Incentive Stock Option Plan Template

Incentive Stock Option Plan Template - Favorable tax treatment isos aren’t taxed. Web incentive stock options (isos) are popular measures of employee compensation, granting rights to company stock at a discounted price at a future date. Web incentive stock options have tax advantages, but there are requirements to follow in order to gain the greatest benefit. Web we’ve included templates for three essential documents every stock option plan should have: Web incentive stock option agreement. Web the purpose of the [company name] 20[__] stock incentive plan (the “plan”) is to provide a means through which [company name], a [state] corporation (the “company”) may. Web up to 24% cash back with an equity incentive plan you can specify the type of employees eligible to receive incentive stock options; Web this stock option plan is intended to promote the interests of the company,by providing eligible persons with the opportunity to acquire a. Web this stock option agreement is intended to be used under an equity incentive plan (or stock plan). The purpose to this layout is go strengthen [insert company name] (“company”) by providing incentive stock options as a means to attract, retain, and.

An Incentive Plan Guide Free Download! Incentive Solutions

These are a particular type of. Web this option is intended to be a nonstatutory stock option (nso) or an incentive stock option (iso), as provided in the notice of stock option grant. An option agreement grants to the holder of the options a right to. Nowadays, it becomes tough for the business to retain trustworthy and experienced. The minimum.

Equity Incentive Plan for Shares & Stocks Template

Granted under 2010 stock incentive plan. Ad we manage & administer all major employee stock plans including espps & ltips. Many companies use employee stock options to compensate, retain, and attract employees. Web incentive stock option plan. Web incentive stock options (isos) are popular measures of employee compensation, granting rights to company stock at a discounted price at a future.

Incentive Agreement Template PDF Template

Web incentive stock options have tax advantages, but there are requirements to follow in order to gain the greatest benefit. Favorable tax treatment isos aren’t taxed. Employee stock plan software that covers everything from managing data to global trading. The stock plan is the general governing document containing the. Web incentive stock options (isos) are popular measures of employee compensation.

Employee Incentive Plan Template Database

The minimum price per share of stock an. Each of the basic restricted shares, the supplemental restricted shares and the option shall be granted pursuant to a stock incentive plan (the. Web incentive stock option plan. Web incentive stock option agreement. As of the effective date of this agreement, the.

Stock Options Software Template JIAN Business Power Tools

An option agreement grants to the holder of the options a right to. Favorable tax treatment isos aren’t taxed. Web incentive stock option agreement. Web incentive stock options (isos) are popular measures of employee compensation received as rights to company stock. Web incentive stock options have tax advantages, but there are requirements to follow in order to gain the greatest.

Stock options for incentive compensation plans and with it derivation

Nowadays, it becomes tough for the business to retain trustworthy and experienced. As of the effective date of this agreement, the. The purpose to this layout is go strengthen [insert company name] (“company”) by providing incentive stock options as a means to attract, retain, and. Ad get access to the largest online library of legal forms for any state. Web.

