Printable 1040 Schedule C

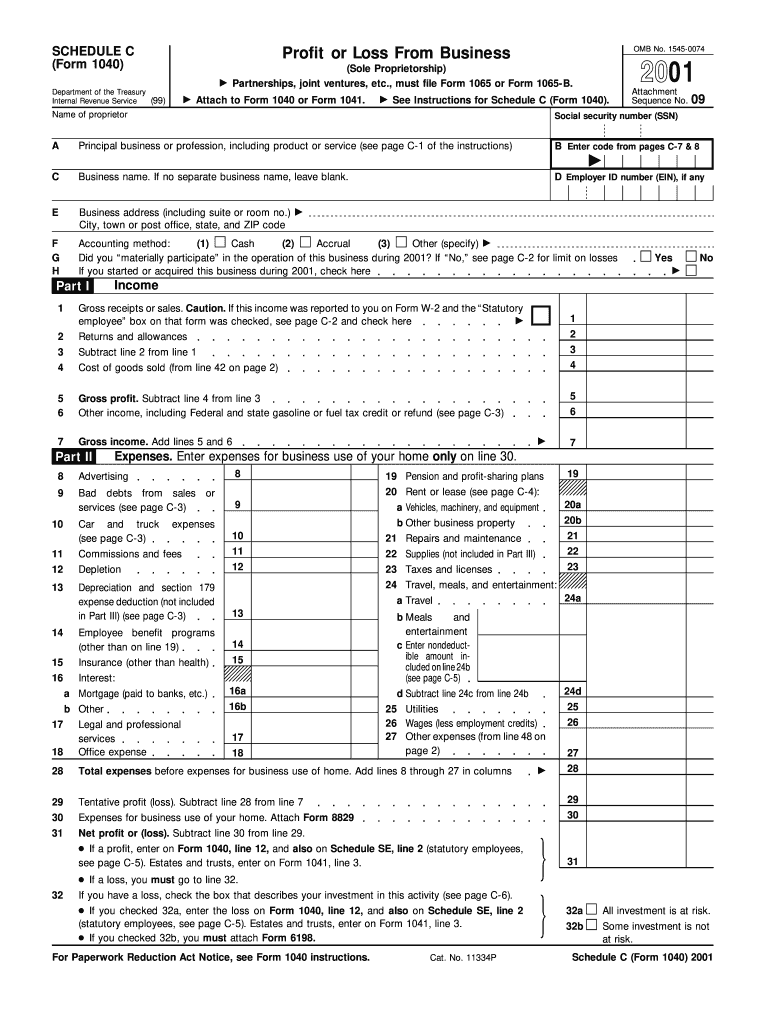

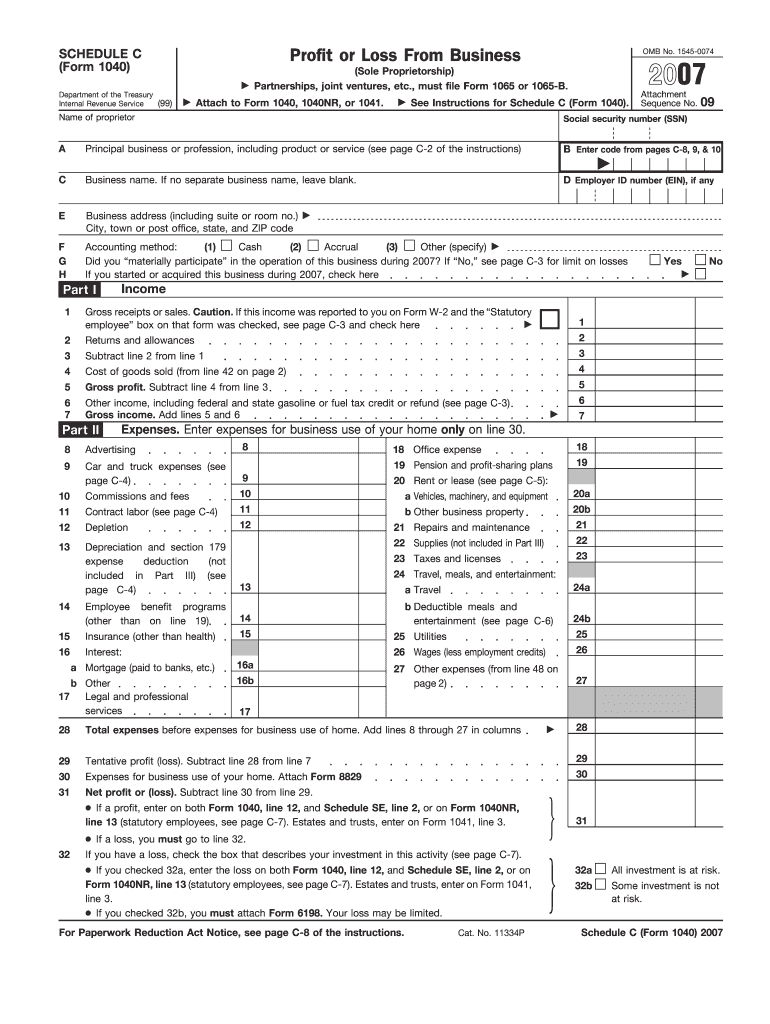

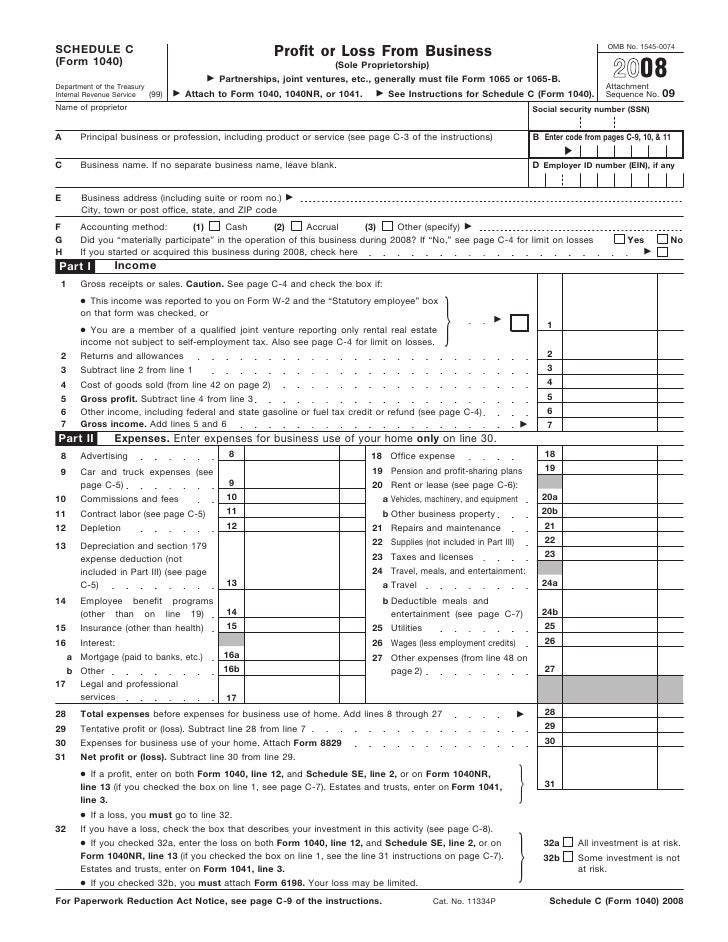

Printable 1040 Schedule C - Web go to www.irs.gov/schedulec for instructions and the latest information. The form requires three types. Partnerships must generally file form 1065. Web if a profit, enter on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Partnerships must generally file form 1065. Web steps for completing schedule c (form 1040) follow the following steps in order to complete schedule c form 1040: Web go to www.irs.gov/schedulec for instructions and the latest information. Estates and trusts, enter on form 1041, line. Web follow the simple instructions below:

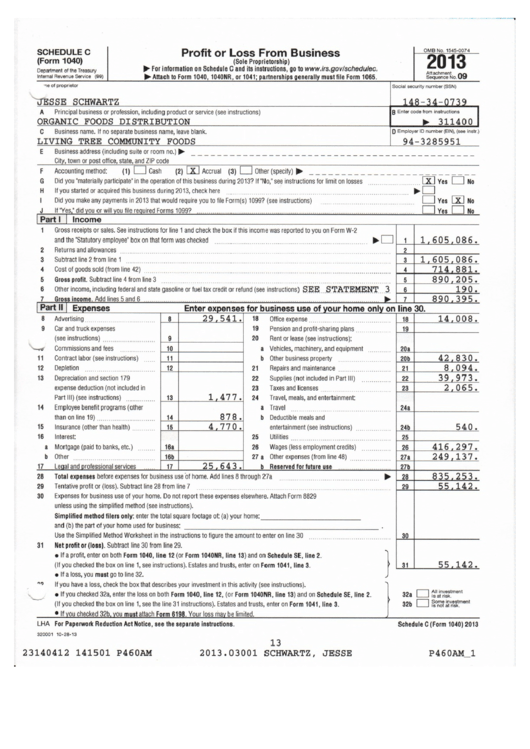

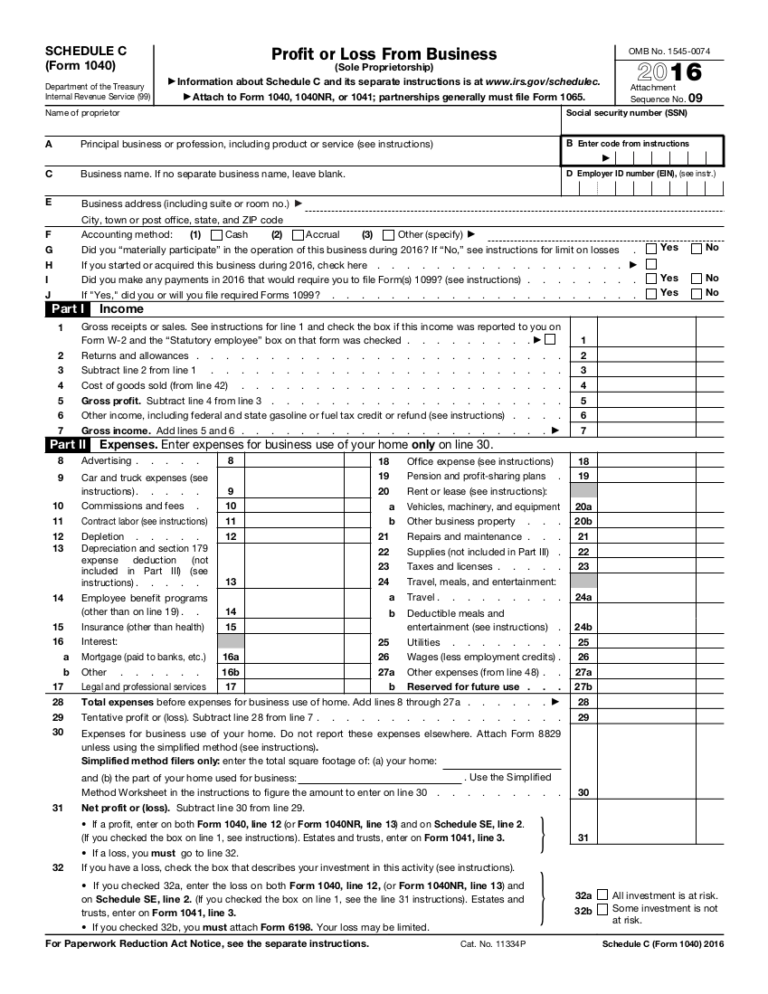

Form 1040 Schedule C Sample Profit Or Loss From Business printable

Web steps for completing schedule c (form 1040) follow the following steps in order to complete schedule c form 1040: Web income tax forms 1040 (schedule c) federal — profit or loss from business (sole proprietorship) download this form print this form it appears you don't have a pdf. (if you checked the box on line 1, see instructions). Web.

Form 1040 Schedule C Investment At Risk 1040 Form Printable

Ad discover helpful information and resources on taxes from aarp. Estimate your taxes and refunds easily with this free tax calculator from aarp. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Complete, edit or print tax forms instantly.

2007 Form IRS 1040 Schedule C Fill Online, Printable, Fillable, Blank

Estimate your taxes and refunds easily with this free tax calculator from aarp. Estates and trusts, enter on form 1041, line. The form requires three types. (if you checked the box on line 1, see instructions). Save time with our amazing tool.

FREE 9+ Sample Schedule C Forms in PDF MS Word

It shows your income and how much taxes you owe. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Partnerships must generally file form 1065. Estimate your taxes and refunds easily with this free tax calculator from aarp. An activity qualifies as a business.

Tax Form 1040 Schedule 1 Form Resume Examples N48mYd68yz

Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions. Ad discover helpful information and resources on taxes from aarp. $520 for married couples who filed jointly with an. Web use schedule c (form 1040) to report income or (loss) from a business you operated or.

Form 1040, Schedule CProfit or Loss From Business

It has bigger print, less shading, and features. Ad discover helpful information and resources on taxes from aarp. When the tax season began unexpectedly or you just forgot about it, it could probably cause problems for you. Save time with our amazing tool. An activity qualifies as a business if your.

1040 Schedule C 2016 2021 Tax Forms 1040 Printable

Ad access irs tax forms. Estates and trusts, enter on form 1041, line. Web go to www.irs.gov/schedulec for instructions and the latest information. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Web steps for completing schedule c (form 1040) follow the following steps in order to complete schedule.

