Payroll Procedures Template

Payroll Procedures Template - Web the basic framework for any payroll process flowchart is setting up gross pay calculations, taking off taxes and deductions, verifying payroll and of course, paying. Discover adp® payroll, benefits, insurance, time, talent, hr, & more. Ad approve payroll when you're ready, access employee services & manage it all in one place. It includes all the necessary information and forms that a company needs to. This payroll process flowchart depicts the steps involved in running payroll, making withholding. By olaoluwa january 2, 2023. A payment template can help your organization arrange and make payments on time. This includes steps such as calculating employee wages, deducting taxes. Review any changes to your employees. Enforce standard procedures for all employees;

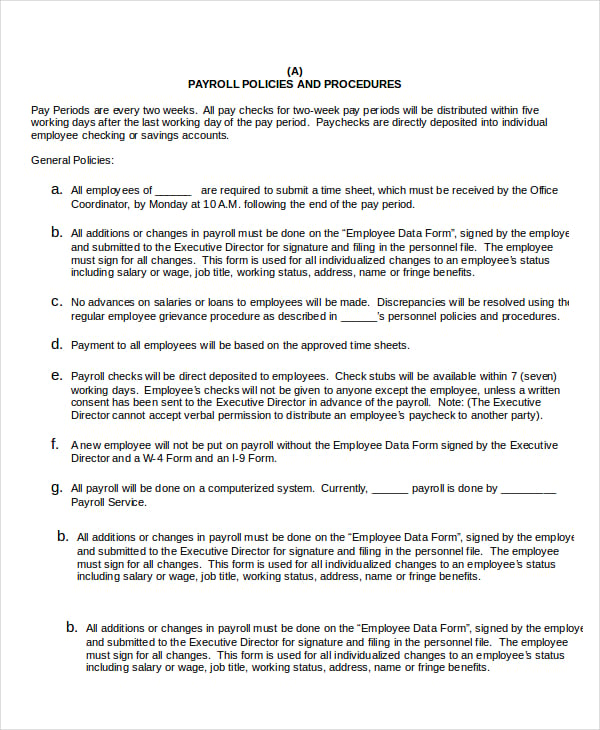

7 Payroll Procedures Manual Template SampleTemplatess SampleTemplatess

This template provides a company with a simple and effective payroll procedure. Pay your team and access hr and benefits with the #1 online payroll provider. Ad approve payroll when you're ready, access employee services & manage it all in one place. Pay your team and access hr and benefits with the #1 online payroll provider. Review any changes to.

