Independent Contractor Profit And Loss Statement Template

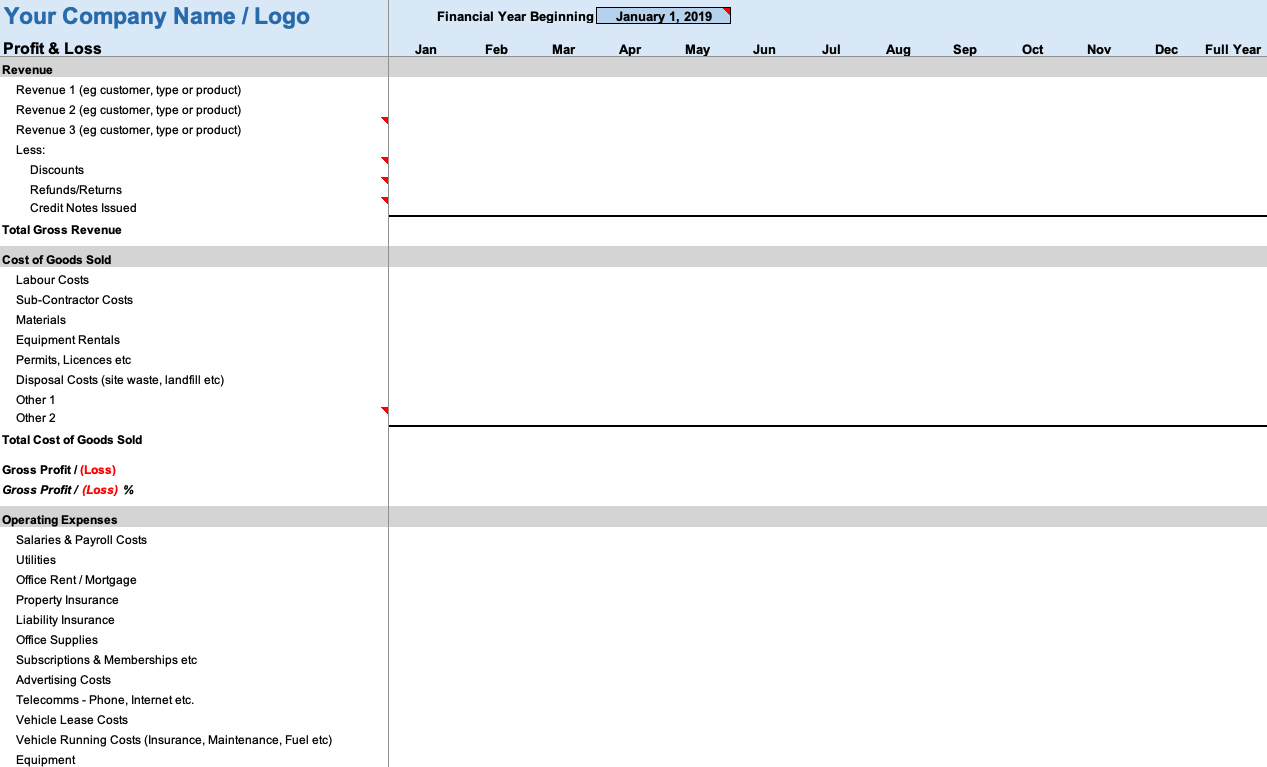

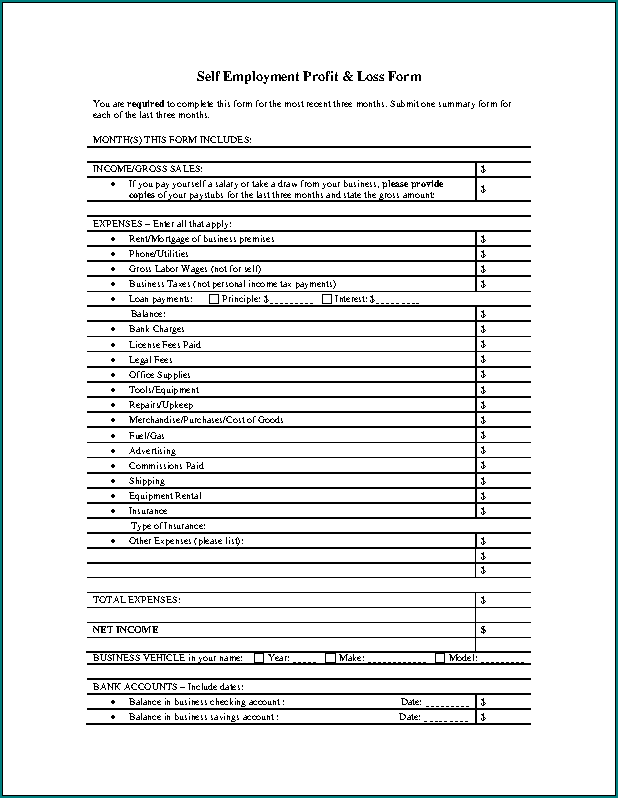

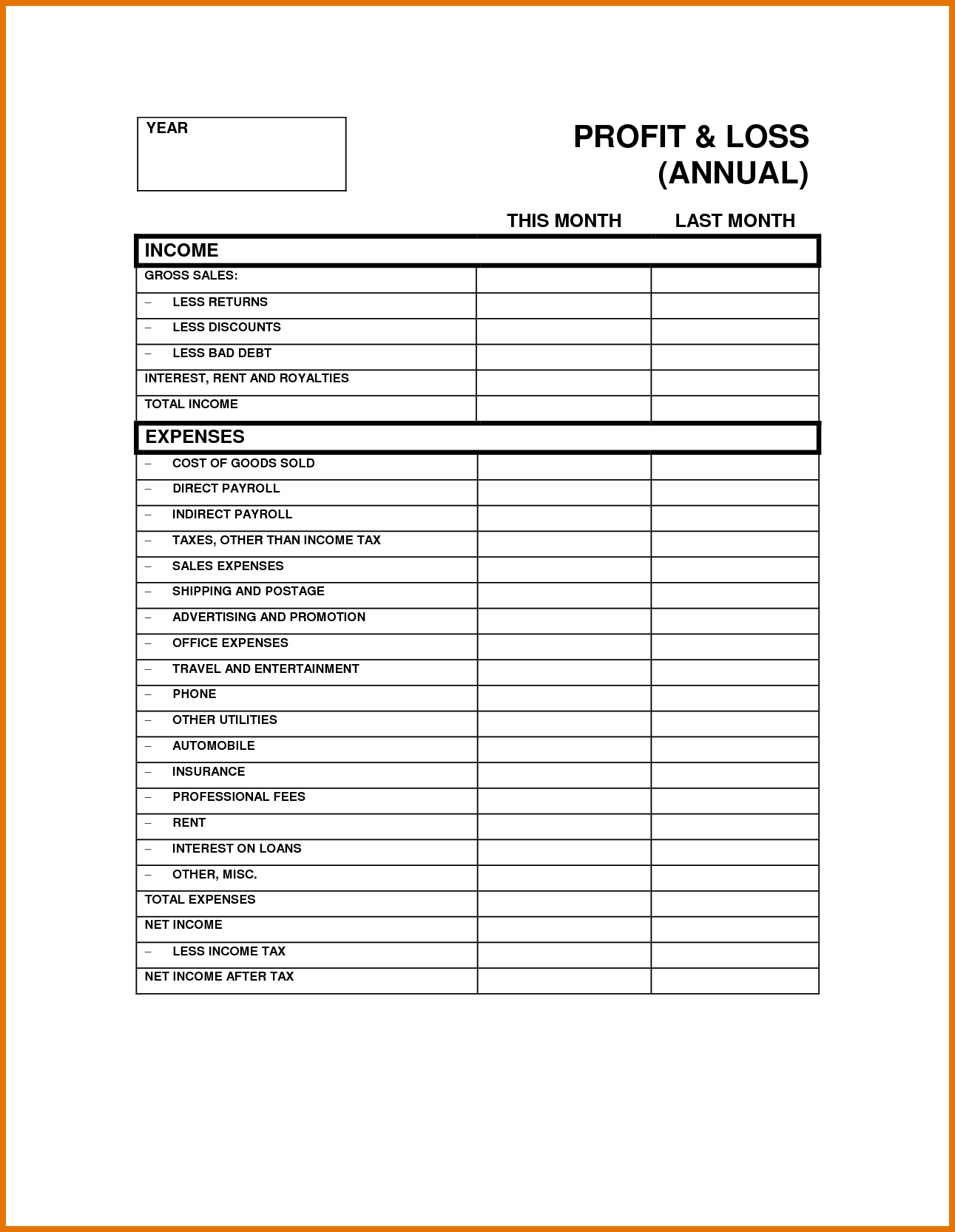

Independent Contractor Profit And Loss Statement Template - Sign up & make payroll a breeze. This is a sample template to be used as a guide for homeowners. Web you will need to fill out and file the form in a timely manner in order to satisfy irs profit and loss reporting requirements for sole proprietors. Explore the #1 accounting software for small businesses. Ad simply the best payroll service for small business. The single