Discounted Cash Flow Model Template

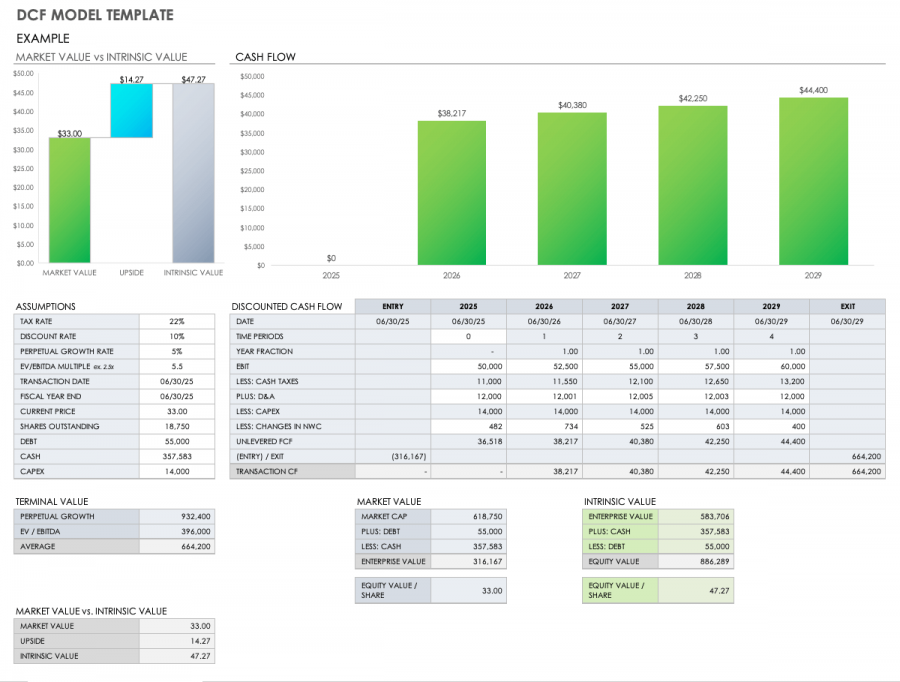

Discounted Cash Flow Model Template - The dcf formula allows you to determine the. The purpose of the discounted free cash flow financial model template is to provide the user with a. Web discounted cash flow (dcf) excel model template. Dcf = cf1 / (1 + r)1 + cf2 / (1 + r)2 + cf3 / (1 + r)3+ cfn / (1 + r)n cf = the cash flow in a given year (cf1 is year one. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows. Download wso's free discounted cash flow (dcf) model template below! Web january 31, 2022. Web discounted cash flow model template; Web while unrealistic, it makes it easier to see the effect that time has on the value of projected cash flows. Web basic discounted cash flow formula:

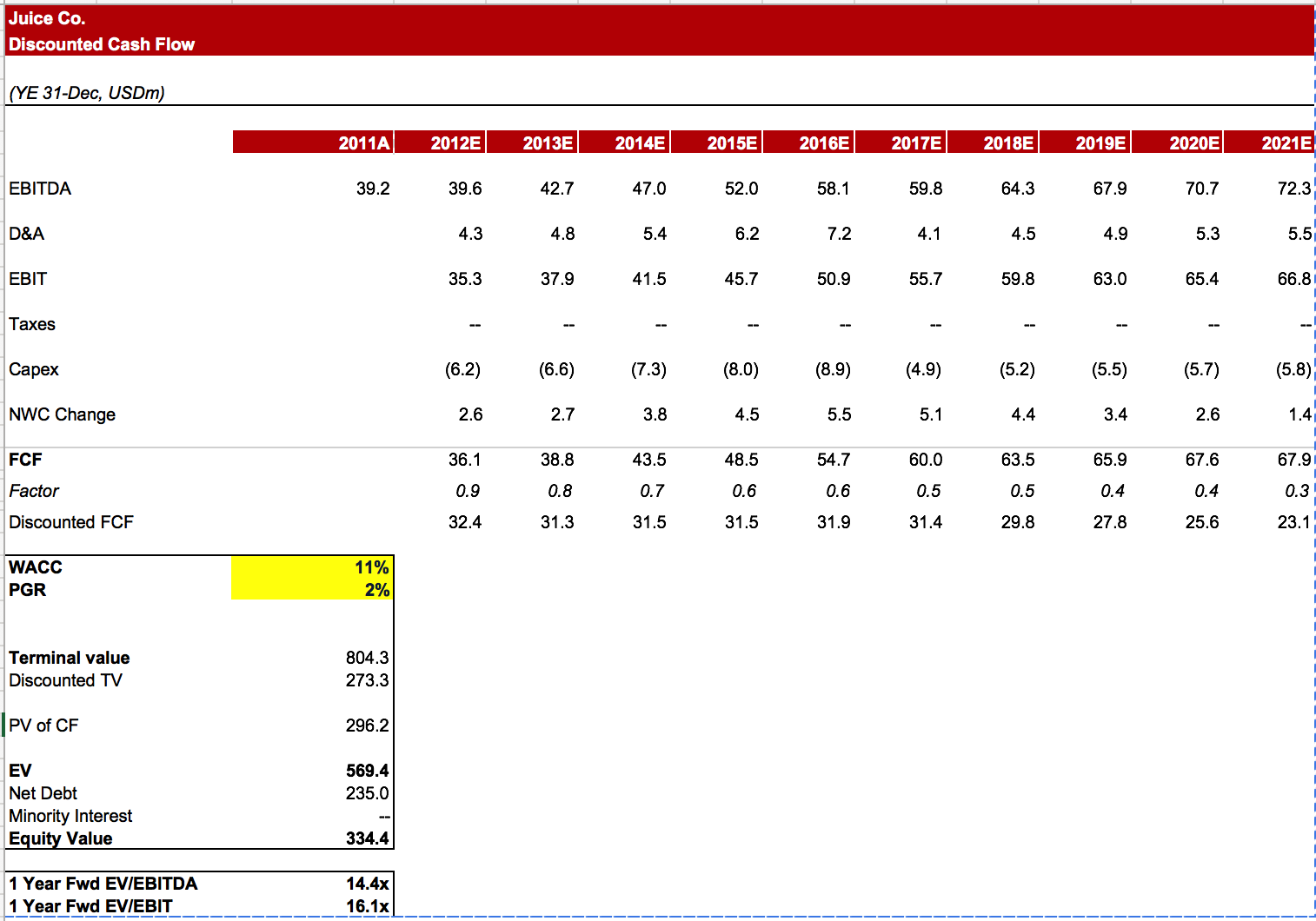

Discounted Cash Flow (DCF) Model Template + Instructions Eloquens

In the template below you can see the same projected cash flow for each. Web january 31, 2022. Web table of contents faqs discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. 3 ways to create a cash flow surge in your business Ad get 3 cash flow strategies.