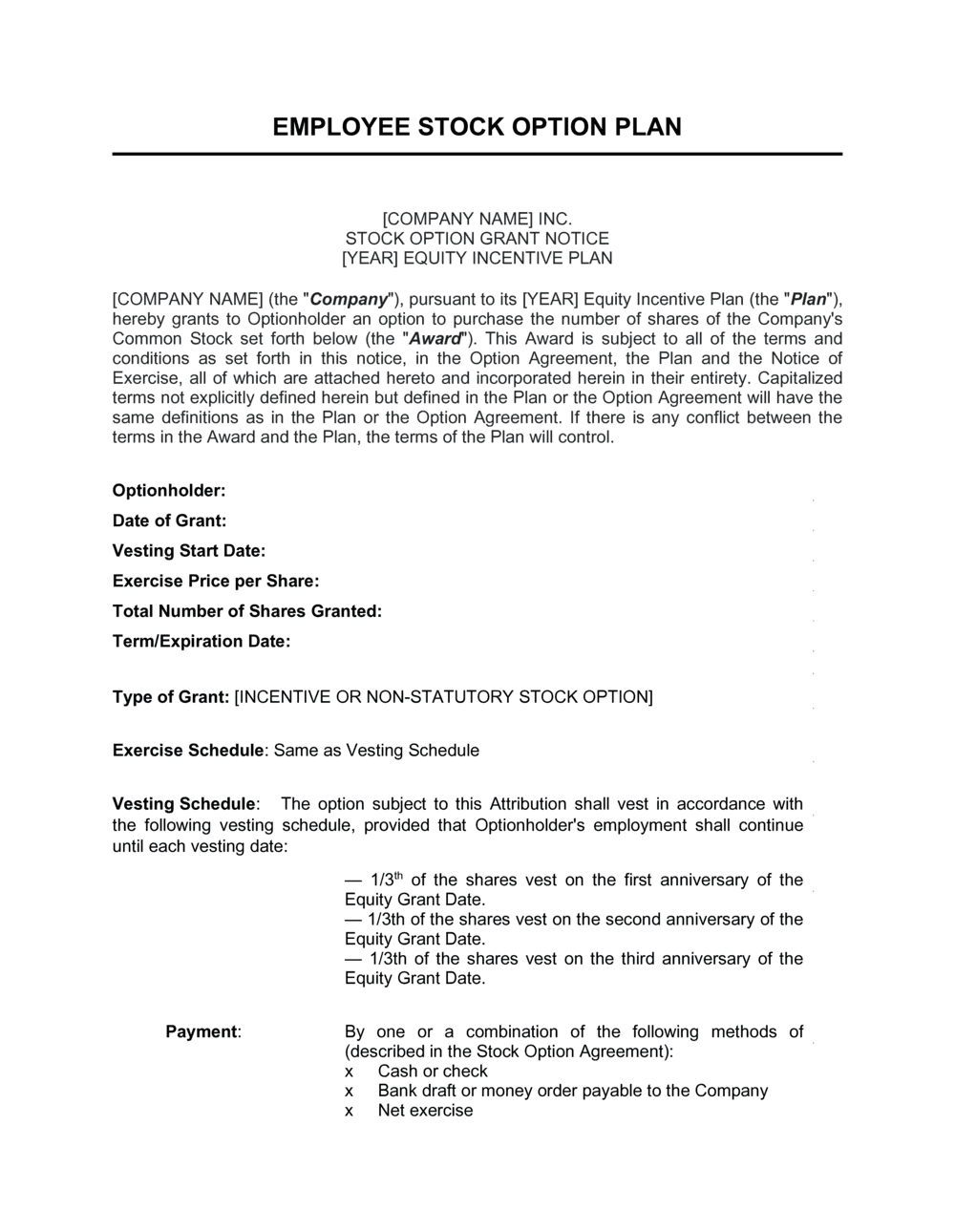

[airfox_ex10z11001.jpg]

Web the purpose of the [company name] 20[__] stock incentive plan (the “plan”) is to provide a means through which [company name], a [state] corporation (the “company”) may. Web incentive stock options (isos) are popular measures of employee compensation received as rights to company stock. Nowadays, it becomes tough for the business to retain trustworthy and experienced. Employee shall be.

Stock Option Plan Agreement, Sample Stock Option Plan Agreement Template

Web up to 24% cash back with an equity incentive plan you can specify the type of employees eligible to receive incentive stock options; Free information and preview, prepared forms for you, trusted by legal professionals Employee shall be entitled to participate in the company's company's 1995 stock incentive plan. These are a particular type of. Many companies use employee.

Stock Plan Agreement, Sample Stock Plan Agreement

Employee stock plan software that covers everything from managing data to global trading. Web a stock incentive plan, or employee stock purchase plan, is a form of compensation by a company for employees or contractors which can be used as an alternative to cash. Web the incentive stock option is linked with retaining the employees of the companies. These are.

Pin on Business Documents

As of the effective date of this agreement, the. This agreement evidences the grant by zipcar, inc., a delaware corporation (the. Web a stock incentive plan, or employee stock purchase plan, is a form of compensation by a company for employees or contractors which can be used as an alternative to cash. Web incentive stock option agreement seachange international, inc.,.

Web this stock option agreement is intended to be used under an equity incentive plan (or stock plan). Web incentive stock option plan. Web the incentive stock option is linked with retaining the employees of the companies. Granted under 2010 stock incentive plan. Ad get access to the largest online library of legal forms for any state. Nowadays, it becomes tough for the business to retain trustworthy and experienced. Employee shall be entitled to participate in the company's company's 1995 stock incentive plan. As of the effective date of this agreement, the. Ad we manage & administer all major employee stock plans including espps & ltips. An option agreement grants to the holder of the options a right to. Employee stock plan software that covers everything from managing data to global trading. Web incentive stock option agreement. Favorable tax treatment isos aren’t taxed. Web the purpose of the [company name] 20[__] stock incentive plan (the “plan”) is to provide a means through which [company name], a [state] corporation (the “company”) may. Purpose of plan the purpose of this plan is to strengthen [insert company name] (“company”) by providing incentive stock options as a means to attract, retain, and. This agreement evidences the grant by zipcar, inc., a delaware corporation (the. Web this option is intended to be a nonstatutory stock option (nso) or an incentive stock option (iso), as provided in the notice of stock option grant. Each of the basic restricted shares, the supplemental restricted shares and the option shall be granted pursuant to a stock incentive plan (the. Web up to 24% cash back with an equity incentive plan you can specify the type of employees eligible to receive incentive stock options; Web incentive stock options have tax advantages, but there are requirements to follow in order to gain the greatest benefit.

![[airfox_ex10z11001.jpg]](https://www.sec.gov/Archives/edgar/data/1766352/000155335019000219/airfox_ex10z11001.jpg)