worksheet in this template (called “independent contractor p&l”) has the typical profit and loss sections (income and expenses) that i mentioned above. Ad simply the best payroll service for small business. Independent contractors report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). For instructions and the latest. Sign up & make payroll a breeze.

Independent Contractor Profit And Loss Statement Template Database

Web updated may 31, 2023. Ad 1) fill out income statement (profit & loss) template. Web the other goal, usage your knowledge of an earned statement, is to help you evaluate if this downloadable independent contractors profit and loss statement patterns will. Sign up & make payroll a breeze. Sign up & make payroll a breeze.

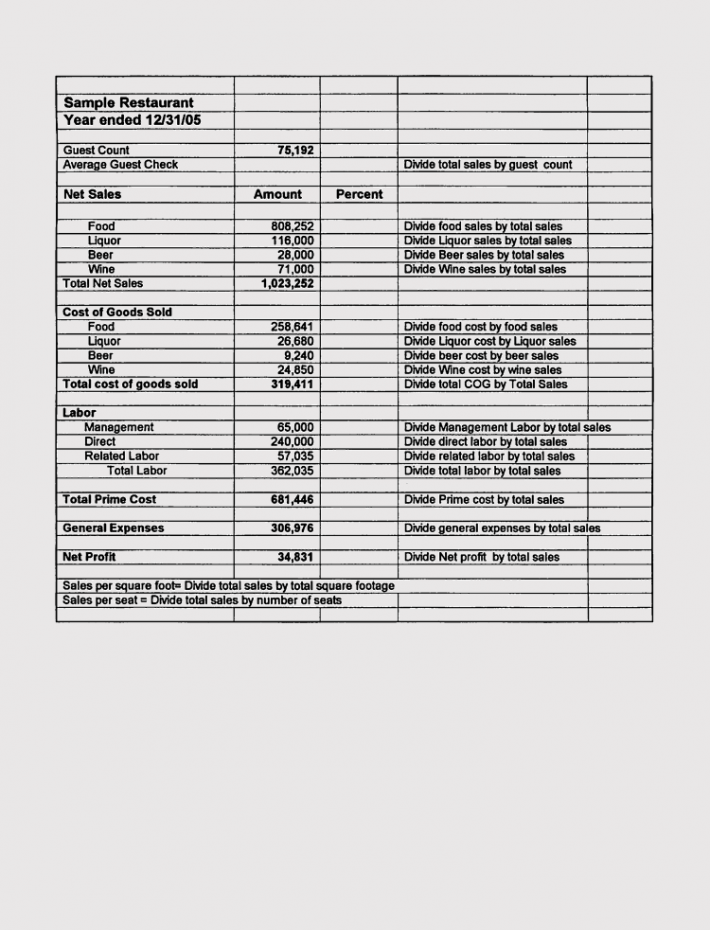

19 Printable Profit And Loss Statement For Self Employed Construction

Ad manage all your business expenses in one place with quickbooks®. Ad manage all your business expenses in one place with quickbooks®. A freelance (independent contractor) invoice is a document that allows any contractor providing any type of service, from gardener to. Web the other goal, using your knowledge of an income statement, is to help you ranking if save.

