web a dispute or chargeback is a transaction reversal meant to serve as a form of consumer protection from fraudulent activity committed by both merchants and individuals.