Irs Form 8332 Printable

Irs Form 8332 Printable - The deduction for personal exemptions is suspended for tax years 2018 through 2025 by the tax cuts and. Web claim the child tax credit and additional child tax credit for the qualifying child if the custodial parent provides them with form 8332, release/revocation of release of claim to. Web separated, or never married lifecycleseries parents this publication presents basic information about some of the tax consequences of a divorce and some tax issues of. Web fill out sign export or print download your fillable irs form 8332 in pdf table of contents who should fill out the document? Web employer's quarterly federal tax return. The form can be used for current or. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s exemption. Use it when you are. Web prepare the form 8332 on the custodial parent's return. Complete, edit or print tax forms instantly.

Printable Irs Forms 2021 8332 Calendar Printable Free

Download or email irs 8332 & more fillable forms, register and subscribe now! Web prepare the form 8332 on the custodial parent's return. Web how to fill out and sign irs form 8332 printable online? Web separated, or never married lifecycleseries parents this publication presents basic information about some of the tax consequences of a divorce and some tax issues.

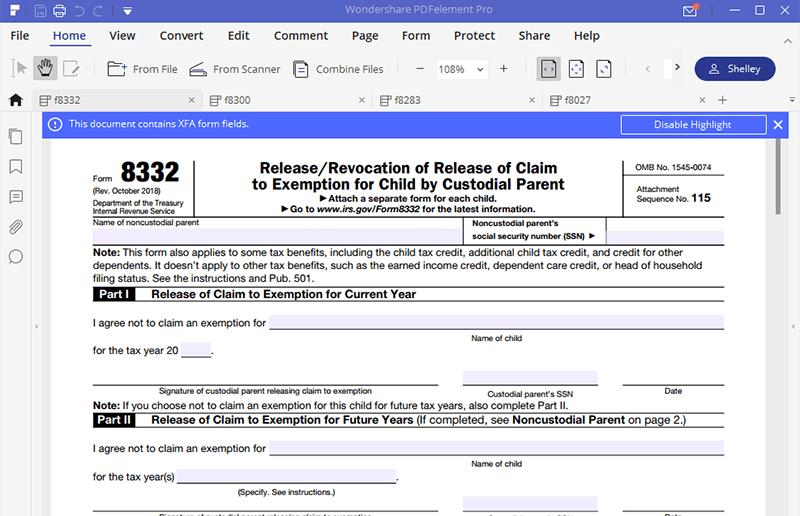

20182020 Form IRS 8332 Fill Online, Printable, Fillable, Blank PDFfiller

Web we last updated the release/revocation of release of claim to exemption for child by custodial parent in february 2023, so this is the latest version of form 8332, fully. Web where do i mail irs form 8332? Use fill to complete blank online irs pdf forms for free. Web an eligible entity uses form 8832 to elect how it.

Irs Form 8332 Printable Printable World Holiday

The form can be used for current or. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. How you can fill out the ir's irs form 8332 printable. Web how to fill out and sign irs form 8332 printable online? Web general instructions what’s new exemption deduction suspended.

Printable Irs Forms 2021 8332 Calendar Printable Free

Edit your form 8332 online type text, add images, blackout confidential details, add comments, highlights and more. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s exemption. Web fillable form 8332 release of claim to child exemption. Ad download or email.

Tax Form 8332 Printable Master of Documents

Delete the data entered in screen 70, release of claim to. How you can fill out the ir's irs form 8332 printable. Web we last updated the release/revocation of release of claim to exemption for child by custodial parent in february 2023, so this is the latest version of form 8332, fully. Purpose of the document how to fill out.

IRS Form 8332 Fill it with the Best PDF Form Filler

When you print/preview the federal electronic filing instructions. Ad download or email irs 8332 & more fillable forms, register and subscribe now! Web the child’s exemption by signing this form or similar statement. Enjoy smart fillable fields and interactivity. Get your online template and fill it in using progressive features.

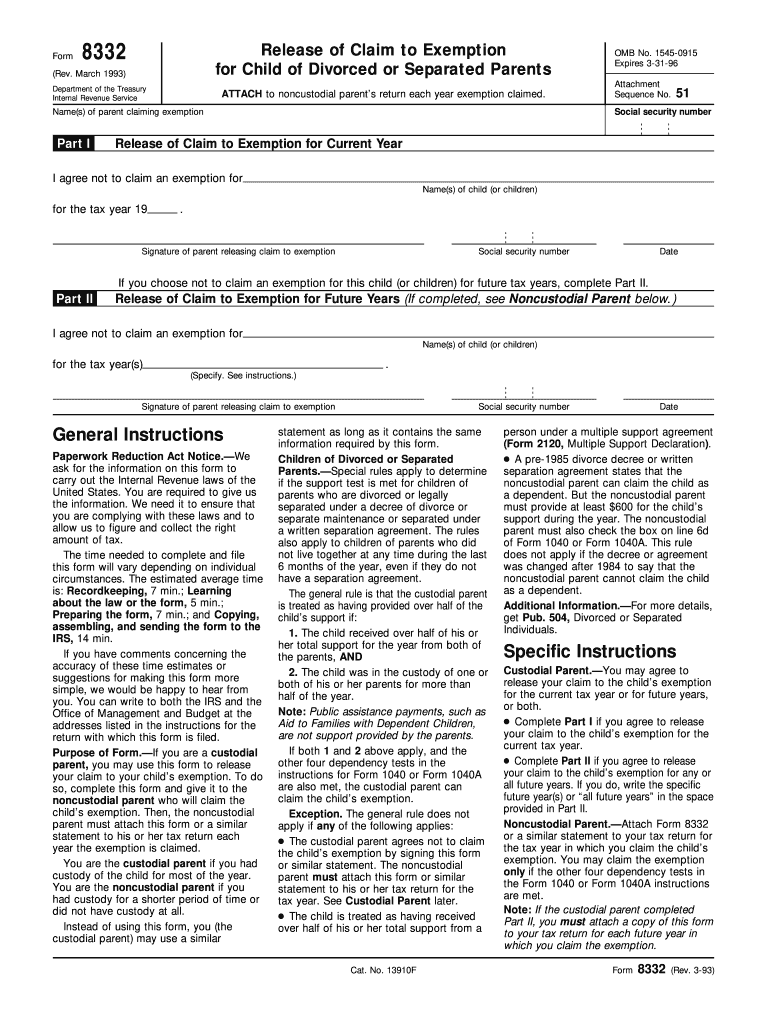

IRS 8332 1993 Fill out Tax Template Online US Legal Forms

Web where do i mail irs form 8332? When you print/preview the federal electronic filing instructions. Web employer's quarterly federal tax return. Web fillable form 8332 release of claim to child exemption. Web fill out sign export or print download your fillable irs form 8332 in pdf table of contents who should fill out the document?

Irs Form W4V Printable / Irs Form 1310 Printable Fill Out and Sign

If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Edit your form 8332 online type text, add images, blackout confidential details, add comments, highlights and more. The form can be used for current or. When you print/preview the federal electronic filing instructions. Web separated, or never married.

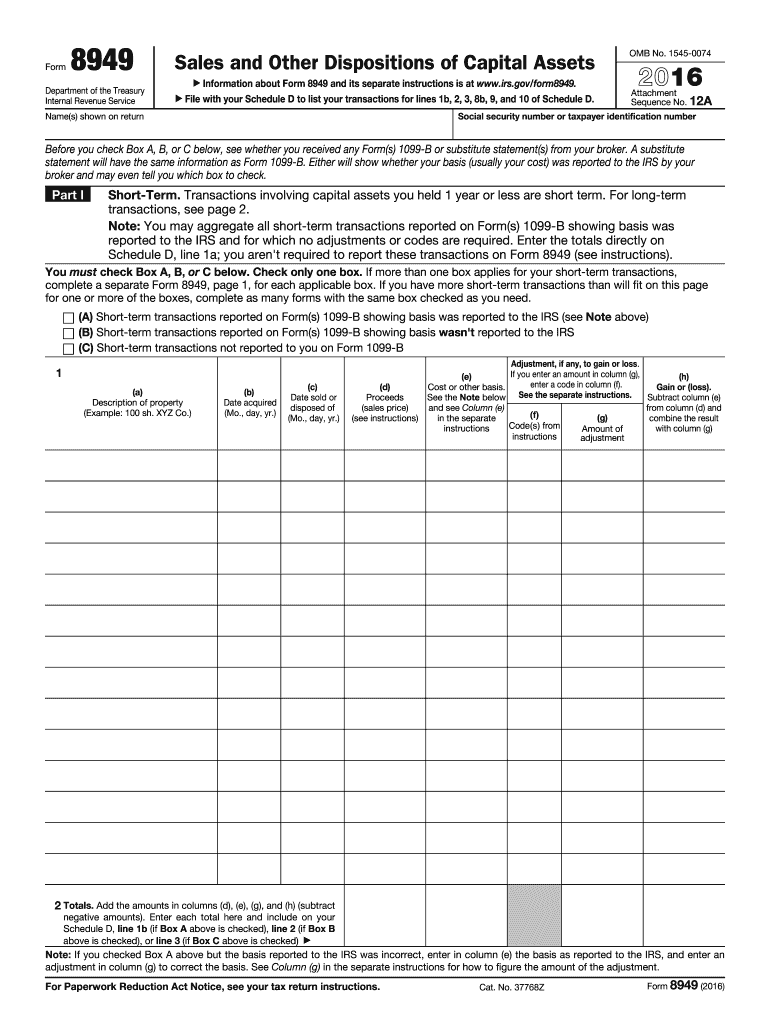

2016 Form IRS 8949 Fill Online, Printable, Fillable, Blank pdfFiller

Sign it in a few clicks draw your signature, type it,. Web separated, or never married lifecycleseries parents this publication presents basic information about some of the tax consequences of a divorce and some tax issues of. Purpose of the document how to fill out a. Web fillable form 8332 release of claim to child exemption. An entity disregarded as.

Print Irs Form 941 Fill Online, Printable, Fillable, Blank pdfFiller

Edit your form 8332 online type text, add images, blackout confidential details, add comments, highlights and more. Use it when you are. Web separated, or never married lifecycleseries parents this publication presents basic information about some of the tax consequences of a divorce and some tax issues of. Ad download or email irs 8332 & more fillable forms, register and.

Delete the data entered in screen 70, release of claim to. Web claim the child tax credit and additional child tax credit for the qualifying child if the custodial parent provides them with form 8332, release/revocation of release of claim to. Web fillable form 8332 release of claim to child exemption. When you print/preview the federal electronic filing instructions. Web fill online, printable, fillable, blank form 8332: Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Purpose of the document how to fill out a. The deduction for personal exemptions is suspended for tax years 2018 through 2025 by the tax cuts and. Web prepare the form 8332 on the custodial parent's return. Enjoy smart fillable fields and interactivity. Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Web we last updated the release/revocation of release of claim to exemption for child by custodial parent in february 2023, so this is the latest version of form 8332, fully. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s exemption. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: Sign it in a few clicks draw your signature, type it,. Web this would enable the return to be electronically filed and form 8332 to be sent to the irs along with form 8453. Release/revocation of release of claim to (irs) form. Fill online, printable, fillable, blank form 8332 release of claim to child exemption form. The release of the dependency exemption will.