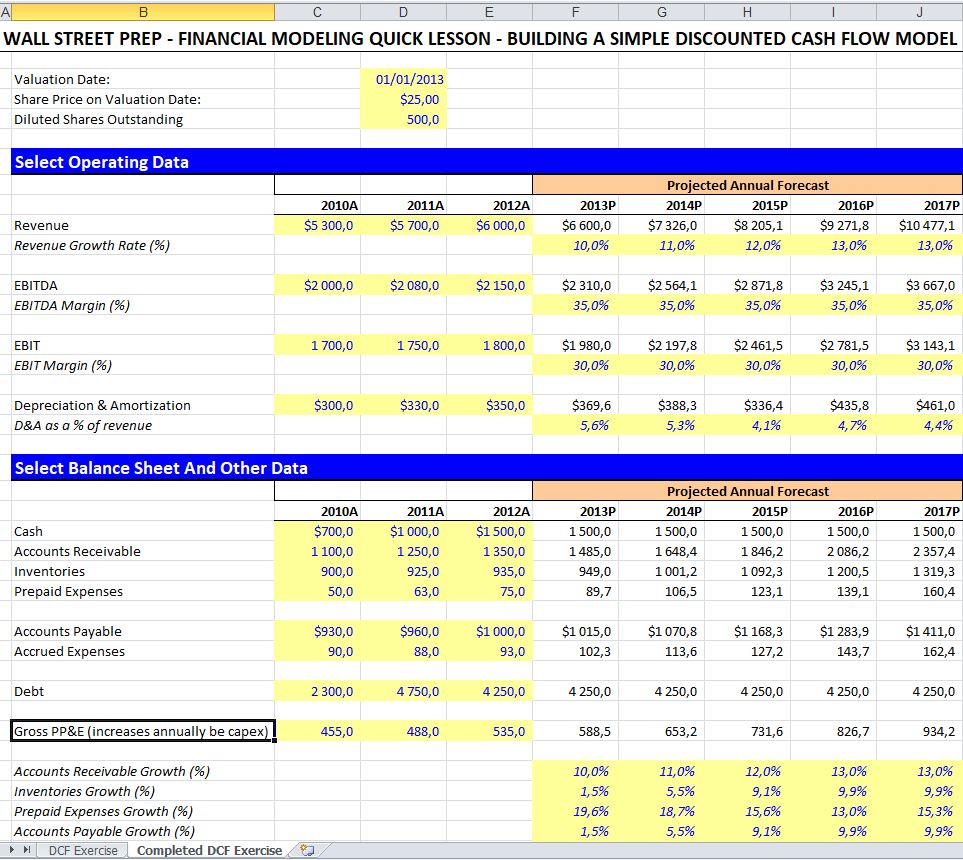

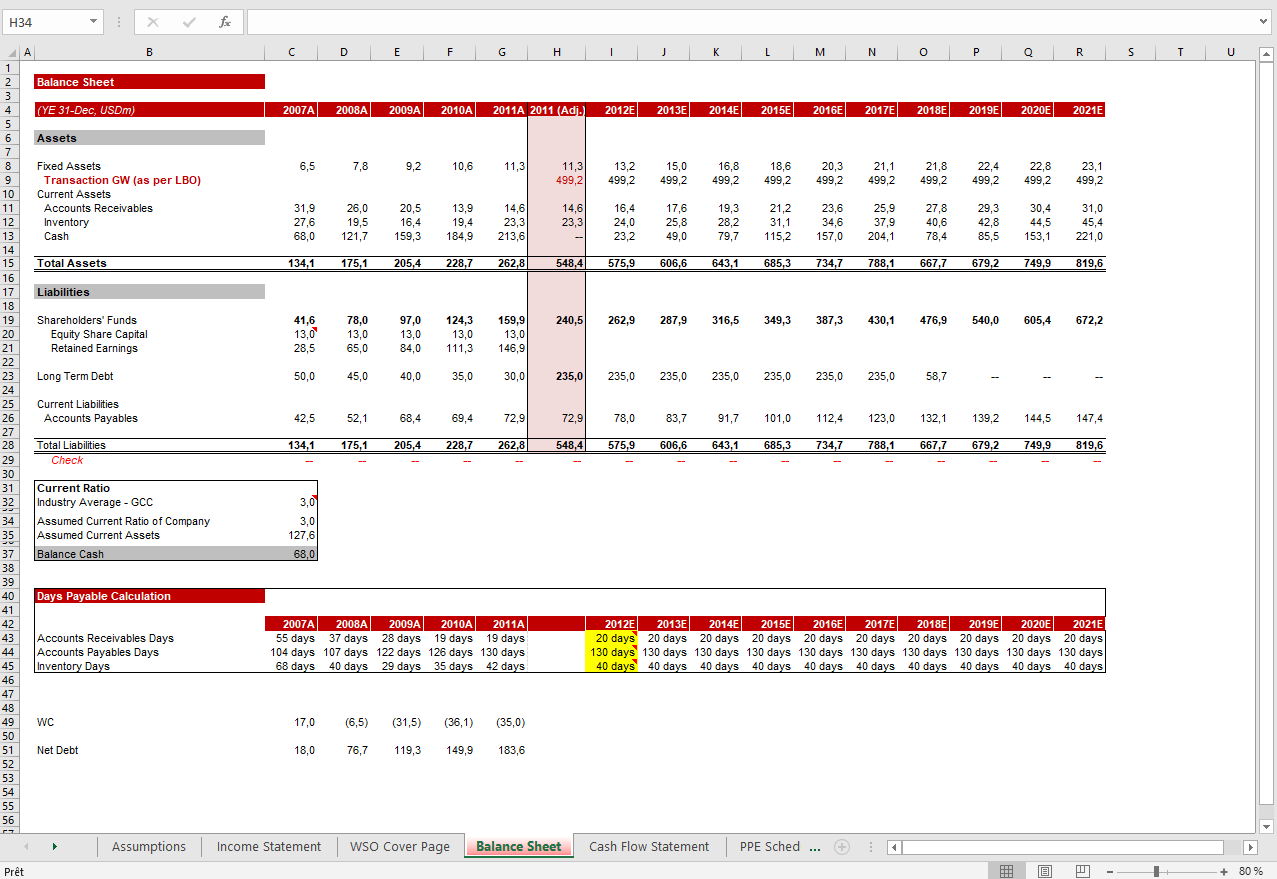

Discounted Cash Flow (DCF) Model Template Wall Street Oasis

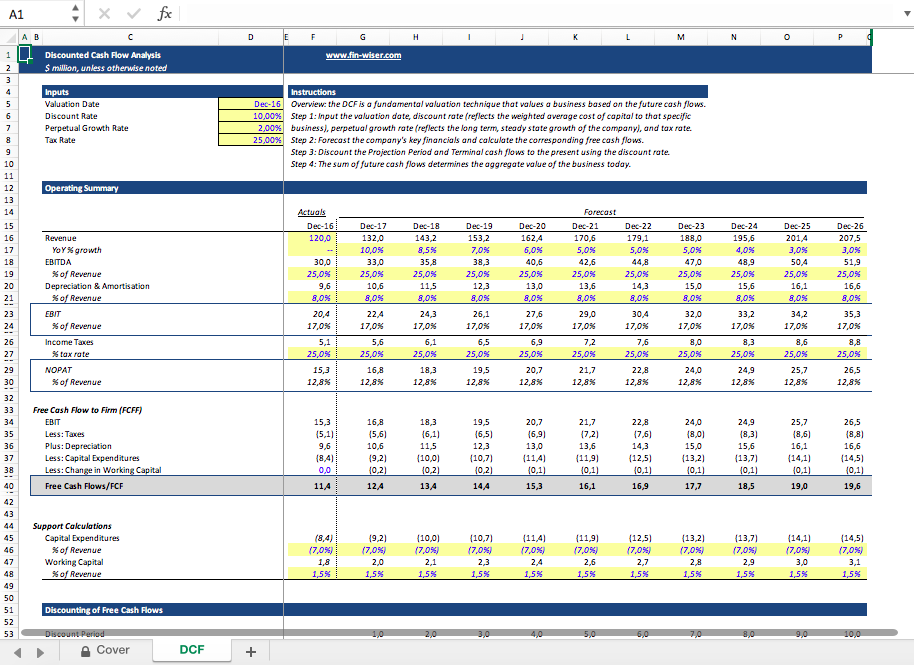

Web discounted cash flow model template; Web discounted cash flow model. The discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting. Web a basic dcf model involves projecting future cash flows and discounting them back to the present using a discount rate that reflects the.

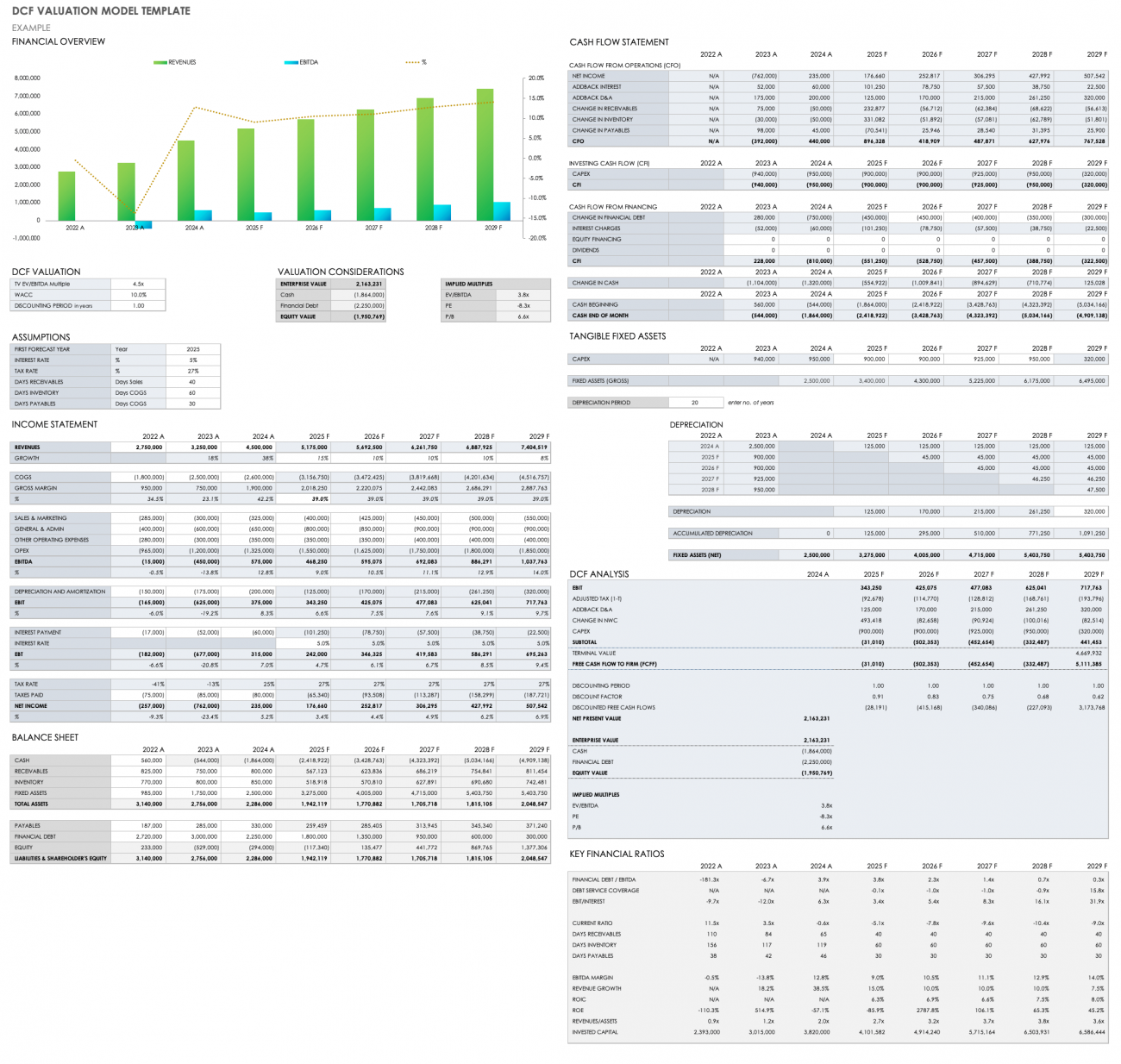

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

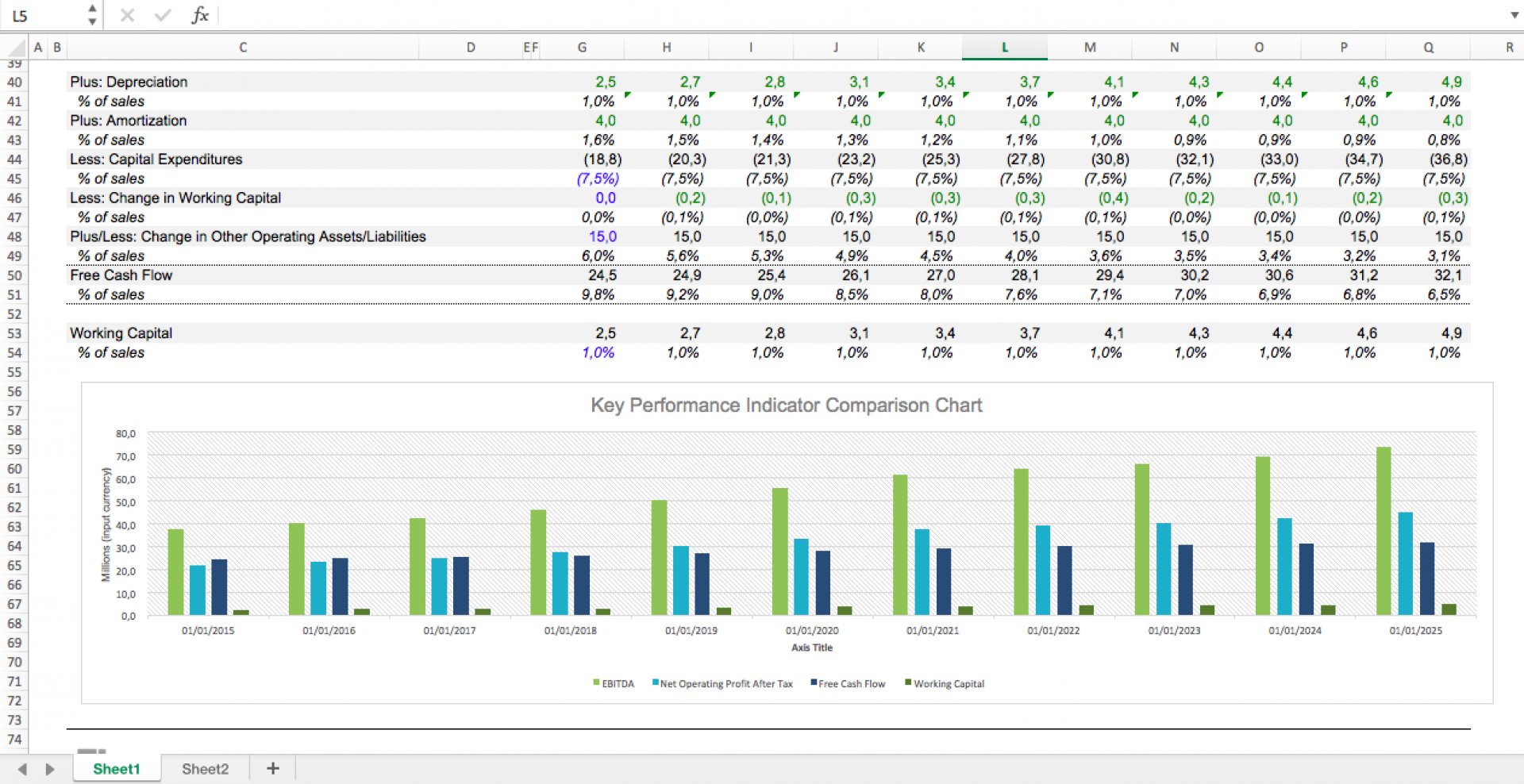

We have ten years of. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Discounted cash flow analysis template; Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows..

