Goodwill Itemized Donation List Printable

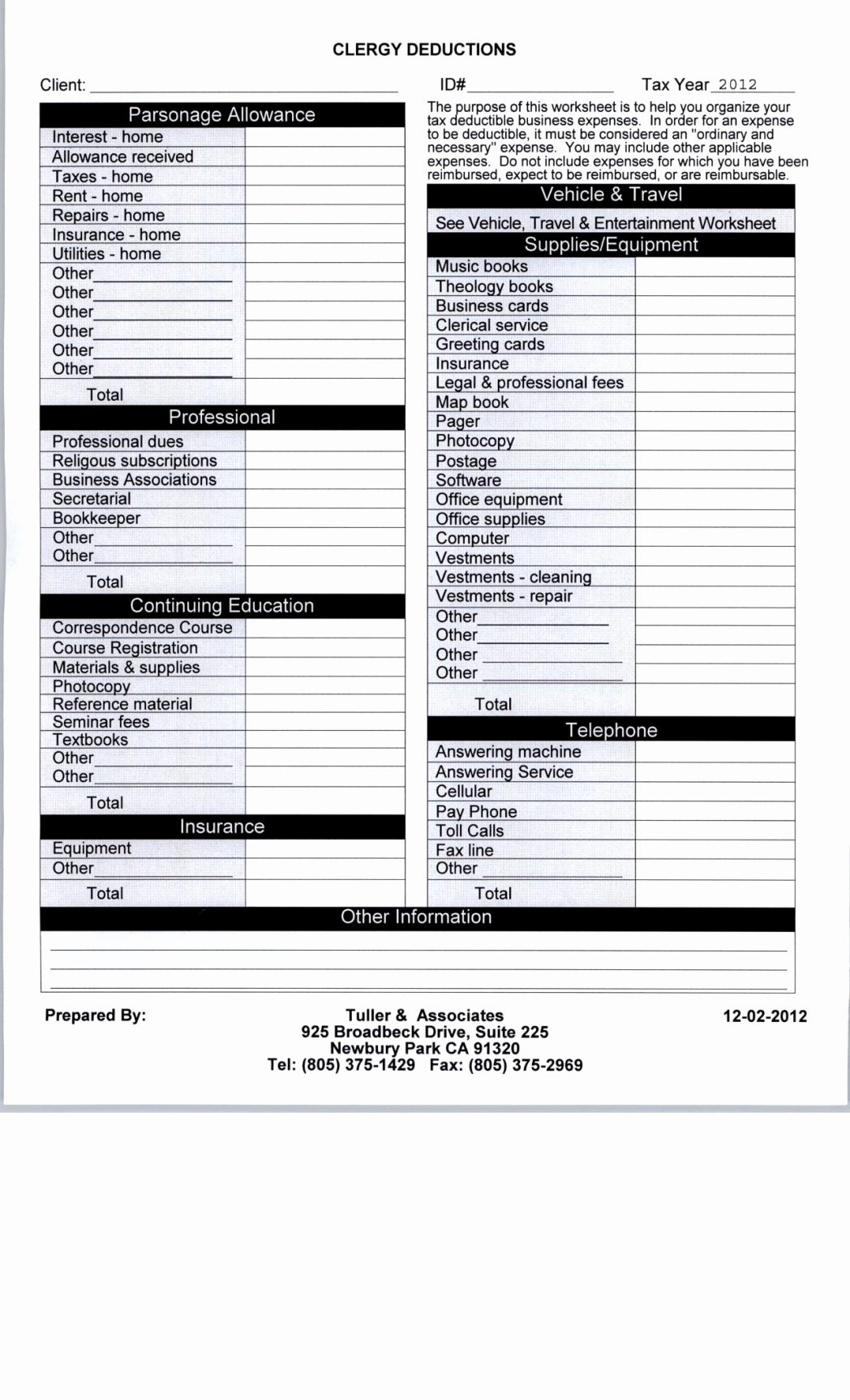

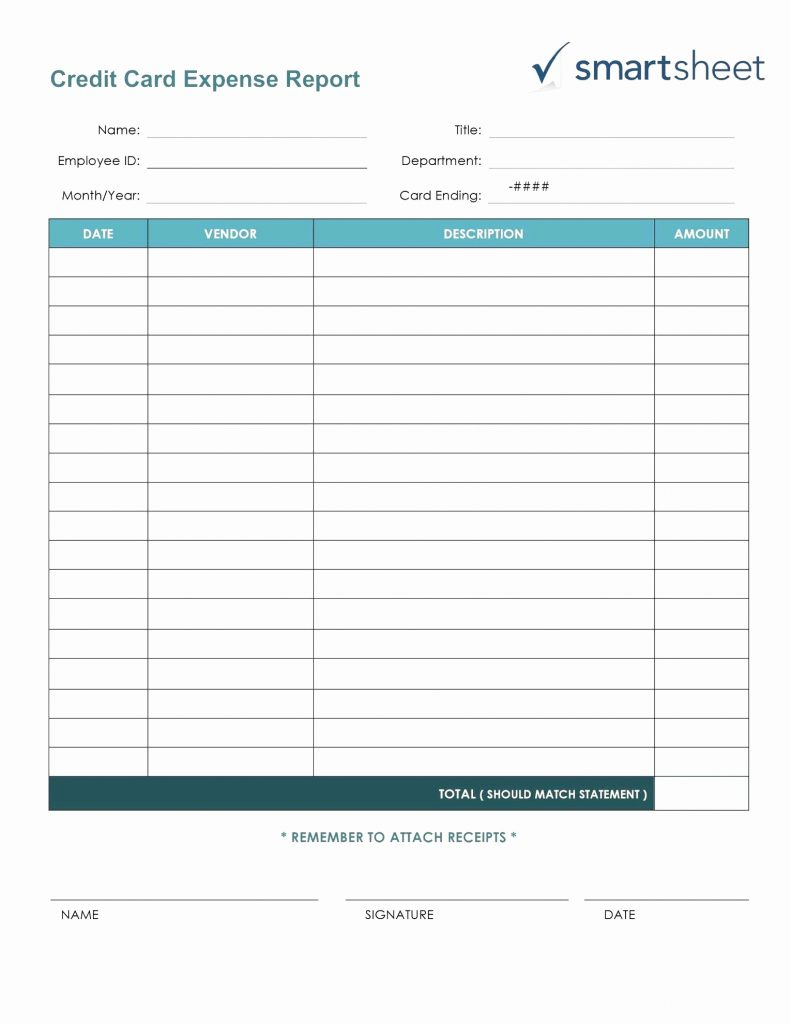

Goodwill Itemized Donation List Printable - Quantity of the donated items; Like medical expenses and mortgage interest, you can only deduct them if you skip the. Web if you donate an item worth more than $50,000, you'll need to get a statement of value from the irs, which will cost you at least $7,500. Some items may surprise you, while others may seem obvious. Web charitable contributions are a type of personal itemized deduction. If you donated to a goodwill in the. To determine the fair market value of an item not on this list, use 30% of the item’s original. Web goodwill accepts gently used items that are clean, safe and resaleable. You may be able to deduct the value of your donations if you choose to itemize them on your taxes. Web a limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes.

