Irs Penalty Abatement Templates

Irs Penalty Abatement Templates - Web the irs can assess many types of penalties against taxpayers: Sample irs penalty abatement request letter. Current revision form 843 pdf. Web you may be given one of the following types of penalty relief depending on the penalty: Web reasonable cause reasonable cause is determined on a case by case basis considering all the facts and circumstances of your situation. Web abatement of any penalty or addition to tax attributable to erroneous written advice by the internal revenue service: Internal revenue service (use the address provided in your tax bill) re: Web the irs offers a penalty abatement on failure to file and failure to pay penalties on the first year of tax debts that you owe. Web fill out irs form 843. The template is available free to.

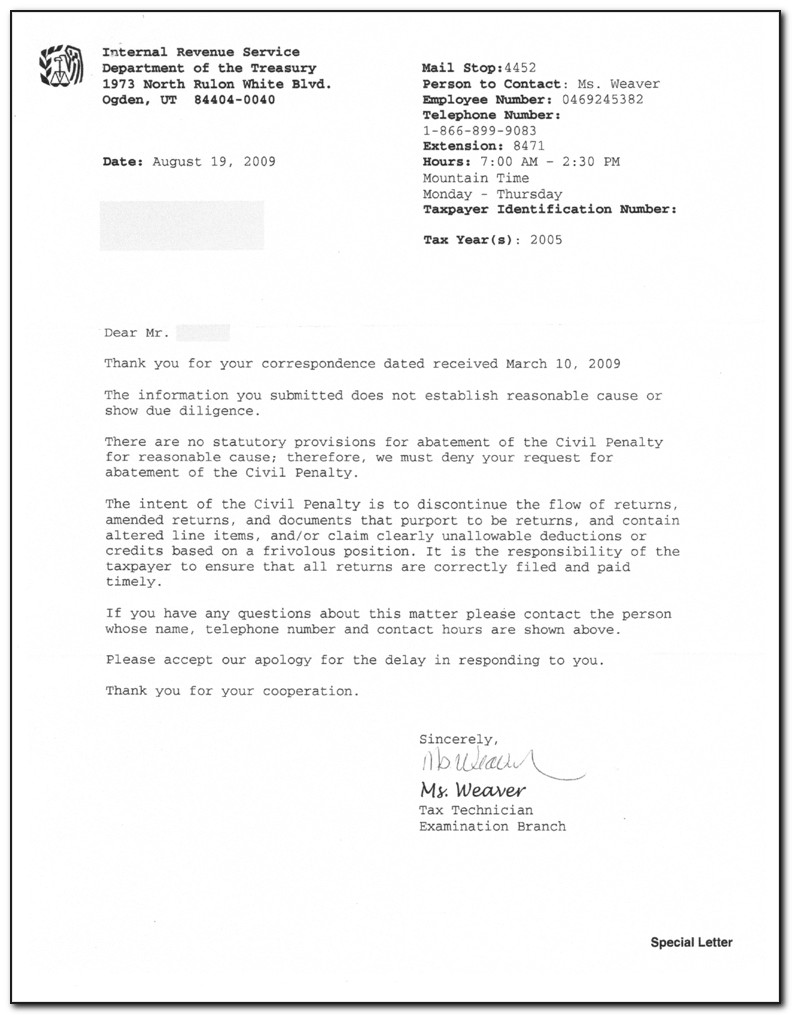

Irs Penalty Abatement Request Letter Example

Current revision form 843 pdf. Estimate how much you could potentially save in just a matter of minutes. However, the failure to pay penalty will continue to increase until you pay the tax in full. Web [address 1] [address 2] [city, state zip] re: You can request first time abate for a penalty even if you haven't fully paid the.

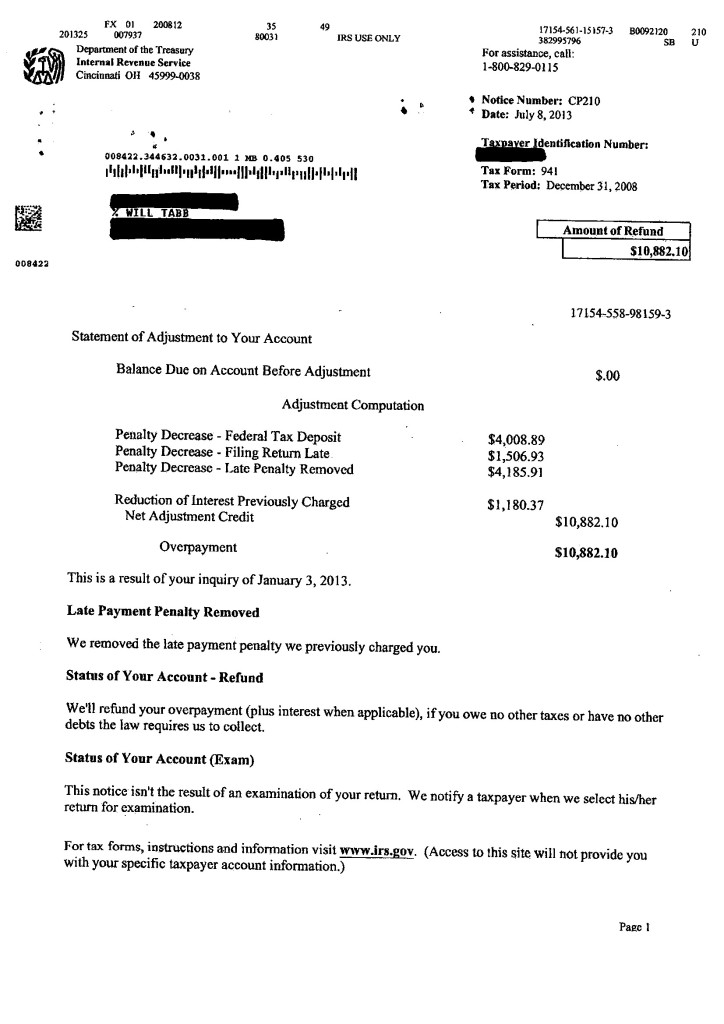

Penalty Abatement Tabb Financial Services

Web the irs can assess many types of penalties against taxpayers: Web abatement of any penalty or addition to tax attributable to erroneous written advice by the internal revenue service: Here are sample letters to request irs penalty abatement. Current revision form 843 pdf. Buyerassisthub.com has been visited by 10k+ users in the past month

Irs form 5472 Penalty Abatement New How to Write Letter to Irs About

Web template for a penalty abatement letter. Web [address 1] [address 2] [city, state zip] re: The template is available free to. However, the failure to pay penalty will continue to increase until you pay the tax in full. You can request first time abate for a penalty even if you haven't fully paid the tax on your return.

Sample Penalty Abatement Letter To Irs To Waive Tax Penalties In Bank

However, the failure to pay penalty will continue to increase until you pay the tax in full. Web use the safe harbor. Current revision form 843 pdf. Web the irs can assess many types of penalties against taxpayers: Web aicpa® & cima® is the most influential body of accountants and finance experts in the world, with 689,000 members, students and.

31+ Penalty Abatement Letter Sample Sample Letter

Buyerassisthub.com has been visited by 10k+ users in the past month Web the irs offers a penalty abatement on failure to file and failure to pay penalties on the first year of tax debts that you owe. Web template for a penalty abatement letter. Sample irs penalty abatement request letter. Individual taxpayers will avoid the penalty altogether when they pay.

50 Irs Penalty Abatement Reasonable Cause Letter Ls3p Irs penalties

Web template for a penalty abatement letter. Web the irs offers a penalty abatement on failure to file and failure to pay penalties on the first year of tax debts that you owe. Web aicpa® & cima® is the most influential body of accountants and finance experts in the world, with 689,000 members, students and engaged professionals globally. Internal revenue.

Letter Request To Waive Penalty Charges Sample late fee waiver letter

Web the irs offers a penalty abatement on failure to file and failure to pay penalties on the first year of tax debts that you owe. Web here is a simplified irs letter template that you can use when writing to the irs: Web fill out irs form 843. Sample irs penalty abatement request letter. Web abatement of any penalty.