Independent Contractor Profit And Loss excel template for free

Ad simply the best payroll service for small business. Track everything in one place. Web download the cash flow statement template. Ad manage all your business expenses in one place with quickbooks®. From ____/ ____/ ________ to ____/ ____/ ________ (must be minimum.

Independent Contractor Profit And Loss Statement Template Database

For instructions and the latest. Ad 1) fill out income statement (profit & loss) template. Explore the #1 accounting software for small businesses. Ad manage all your business expenses in one place with quickbooks®. Ad manage all your business expenses in one place with quickbooks®.

8 Independent Contractor Profit And Loss Statement Template Template

2) download & print free! Gusto supports contractor payments in 120+ countries. Profit or loss from business. Track everything in one place. Web department of the treasury internal revenue service.

8 Independent Contractor Profit And Loss Statement Template Template

Gusto supports contractor payments in 120+ countries. Web the other goal, using your knowledge of an income statement, is to help you ranking if save downloadable independent contractor profit and lose statement template will. Web department of the treasury internal revenue service. Explore the #1 accounting software for small businesses. Web updated may 31, 2023.

Independent Contractor Profit And Loss Statement Template Database

Pdfquick.com has been visited by 10k+ users in the past month Ad simply the best payroll service for small business. Explore the #1 accounting software for small businesses. Ad manage all your business expenses in one place with quickbooks®. Track everything in one place.

8 Independent Contractor Profit And Loss Statement Template Template

Also file schedule se (form. Web the other goal, usage your knowledge of an earned statement, is to help you evaluate if this downloadable independent contractors profit and loss statement patterns will. Ad 1) fill out income statement (profit & loss) template. 2) download & print free! Sign up & make payroll a breeze.

Sensational Independent Contractor Profit And Loss Statement Template

For instructions and the latest. Sign up & make payroll a breeze. A freelance (independent contractor) invoice is a document that allows any contractor providing any type of service, from gardener to. Gusto supports contractor payments in 120+ countries. Take a look at the overviewimage to see a screenshot of the statement (the details of the income and expense sections.

Real Estate Profit And Loss Spreadsheet With Regard To Company Profit

Ad manage all your business expenses in one place with quickbooks®. Also file schedule se (form. Explore the #1 accounting software for small businesses. Take a look at the overviewimage to see a screenshot of the statement (the details of the income and expense sections are hidden to provide a clearer. For instructions and the latest.

Pdfquick.com has been visited by 10k+ users in the past month Ad 1) fill out income statement (profit & loss) template. From ____/ ____/ ________ to ____/ ____/ ________ (must be minimum. For instructions and the latest. Also file schedule se (form. Web the other goal, usage your knowledge of an earned statement, is to help you evaluate if this downloadable independent contractors profit and loss statement patterns will. Track everything in one place. Sign up & make payroll a breeze. Ad simply the best payroll service for small business. Sign up & make payroll a breeze. Independent contractors report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). Web updated may 31, 2023. Ad manage all your business expenses in one place with quickbooks®. 2) download & print free! Web you will need to fill out and file the form in a timely manner in order to satisfy irs profit and loss reporting requirements for sole proprietors. A freelance (independent contractor) invoice is a document that allows any contractor providing any type of service, from gardener to. Track everything in one place. Sounds like a profit and loss statement template sent from the clouds. Web department of the treasury internal revenue service. Web the other goal, using your knowledge of an income statement, is to help you ranking if save downloadable independent contractor profit and lose statement template will.