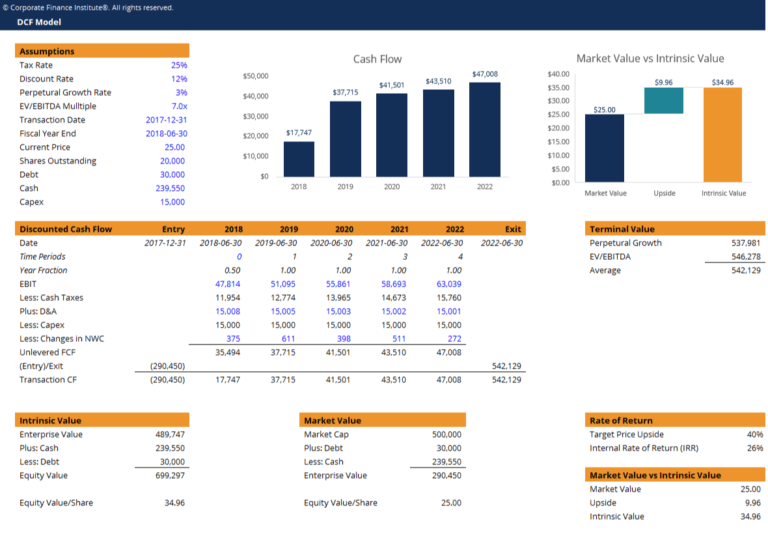

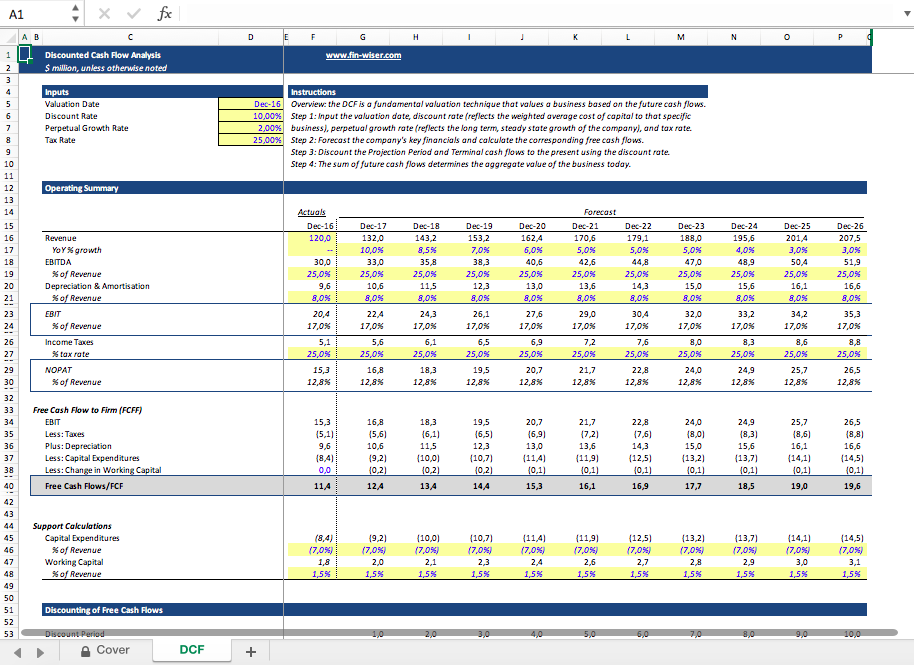

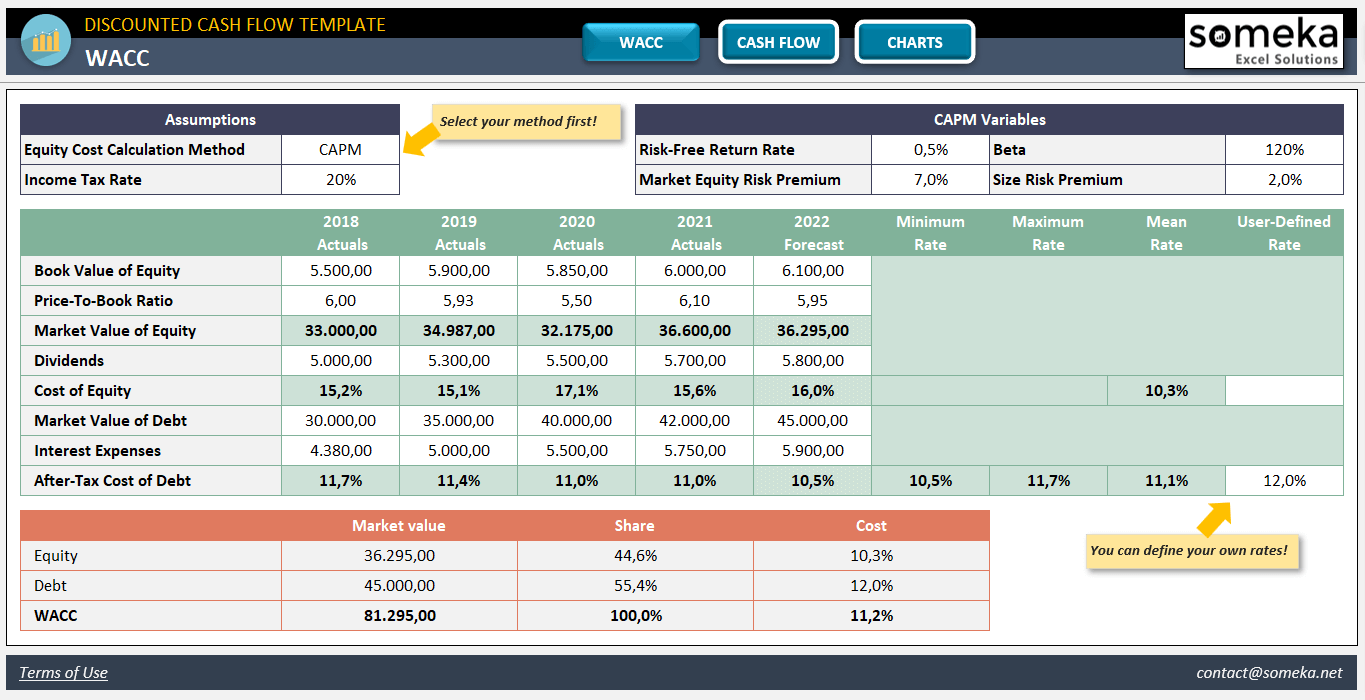

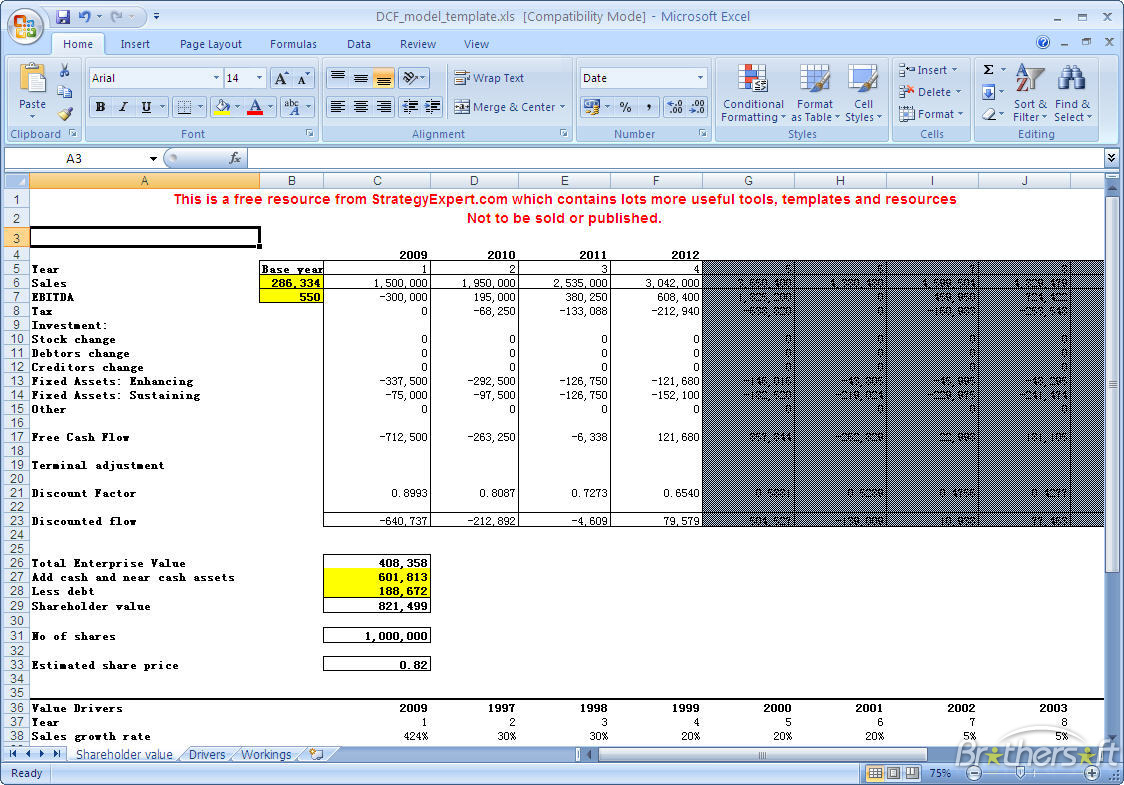

Dcf Valuation Excel Template

Dcf Valuation Excel Template - This solid and simple dcf model excel template is formulated in a way that allows users to analyze. This template allows you to build your own discounted cash flow. Download wso's free discounted cash flow (dcf) model template below! Web start free trial to access template. The dcf approach requires that we forecast a company’s future cash flows and discount them to the present in order to arrive at a. Web what is dcf model? Web download now the dcf valuation model free excel template. This spreadsheet allows you to reconcile the. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Below is a preview of the dcf model template:

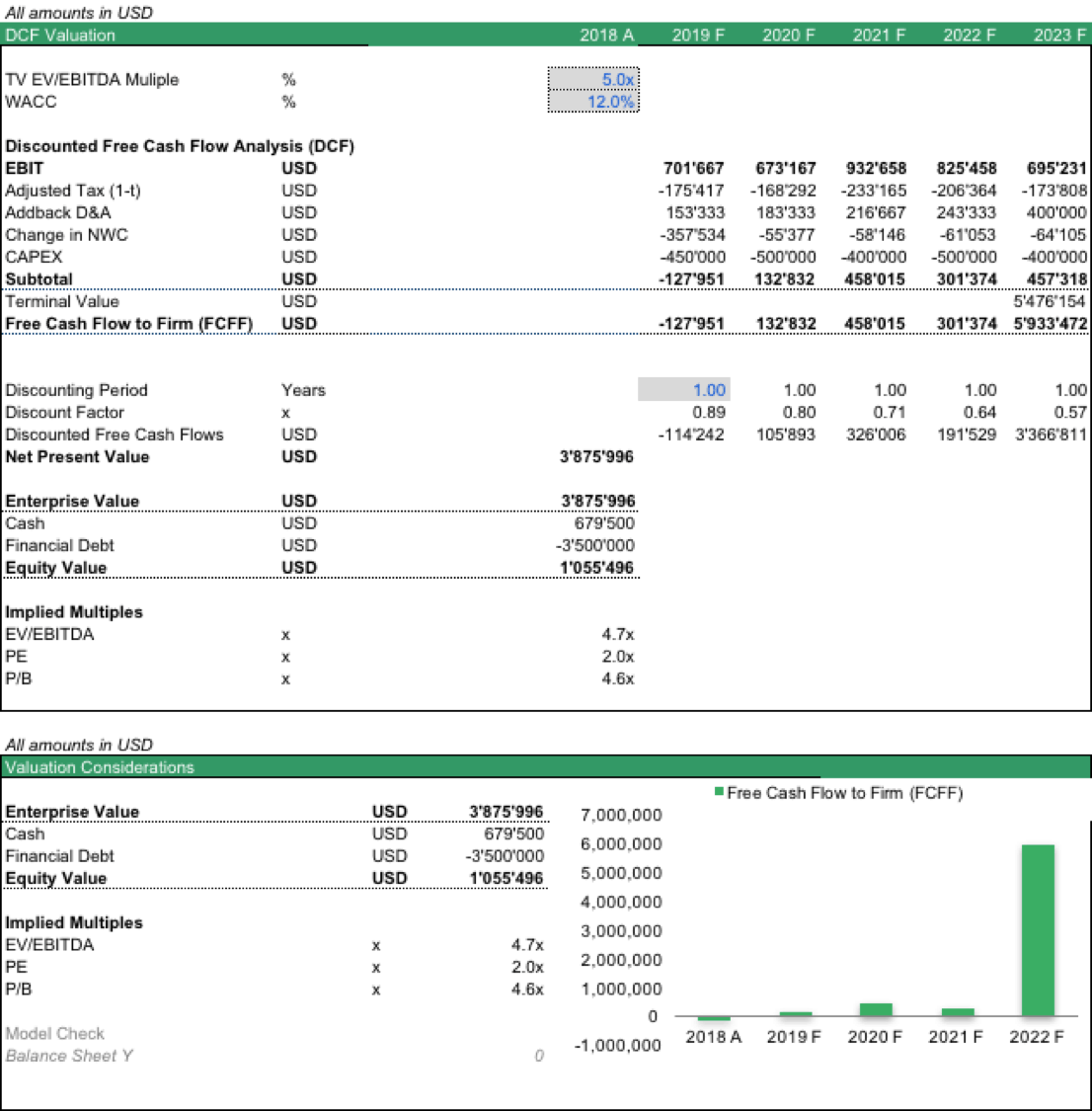

Valuation Model (DCF) Financial analysis, Business template

Web this spreadsheet reconciles a cost of capital dcf valuation with an eva valuation of the same company : This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. An office building, industrial site,. Web discounted cash flow (dcf) excel template updated: Web what is dcf model?

Dcf Model Template Download Free Excel Template With Regard To

Web updated may 1, 2023 what is valuation modeling in excel? Web what is dcf model? Web download now the dcf valuation model free excel template. This discounted cash flow (dcf) model, is a powerful tool designed to provide a detailed financial analysis. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future.

Discounted Cash Flow Xls Stock Value

Watch this short video explanation of. Below is a preview of the dcf model template: Download wso's free discounted cash flow (dcf) model template below! Get an overview of your company’s or. Web updated may 1, 2023 what is valuation modeling in excel?

DCF, Discounted Cash Flow Valuation in Excel Video YouTube

This spreadsheet allows you to reconcile the. Once you have the pv it can then be. Web download now the dcf valuation model free excel template. Web this spreadsheet shows the equivalence of the dcf and eva approaches to valuation. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking.

DCF model tutorial with free Excel

Web this commercial real estate valuation model template in excel can be used to run a dcf valuation of a commercial property such as e.g. Enter your name and email in the form below and download the free template now! Once you have the pv it can then be. This template allows you to build your own discounted cash flow..

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Web discounted cash flow (dcf) excel template updated: Web the dcf formula is required in financial modeling to determine the value of a business when building a dcf model in excel. This spreadsheet allows you to reconcile the. Web download now the dcf valuation model free excel template. This dcf model template provides you with a foundation to build your.

Discounted Cash Flow Excel Template DCF Valuation Template

Web this commercial real estate valuation model template in excel can be used to run a dcf valuation of a commercial property such as e.g. Basic discounted cash flow valuation template. Download wso's free discounted cash flow (dcf) model template below! Web what is dcf model? Web download now the dcf valuation model free excel template.

Dcf Valuation Excel Template

Below is a preview of the dcf model template: This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. The dcf approach requires that we forecast a company’s future cash flows and discount them to the present in order to arrive at a. Web click here to download the dcf.

Valuation Spreadsheet Mckinsey intended for Dcf Model Excel Hashtag Bg

Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Web what is dcf model? Web updated may 1, 2023 what is valuation modeling in excel? The dcf approach requires that we forecast a company’s future cash flows and discount them to the.

10 Best Dcf Model Template In Excel By Ex Deloitte Consultants Images

This discounted cash flow (dcf) model, is a powerful tool designed to provide a detailed financial analysis. Web download now the dcf valuation model free excel template. Dcf valuation templates can be used to create customized data management and analysis tools. Once you have the pv it can then be. What is free cash flow?

Below is a preview of the dcf model template: Web updated may 1, 2023 what is valuation modeling in excel? Enter your name and email in the form below and download the free template now! This solid and simple dcf model excel template is formulated in a way that allows users to analyze. Web january 31, 2022. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Dcf valuation templates can be used to create customized data management and analysis tools. Formula to calculate free cash flow what is time value of money how can dcf valuations help investors? This template allows you to build your own discounted cash flow. Web this spreadsheet shows the equivalence of the dcf and eva approaches to valuation. Once you have the pv it can then be. Web this commercial real estate valuation model template in excel can be used to run a dcf valuation of a commercial property such as e.g. Web the dcf formula is required in financial modeling to determine the value of a business when building a dcf model in excel. Download wso's free discounted cash flow (dcf) model template below! This spreadsheet allows you to reconcile the. Watch this short video explanation of. Basic discounted cash flow valuation template. Web download now the dcf valuation model free excel template. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. The dcf approach requires that we forecast a company’s future cash flows and discount them to the present in order to arrive at a.