Fillable Schedule C Irs Form 1040 Printable Pdf Download 1040 Form

The form requires three types. Estimate your taxes and refunds easily with this free tax calculator from aarp. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web how much will i receive? Web income tax forms 1040 (schedule c) federal — profit or.

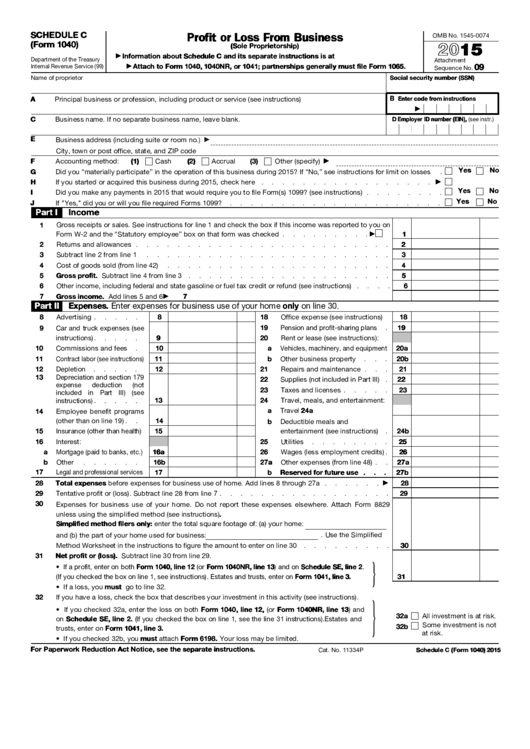

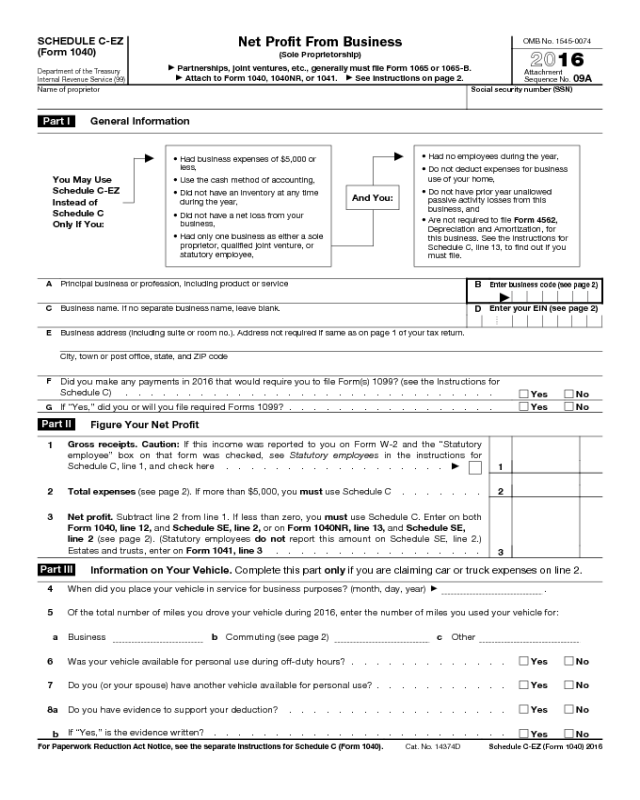

Form 1040 Schedule CEZ Edit, Fill, Sign Online Handypdf

Profit or loss from business (form 1040)? Estimate your taxes and refunds easily with this free tax calculator from aarp. An activity qualifies as a business if: Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. When the tax season began unexpectedly or you.

Irs 1040 Form Schedule C Schedule C Form 1040 How to Complete it

It has bigger print, less shading, and features. An activity qualifies as a business if your. Get ready for tax season deadlines by completing any required tax forms today. Web the irs has released a new tax filing form for people 65 and older. Web follow the simple instructions below:

It has bigger print, less shading, and features. Estates and trusts, enter on form 1041, line. Web go to www.irs.gov/schedulec for instructions and the latest information. $520 for married couples who filed jointly with an. When the tax season began unexpectedly or you just forgot about it, it could probably cause problems for you. Web income tax forms 1040 (schedule c) federal — profit or loss from business (sole proprietorship) download this form print this form it appears you don't have a pdf. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Ad complete your 1040 form. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Ad discover helpful information and resources on taxes from aarp. Save time with our amazing tool. The form requires three types. An activity qualifies as a business if your. Web the irs has released a new tax filing form for people 65 and older. Web what is schedule c: Web follow the simple instructions below: Profit or loss from business (form 1040)? Web printable federal income tax schedule c. Complete, edit or print tax forms instantly.