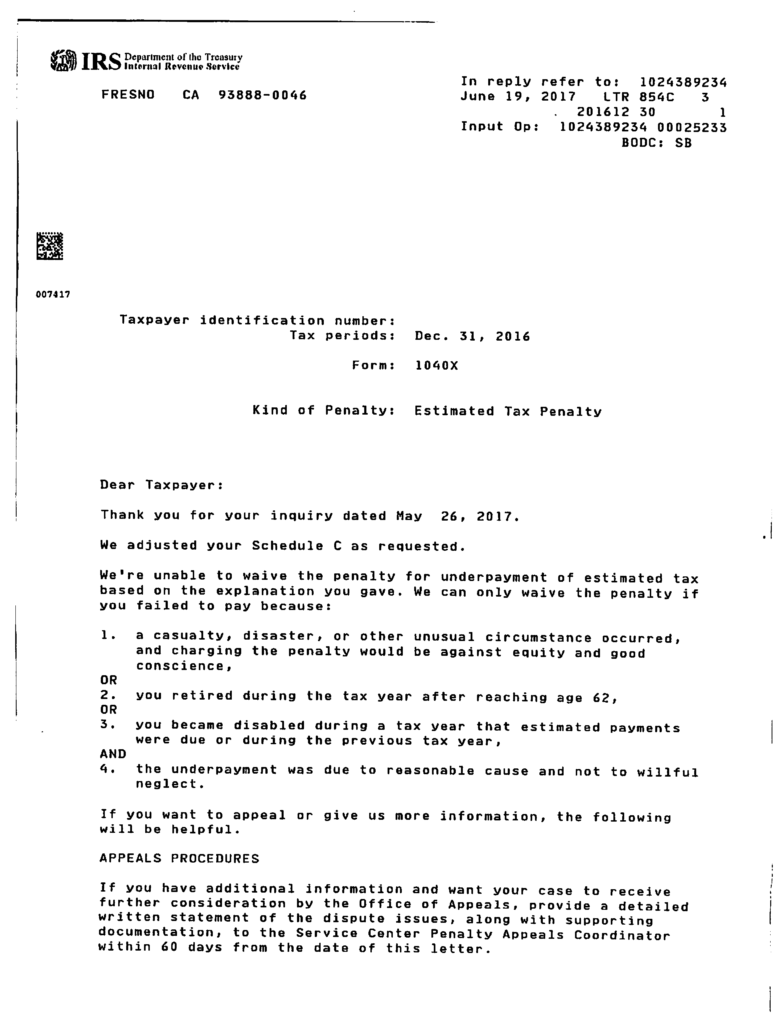

IRS Letter 854C Penalty Waiver or Abatement Disallowed H&R Block

Web the penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal income tax return is filed late. Here are sample letters to request irs penalty abatement. Web the irs can assess many types of penalties against taxpayers: The template is available free to. Buyerassisthub.com has been visited by.

Tax Tax Penalty Appeal Letter Sample Printable tax penalty

Web fill out irs form 843. The template is available free to. Web the irs denied your request to remove the penalty (penalty abatement) you received a letter denying your request, which gives you your appeal rights for an. Web template for a penalty abatement letter. Buyerassisthub.com has been visited by 10k+ users in the past month

50 Irs First Time Penalty Abatement Letter Example Ig2s Letter

Web the irs will also consider your prior history of filing and paying your taxes on time. Web the irs denied your request to remove the penalty (penalty abatement) you received a letter denying your request, which gives you your appeal rights for an. However, the failure to pay penalty will continue to increase until you pay the tax in.

This template for a penalty abatement letter can serve as a guide for taxpayers the have no idea how to proceed. Web template for a penalty abatement letter. Internal revenue service (use the address provided in your tax bill) re: You didn't fully pay your taxes in 2021 and got a notice with the balance due and penalty charges. However, the failure to pay penalty will continue to increase until you pay the tax in full. Sample irs penalty abatement request letter. The template is available free to. Web here is a simplified irs letter template that you can use when writing to the irs: Web the irs offers a penalty abatement on failure to file and failure to pay penalties on the first year of tax debts that you owe. Buyerassisthub.com has been visited by 10k+ users in the past month First time penalty abate and administrative waiver reasonable cause. Web fill out irs form 843. Here are sample letters to request irs penalty abatement. Web the irs will also consider your prior history of filing and paying your taxes on time. Web you may be given one of the following types of penalty relief depending on the penalty: Web the illinois department of revenue (idor) will abate late estimated payment penalties assessed on fourth quarter estimated payments due december 15, 2022, for. If you've already paid a penalty and now realize you might be able to get your money back, you’ll want to file irs form 843. Web use the safe harbor. For example, a taxpayer wants to request penalty abatement because a fire destroyed his. Web [address 1] [address 2] [city, state zip] re: