Present Value Calculator Excel Template

Present Value Calculator Excel Template - Web = pv (rate, nper, pmt, [fv], [type]) where: In other words, $100 is the present value of $110 that are expected to be received in the future. Or, use the excel formula coach to find the present value of your financial. Web present value (pv)—also known as a discount value—measures the value of future cash flows in today’s dollar. First thing that you need to do is to find out the amount of interest rate and fill them out on the interest rate column. Net present value (npv) adds up the present values of all future cashflows to bring them to. Net present value is the difference between pv of cash flows and pv of cash outflows. Web net present value template. The present value (pv) is an estimation of how much a future cash flow (or stream of cash flows) is worth right now. Calculate present value of an insurance

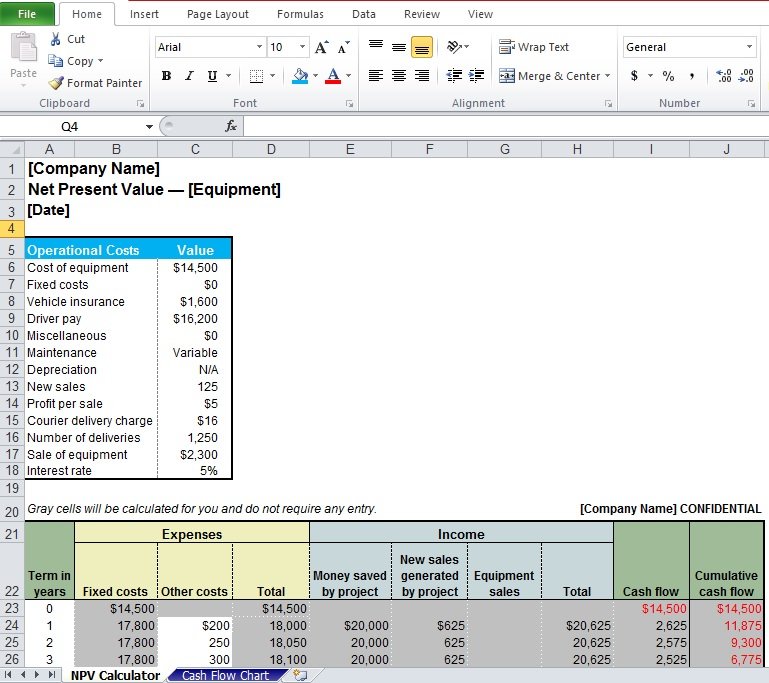

Net Present Value Calculator Template Are you looking for a Net

Web dividend retention ratio implied dividend growth rate what is present value? April 12, 2022 this time value of money excel template can help you to calculate the following: Present value is discounted future cash flows. Syntax npv (rate,value1, [value2],.) the npv function syntax has the following arguments: Web npv calculates that present value for each of the series of.

Net Present Value Calculator Excel Template SampleTemplatess

It is used to determine the profitability you derive from a project. Web the net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. Here is a screenshot of the net present value template: First thing that you need to do is to find out the.

8 Npv Calculator Excel Template Excel Templates

Web net present value template. Payment per period (amount, including principal and interest) fv: Web download this template for free get support for this template table of content when somebody from financial institution come to you and offer some investment opportunities, usually they will hand you the table of the value of your money after some period of time. Web.

Net Present Value Calculator Excel Templates

April 12, 2022 this time value of money excel template can help you to calculate the following: Present value is discounted future cash flows. Web use the excel formula coach to find the present value (loan amount) you can afford, based on a set monthly payment. The returned present value is negative as it represents outgoing payment. In other words,.

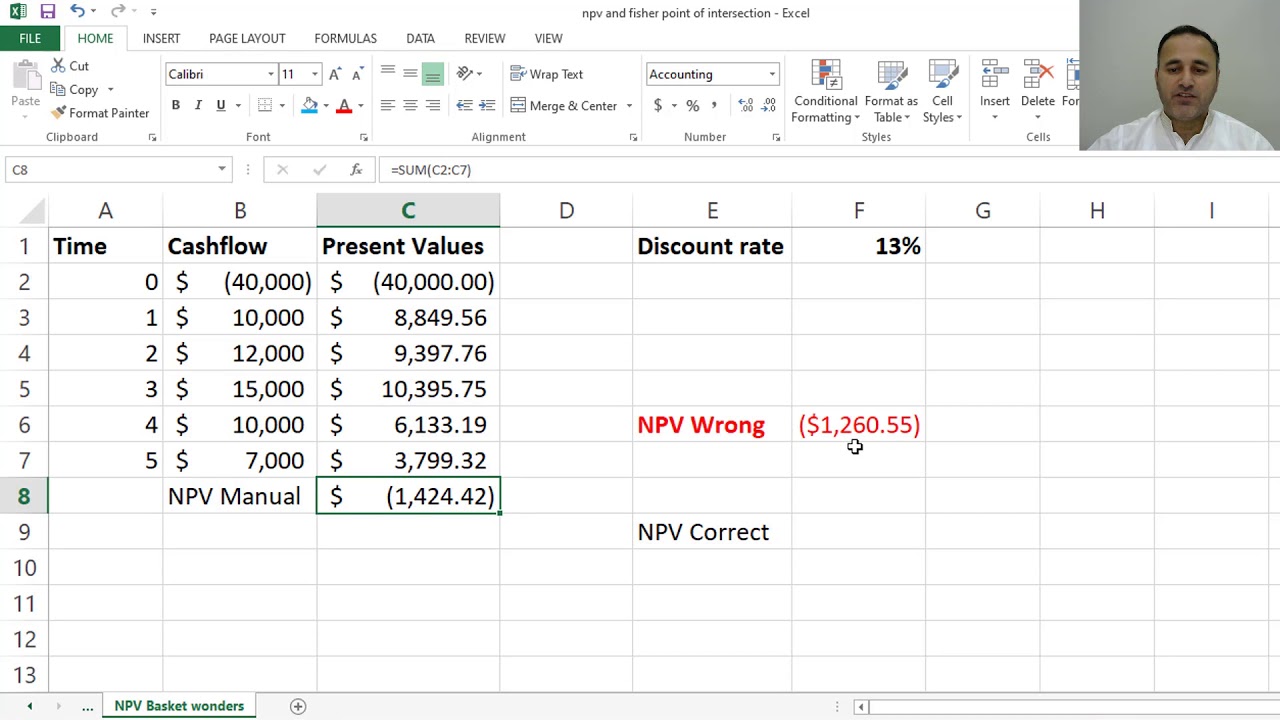

Net Present Value (NPV) with Excel YouTube

It is used to determine the profitability you derive from a project. Interest rate per payment period nper: Web present value and future value excel template updated: Web download this template for free get support for this template table of content when somebody from financial institution come to you and offer some investment opportunities, usually they will hand you the.

Net Present Value Calculator »

Web present value and future value excel template updated: At the same time, you'll learn how to use the pv function in a formula. The returned present value is negative as it represents outgoing payment. Rate is the interest rate per. In other words, $100 is the present value of $110 that are expected to be received in the future.

Net Present Value Excel Template

The big difference between pv and npv is that npv takes into account the initial investment. This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Web if you want to calculate the present value of a single investment that earns a fixed interest rate, compounded over a specified number of.

Professional Net Present Value Calculator Excel Template Excel

While you can calculate pv in excel, you can also calculate net present value(npv). Rate is the interest rate per. =pv(d7,d8,d9,d10,d11) the present value of the investment is. Here is a screenshot of the net present value template: If left blank, value is.

How to calculate Present Value using Excel

Web the net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. And in this spreadsheet, this calculation is used to compare three different projects or investments based on discount rate, period, initial cash flow and yearly cash flow. Calculate present value of an insurance Here.

Professional Net Present Value Calculator Excel Template Excel TMP

At the same time, you'll learn how to use the pv function in a formula. Web use the excel formula coach to find the present value (loan amount) you can afford, based on a set monthly payment. April 12, 2022 this time value of money excel template can help you to calculate the following: Next, you need to fill out.

Web = pv (rate, nper, pmt, [fv], [type]) where: April 12, 2022 this time value of money excel template can help you to calculate the following: Present value future value fv of an annuity fva due pv of an annuity pva due unequal. Rate is the interest rate per. Web present value (pv)—also known as a discount value—measures the value of future cash flows in today’s dollar. Syntax npv (rate,value1, [value2],.) the npv function syntax has the following arguments: Web download this template for free get support for this template table of content when somebody from financial institution come to you and offer some investment opportunities, usually they will hand you the table of the value of your money after some period of time. Or, use the excel formula coach to find the present value of your financial. At the same time, you'll learn how to use the pv function in a formula. Number of payment periods pmt: =fv/ (1+rate)^nper where, fv is the future value of the investment; Web formula examples calculator what is the present value formula? =pv(d7,d8,d9,d10,d11) the present value of the investment is. If left blank, value is. Web if you want to calculate the present value of a single investment that earns a fixed interest rate, compounded over a specified number of periods, the formula for this is: Next, you need to fill out the period column with the. The formula for npv is: Web the net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. Payment per period (amount, including principal and interest) fv: This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows.