Employee Retention Credit Template

Employee Retention Credit Template - Web beginning on january 1, 2021 and through june 30, 2021, eligible employers may claim a refundable tax credit against certain employment taxes equal to 70% of. Web 2021 (caa) passed in late december 2020. Web 1124 employee retention credit: Ad stentam is the nations leading tax technology firm. Web get started with the ey employee retention credit calculator. Now you have your own version of the calculator. Make sure you qualify for the erc. Claim your ercs with confidence today. Web washington — the internal revenue service today issued guidance for employers claiming the employee retention credit under the coronavirus aid, relief,. Is your business eligible for the employee retention credit?

Employee Retention Credit Form MPLOYME

Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Make sure you qualify for the erc. Get started today to find out Web eligibility for employee retention tax credit any quarter in 2020 original law: Web washington — the internal revenue service today issued guidance for employers claiming the employee.

COVID19 Relief Legislation Expands Employee Retention Credit

Ad stentam is the nations leading tax technology firm. Ad we take the confusion out of erc funding and specialize in working with small businesses. Click on the tab at the. Ad our team of experts determine exactly how much of a payroll tax refund you're entitled to. The employer portion of certain.

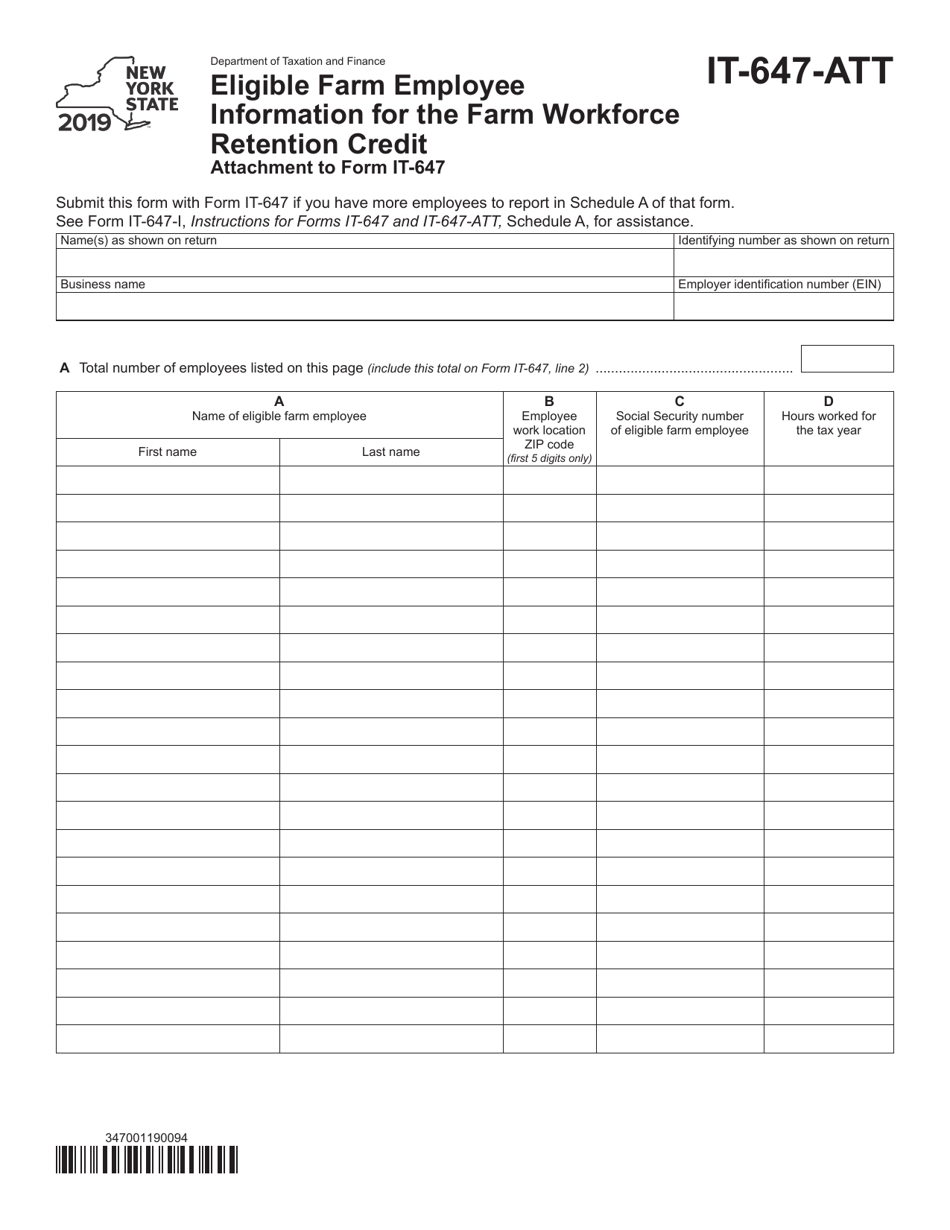

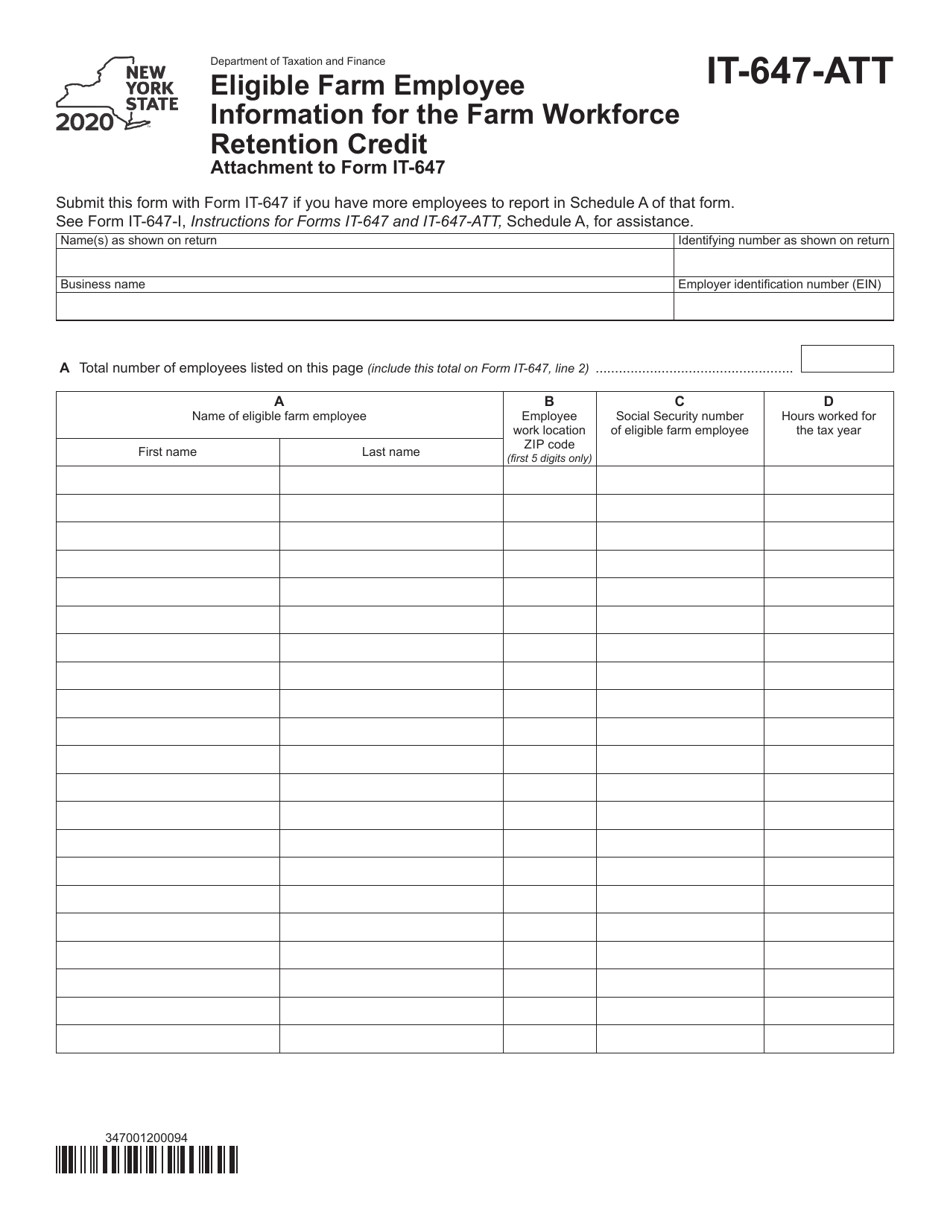

Form IT647ATT Download Fillable PDF or Fill Online Eligible Farm

Web for more information about the employee retention credit, including the dates for which the credit may be claimed, go to irs.gov/erc. Web 1124 employee retention credit: Web the employee retention tax credit is a broad based refundable tax credit designed to encourage employers to keep employees on their payroll. The following tools for calculating erc were submitted by pstap.

Employee Retention Credit Form MPLOYME

Web beginning on january 1, 2021 and through june 30, 2021, eligible employers may claim a refundable tax credit against certain employment taxes equal to 70% of. •corrections to amounts reported on. Web practitioners are sure to see a lot of employee retention credit (erc) issues. Web eligibility for employee retention tax credit any quarter in 2020 original law: Now.

Employee Retention Credit (ERC) Calculator Gusto

Make sure you qualify for the erc. Web washington — the internal revenue service today issued guidance for employers claiming the employee retention credit under the coronavirus aid, relief,. Web this is a preliminary calculation in anticipation of further guidance from the treasury to calculate the employee retention credit with ppp loan forgiveness without losing both. Web these templates will.

Employee Retention Credit Worksheet 1

Businesses can receive up to $26k per eligible employee. Is your business eligible for the employee retention credit? Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help businesses with the cost of keeping staff. Business operations that are either fully or partially (click here to view irs guidance on pages.

Form IT647ATT Download Fillable PDF or Fill Online Eligible Farm

Is your business eligible for the employee retention credit? Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Get started today to find out The employer portion of certain. Web employee 8 employee 9 total total wages capped at $10,000 per ee max elg wages credit % calculate the credit,.

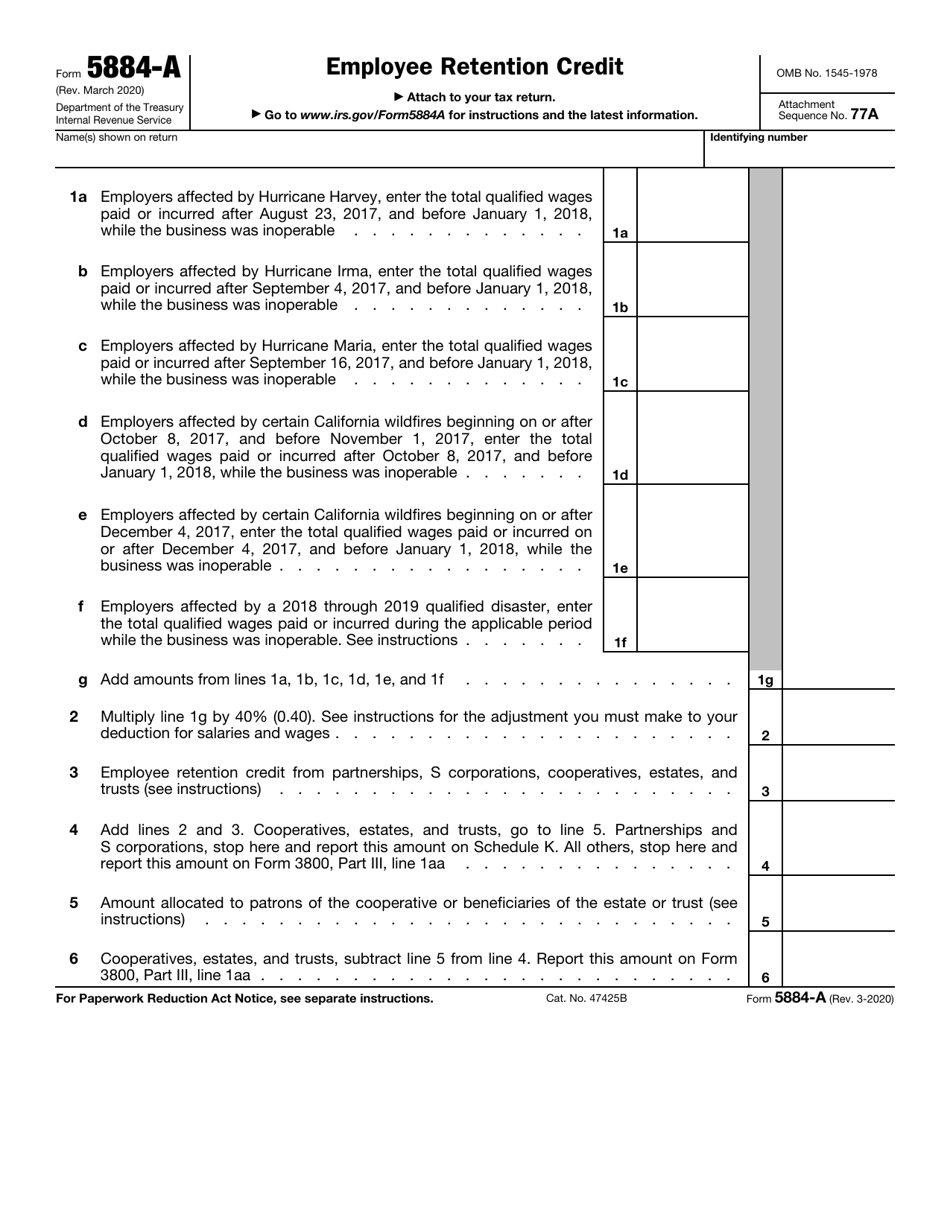

IRS Form 5884A Download Fillable PDF or Fill Online Employee Retention

Get started today to find out Ad our team of experts determine exactly how much of a payroll tax refund you're entitled to. Web washington — the internal revenue service today issued guidance for employers claiming the employee retention credit under the coronavirus aid, relief,. Check to see if you qualify. Web 1124 employee retention credit:

Employee Retention Credit Form MPLOYME

Web for more information about the employee retention credit, including the dates for which the credit may be claimed, go to irs.gov/erc. Web the employee retention tax credit is a broad based refundable tax credit designed to encourage employers to keep employees on their payroll. Businesses can receive up to $26k per eligible employee. Ad our team of experts determine.

Ertc Worksheet Excel

Web for more information about the employee retention credit, including the dates for which the credit may be claimed, go to irs.gov/erc. Businesses can receive up to $26k per eligible employee. Web these templates will assist you in determining your specific qualification and the potential credit to your business. Web the employee retention tax credit is a broad based refundable.

Get started today to find out Up to $26,000 per employee. The employer portion of certain. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Business operations that are either fully or partially (click here to view irs guidance on pages 27. Click on the tab at the. Click file > make a copy at the top right hand of your screen. Now you have your own version of the calculator. Businesses can receive up to $26k per eligible employee. •corrections to amounts reported on. Web these templates will assist you in determining your specific qualification and the potential credit to your business. Web practitioners are sure to see a lot of employee retention credit (erc) issues. Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help businesses with the cost of keeping staff. The requirements are different depending on the time. Check to see if you qualify. Web 1124 employee retention credit: Web the employee retention tax credit is a broad based refundable tax credit designed to encourage employers to keep employees on their payroll. Get started today to find out Businesses can receive up to $26k per eligible employee. Ad we take the confusion out of erc funding and specialize in working with small businesses.