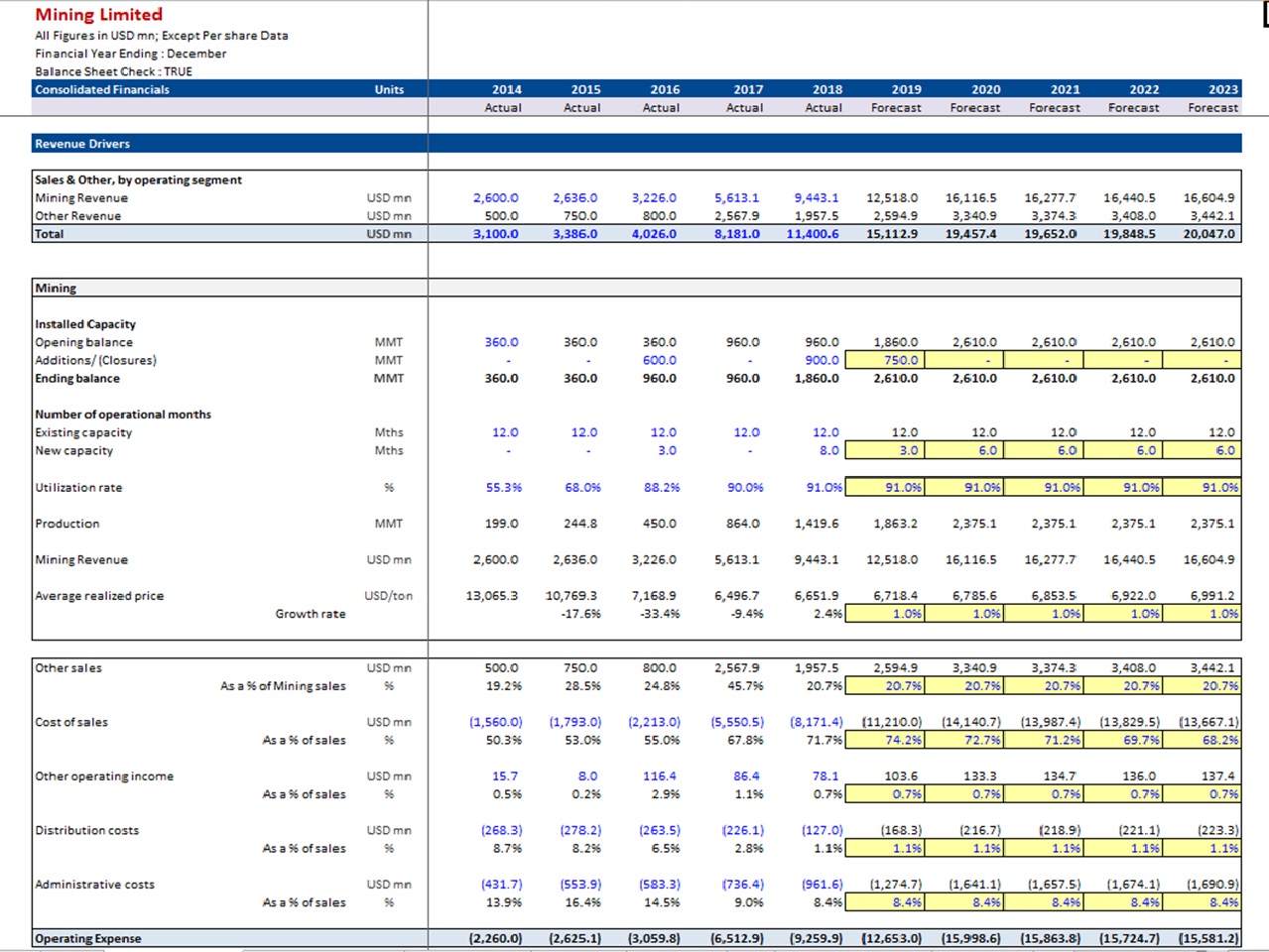

Discounted Cash Flow DCF Valuation Model Template (Mining Company

Web dcf stands for discounted cash flow, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is. Web to aid your understanding of how to create and interpret a dcf model, we will go through the wso discounted cash flow template below. 3 ways to create a cash.

DCF Discounted Cash Flow Model Excel Template Eloquens

Web what is a dcf model? Discounted cash flow analysis template; Book a playbook demo to explore — schedule a call with us and. Building a discounted cash flow model (dcf) model introduces some of the most critical aspects of finance including the time. This template allows you to build your own discounted cash flow.

DCF Discounted Cash Flow Model Excel Template Eloquens

Web dcf stands for discounted cash flow, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web discounted cash flow model. The discounted cash flow model,.

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Web the macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. Web table of contents faqs discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. The purpose of the discounted free cash flow financial model template is to provide the user with a..

Free Discounted Cash Flow Templates Smartsheet

Discounted cash flow analysis template; Web discounted cash flow model. Discounted cash flow valuation template ; Building a discounted cash flow model (dcf) model introduces some of the most critical aspects of finance including the time. Web discounted cash flow model template;

Free Discounted Cash Flow Templates Smartsheet

This template allows you to build your own discounted cash flow. Ad get 3 cash flow strategies to stop leaking, overpaying and wasting your money. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. Web the.

7 Cash Flow Analysis Template Excel Excel Templates

Web discounted cash flow model template; In the template below you can see the same projected cash flow for each. Dcf = cf1 / (1 + r)1 + cf2 / (1 + r)2 + cf3 / (1 + r)3+ cfn / (1 + r)n cf = the cash flow in a given year (cf1 is year one. Web discounted cash.

Download wso's free discounted cash flow (dcf) model template below! Web what is a dcf model? Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. In the template below you can see the same projected cash flow for each. Discounted cash flow analysis template; Web discounted cash flow model template; The dcf formula allows you to determine the. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. It computes the perpetuity growth rate. Web basic discounted cash flow formula: Web to aid your understanding of how to create and interpret a dcf model, we will go through the wso discounted cash flow template below. We have ten years of. The discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting. 3 ways to create a cash flow surge in your business Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. Building a discounted cash flow model (dcf) model introduces some of the most critical aspects of finance including the time. Discounted cash flow valuation template ; Web dcf stands for discounted cash flow, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is. Ad get 3 cash flow strategies to stop leaking, overpaying and wasting your money. Dcf = cf1 / (1 + r)1 + cf2 / (1 + r)2 + cf3 / (1 + r)3+ cfn / (1 + r)n cf = the cash flow in a given year (cf1 is year one.