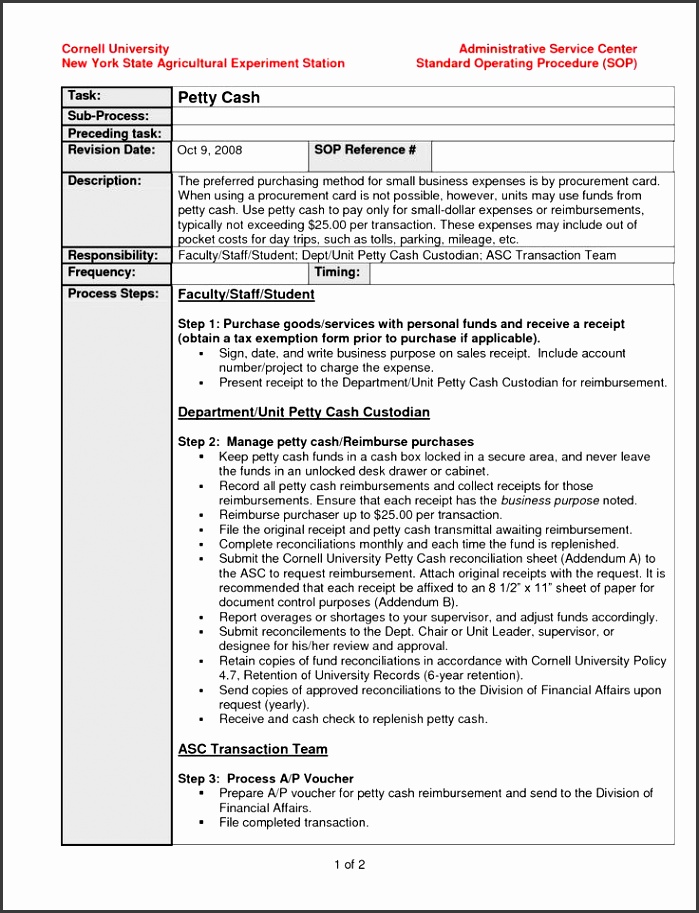

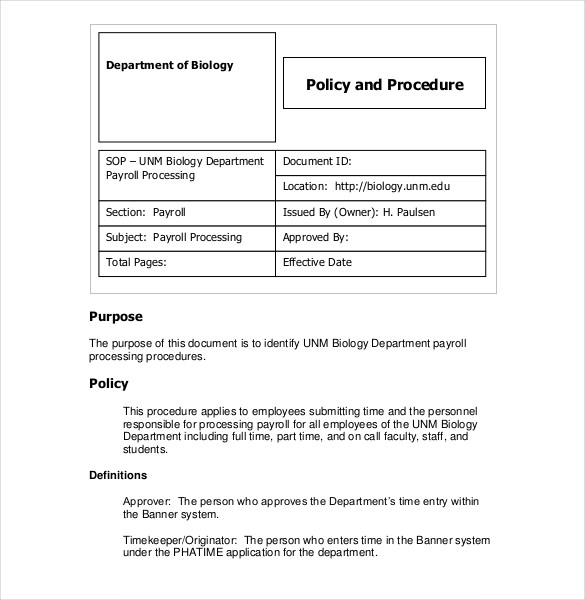

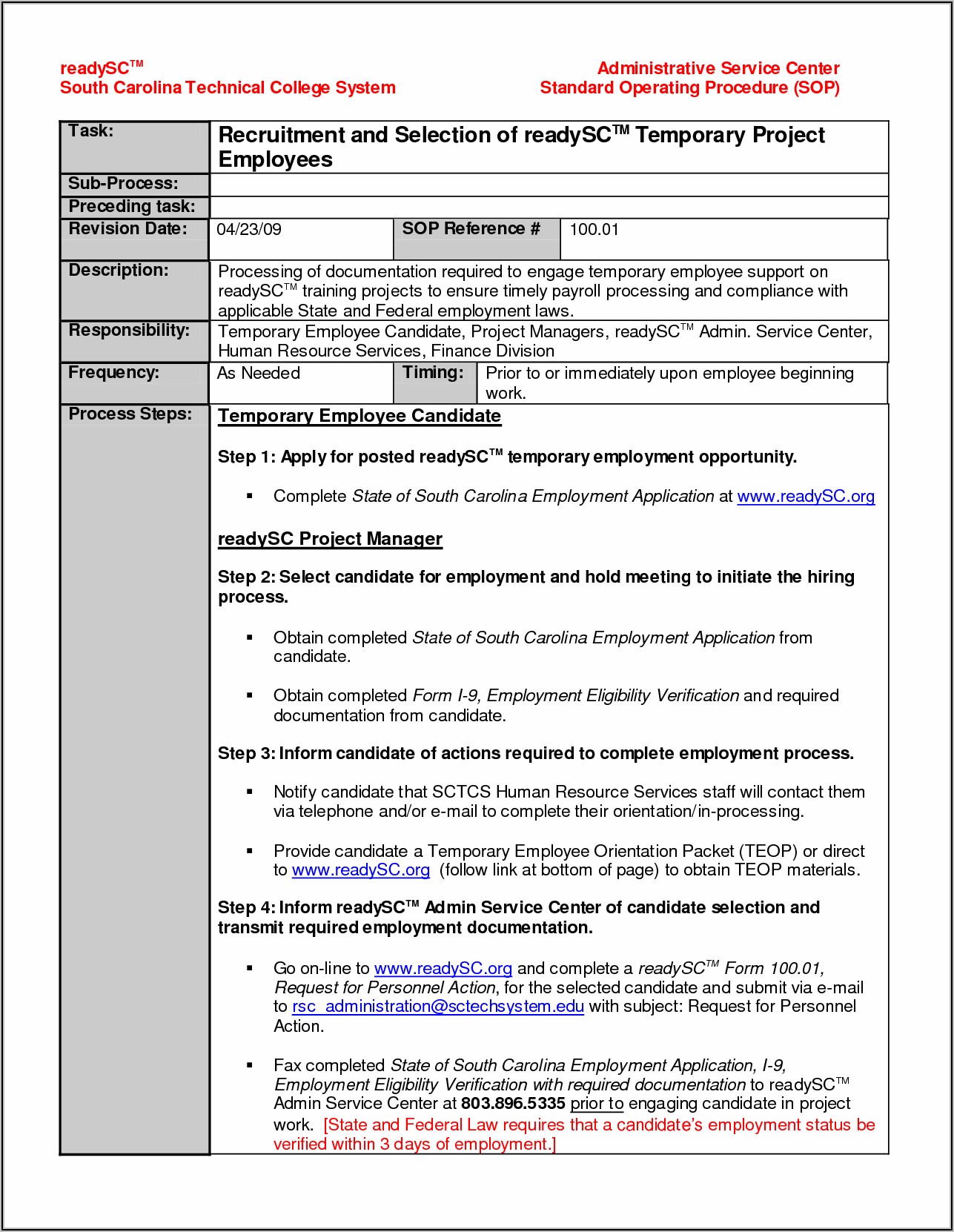

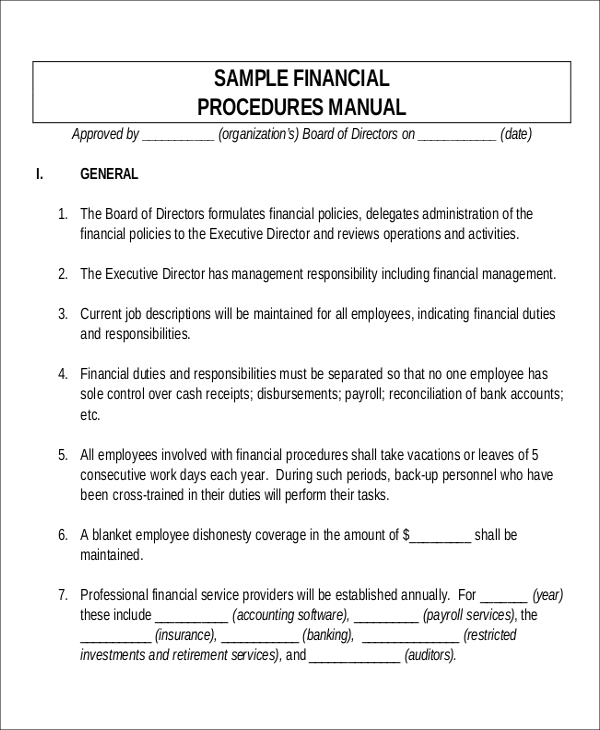

13+ Standard Operating Procedure Templates PDF, DOC Free & Premium

Web learn how to do payroll on your own with our simple guide. Pay your team and access hr and benefits with the #1 online payroll provider. Web payroll management templates payroll schedule templates timecard templates payroll check templates payroll management templates payroll. Enforce standard procedures for all employees; Web payroll processing checklist:

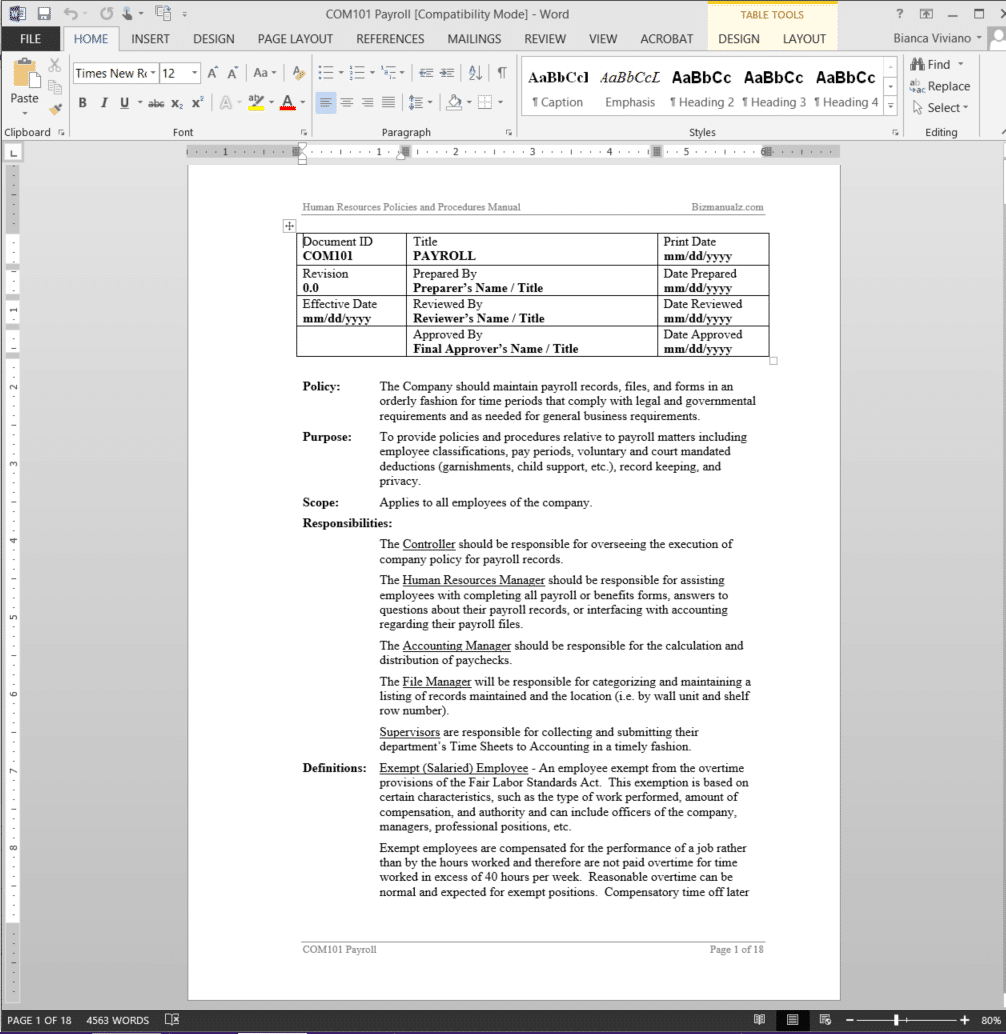

Payroll Procedure

Web here we’ve compiled a list of 10 free payroll templates to streamline the payroll process. Whenever someone moves to a different state. Web a payroll policy defines the entire payroll process of an employee, from net pay and payroll schedules to payment methods, deductions, wage structures &. Web payroll processing checklist: Review any changes to your employees.

40+ Free Payroll Templates & Calculators ᐅ TemplateLab

Enforce standard procedures for all employees; Ensure statutory compliances and accounting processes; Best overall payroll software for small businesses by business.com Employee payroll budgeting and billing template; Web sample payroll company business plan pdf.

Payroll Sop Format Template 1 Resume Examples N8VZdZdM9w

Web with this payroll policy template, you can: Whether you run a small business with a handful of employees or a large firm with. Review any changes to your employees. This includes steps such as calculating employee wages, deducting taxes. Web this guide outlines standard payroll procedures and internal controls that should be applied by all university departments for paying.

13+ Standard Operating Procedure Template Free Download

It includes all the necessary information and forms that a company needs to. Web human resources & payroll process flowchart 1. Update employee master file the payroll clerk receives notification of changes to employee information that impact the processing of payroll, such as. Ad run payroll faster & easier with run powered by adp®. Web sample payroll company business plan.

Procedure Template 23+ Free Word Documents Download

A payment template can help your organization arrange and make payments on time. Ensure statutory compliances and accounting processes; Web with this payroll policy template, you can: Web here we’ve compiled a list of 10 free payroll templates to streamline the payroll process. Get 3 months free payroll!

Payroll Procedures Manual Template For Your Needs

Web learn how to do payroll on your own with our simple guide. Whenever someone moves to a different state. Here is how to write a payroll company business plan. Web payroll processing checklist: Web you can count on these templates to help you figure out where the money's going and how much everyone gets, week after week and month.

7 Payroll Procedures Manual Template SampleTemplatess SampleTemplatess

This includes steps such as calculating employee wages, deducting taxes. Web bank payroll check template; Web here we’ve compiled a list of 10 free payroll templates to streamline the payroll process. Whenever someone moves to a different state. Ad run payroll faster & easier with run powered by adp®.

payrollprocedures Payroll Employment

We'll break down the process and discuss the legal and tax requirements involved. Web learn how to do payroll on your own with our simple guide. Web with this payroll policy template, you can: A payment template can help your organization arrange and make payments on time. It includes all the necessary information and forms that a company needs to.

Enforce standard procedures for all employees; This template provides a company with a simple and effective payroll procedure. It includes all the necessary information and forms that a company needs to. Web the payroll procedures manual (ppm) prescribes detailed payroll procedures not provided elsewhere and coordinates instructions of various authorities on specific. Web a payroll policy defines the entire payroll process of an employee, from net pay and payroll schedules to payment methods, deductions, wage structures &. Pay your team and access hr and benefits with the #1 online payroll provider. Employee payroll budgeting and billing template; Web human resources & payroll process flowchart 1. This includes steps such as calculating employee wages, deducting taxes. Pay your team and access hr and benefits with the #1 online payroll provider. Web payroll management templates payroll schedule templates timecard templates payroll check templates payroll management templates payroll. A payment template can help your organization arrange and make payments on time. The payment made here is on. The template is an essential document used to record the payment. Whenever someone moves to a different state. Discover adp® payroll, benefits, insurance, time, talent, hr, & more. Best overall payroll software for small businesses by business.com Review any changes to your employees. We'll break down the process and discuss the legal and tax requirements involved. Avoid errors and oversight in.