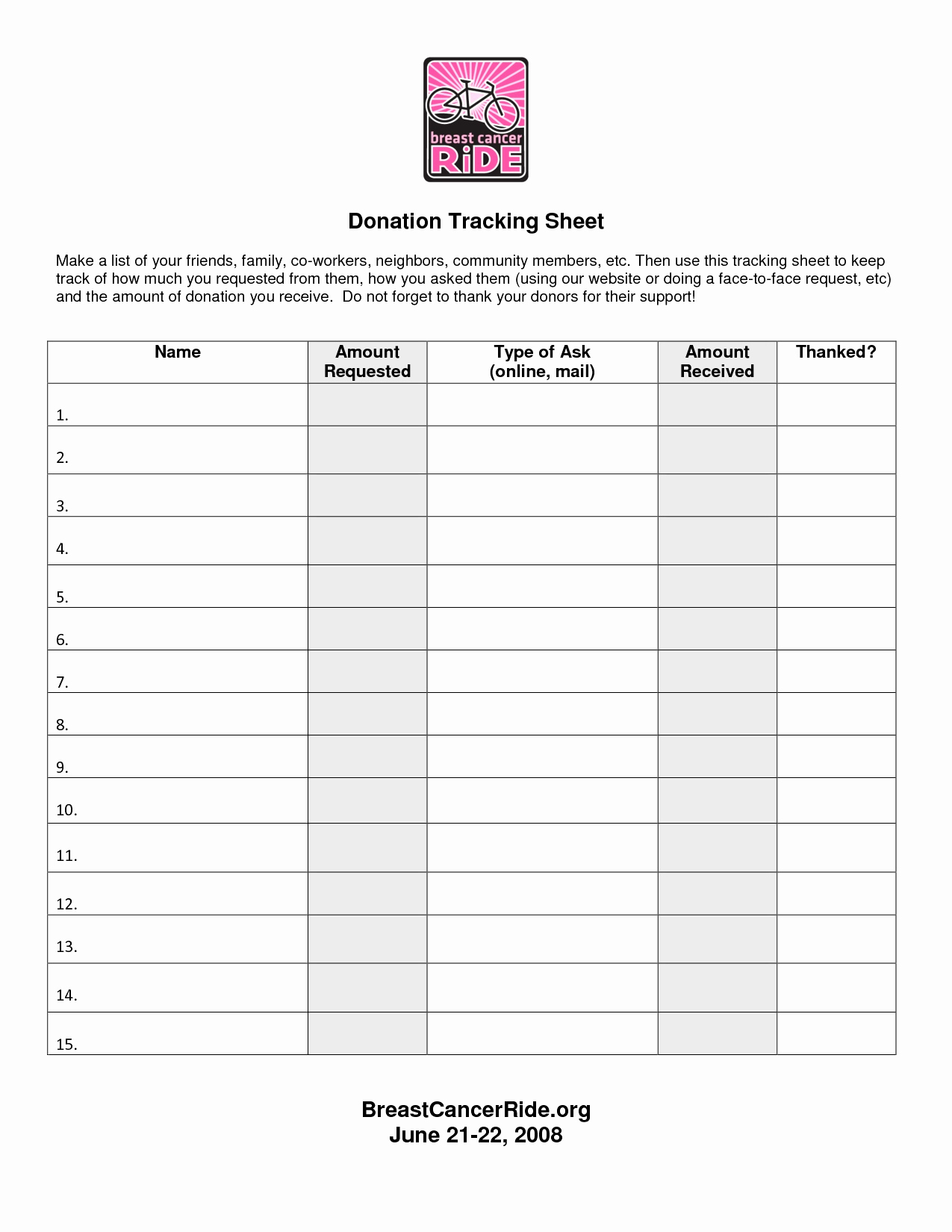

Goodwill Donation Spreadsheet Template Beautiful Goodwill Donation with

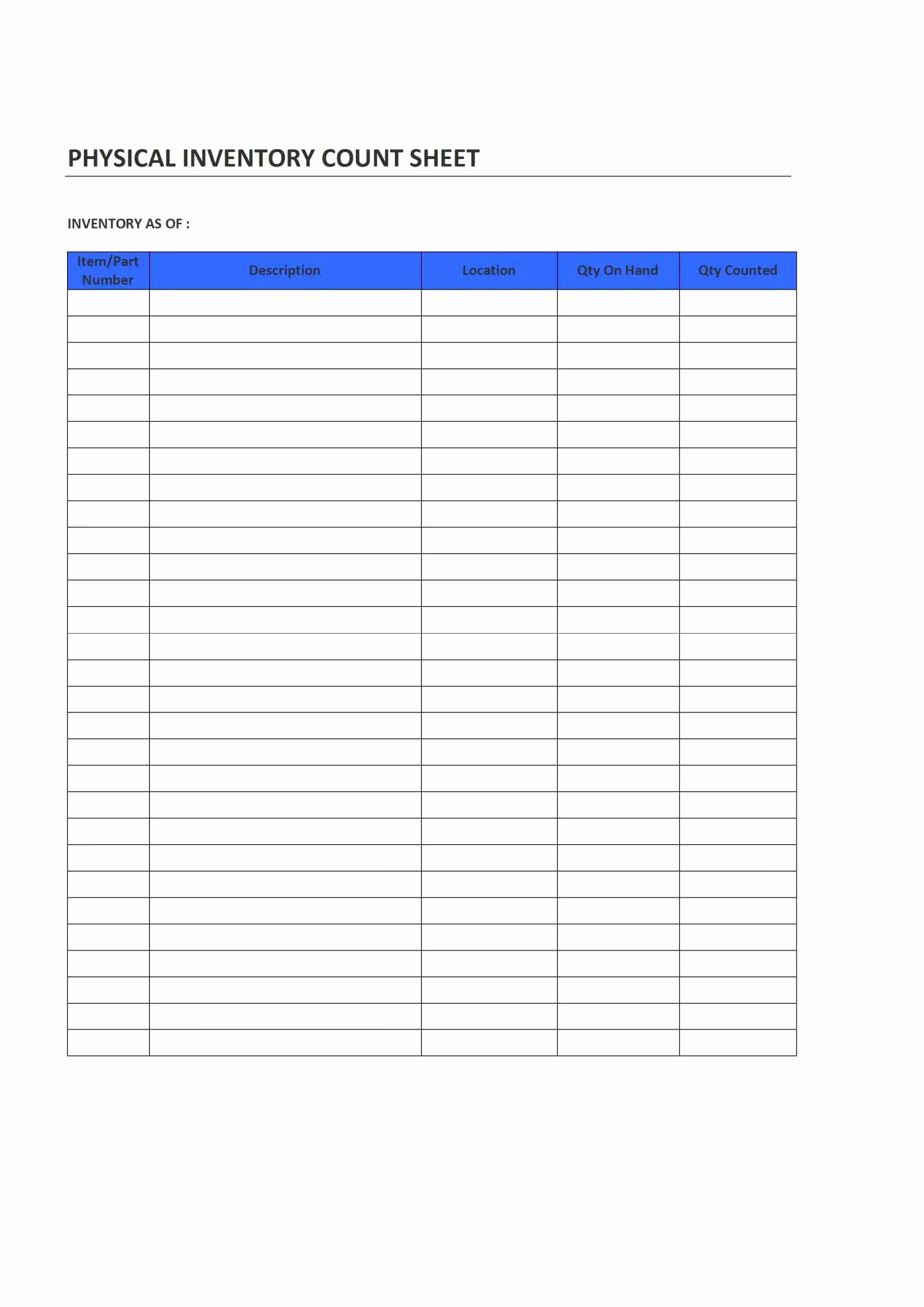

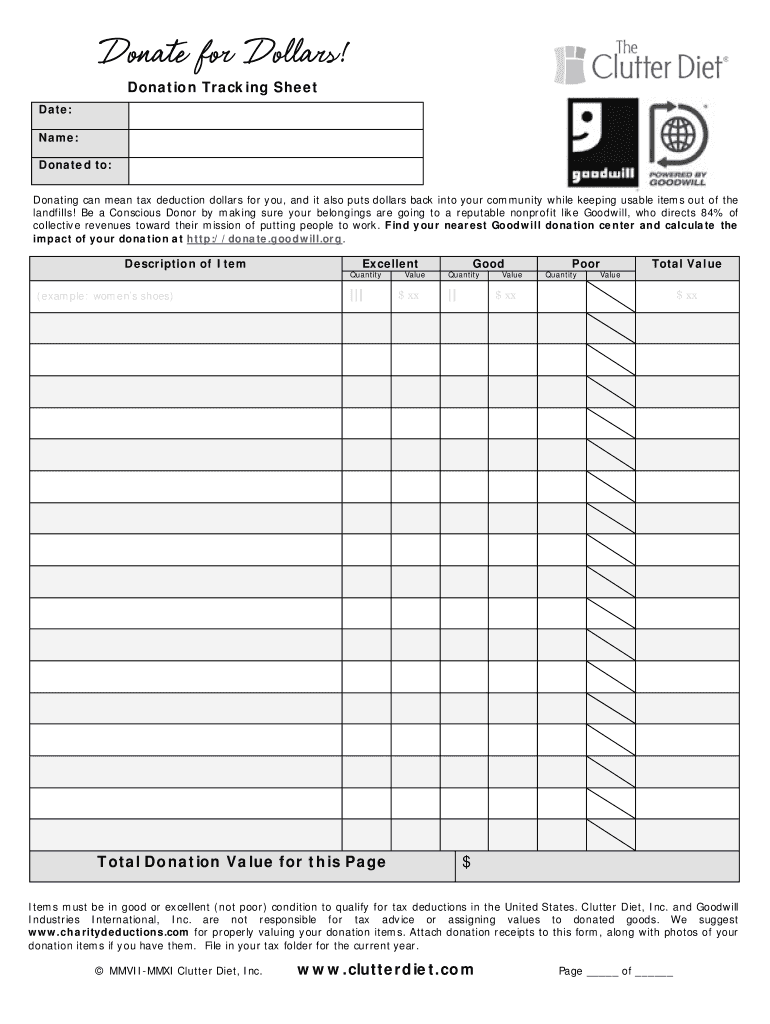

Web up to $40 cash back how to fill out amazinggoodwilldonationreceipt: Please see the list of items we. Web we’ll walk you through all of the categories of items that goodwill accepts and does not accept. Web below is a donation value guide of what items generally sell for at goodwill locations. Assume the following items are in good condition,.

Itemized Donation List Printable Printable Blank World

Web to help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. Total value in the us dollars; Donations can be made at our retail stores and attended donation centers. Create tax receipt share » itemized tax deduction goodwill. Assume the following items are in good condition, and remember:

Fresh 40 Donation Receipt Templates & Letters [goodwill Non Profit

Simply pack up your items and drop them off at the nearest store and donation center. When you bring items to one of our donation locations, you may fill out a paper donation form. Create tax receipt share » itemized tax deduction goodwill. Identify the items you are. If you donated to a goodwill in the.

Itemized Donation List Printable Goodwill

Web to help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. Web for items commonly sold in goodwill® stores. Simply pack up your items and drop them off at the nearest store and donation center. Pdffiller.com has been visited by 1m+ users in the past month Web shoppers in.

Goodwill Donation Spreadsheet Template —

Identify the items you are. Web donors are responsible for valuing their donations. Please list the items you donated to goodwill in the space below (i.e. Web if you donate an item worth more than $50,000, you'll need to get a statement of value from the irs, which will cost you at least $7,500. Number of bags of clothing, boxes.

Goodwill Donation Spreadsheet Template Inside Goodwill Donation

Simply pack up your items and drop them off at the nearest store and donation center. Assume the following items are in good condition, and remember: Web goodwill accepts gently used items that are clean, safe and resaleable. Web below is a donation value guide of what items generally sell for at goodwill locations. Donations can be made at our.

Goodwill Donation Excel Spreadsheet Fresh Goodwill Donation Excel

Web fill out goodwill donation spreadsheet template 2023 in minutes, not hours. Internal revenue service (irs) requires donors to value their items. Simply pack up your items and drop them off at the nearest store and donation center. Web below is a donation value guide of what items generally sell for at goodwill locations. Like medical expenses and mortgage interest,.

Goodwill Donation Spreadsheet Template In Goodwill Donation Value Excel

Web up to $40 cash back how to fill out amazinggoodwilldonationreceipt: Web below is a donation value guide of what items generally sell for at goodwill locations. Identify the items you are. Donations can be made at our retail stores and attended donation centers. Web goodwill accepts gently used items that are clean, safe and resaleable.

Itemized Donation List Printable Goodwill Master of

Assume the following items are in good condition, and remember: Web we’ll walk you through all of the categories of items that goodwill accepts and does not accept. Web if you donate an item worth more than $50,000, you'll need to get a statement of value from the irs, which will cost you at least $7,500. Simply pack up your.

Itemized Donation List Printable Goodwill Master of

Web fill out goodwill donation spreadsheet template 2023 in minutes, not hours. Web goodwill accepts gently used items that are clean, safe and resaleable. Assume the following items are in good condition, and remember: Your donation value generates goodwill program hours. Web here are some handy irs tips for deducting charitable donations.

Simply pack up your items and drop them off at the nearest store and donation center. Web we’ll walk you through all of the categories of items that goodwill accepts and does not accept. Web shoppers in hawaii can make donations of up to $249 at their nearest foodland, which is accepting donations at checkout to support the american red. Assume the following items are in. Web a limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. Donations can be made at our retail stores and attended donation centers. Prices are only estimated values. Web charitable contributions are a type of personal itemized deduction. Web provide the list of expected donation in the following manner: You may be able to deduct the value of your donations if you choose to itemize them on your taxes. Internal revenue service (irs) requires donors to value their items. Web edit itemized donation list printable 2021. Web goodwill accepts gently used items that are clean, safe and resaleable. Web if you donate an item worth more than $50,000, you'll need to get a statement of value from the irs, which will cost you at least $7,500. Quantity of the donated items; Your donation value generates goodwill program hours. When you bring items to one of our donation locations, you may fill out a paper donation form. Save your time required to printing, signing, and scanning a paper copy of goodwill donation. Web here are some handy irs tips for deducting charitable donations. Pdffiller.com has been visited by 1m+ users in the past month