Printable W4 Form

Printable W4 Form - Web for maryland state government employees only. When will my new withholding form go into effect if the change is for the current year, your employer must withhold on the basis of your new. Web exemption on form ct‑w4. Web the form has steps 1 through 5 to guide employees through it. Employers engaged in a trade or business who pay compensation. If too little is withheld, you will generally owe tax when you file your tax return. Employee's withholding certificate form 941; Your withholding is subject to review by the. If too little is withheld, you will generally owe tax when you file your tax return. You have to submit only the 1st page that includes the aforementioned 5 steps.

Fillable Form W4 Form, Fillable forms, Tax

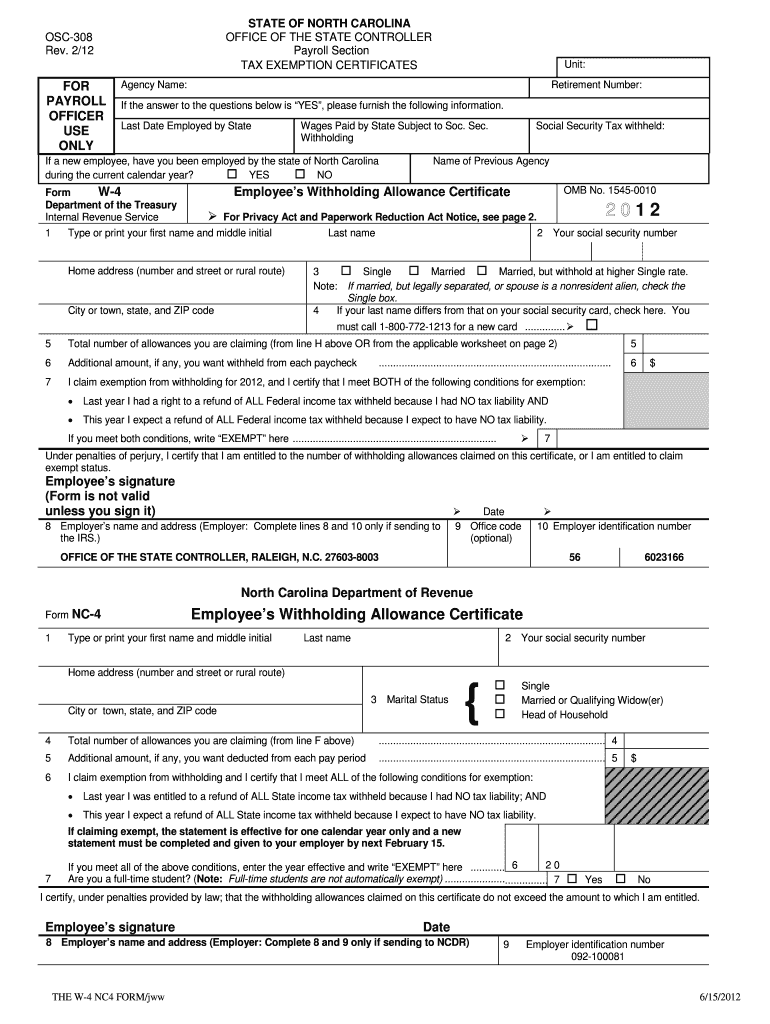

You have to submit only the 1st page that includes the aforementioned 5 steps. If too little is withheld, you will generally owe tax when you file your tax return. When will my new withholding form go into effect if the change is for the current year, your employer must withhold on the basis of your new. Department of the.

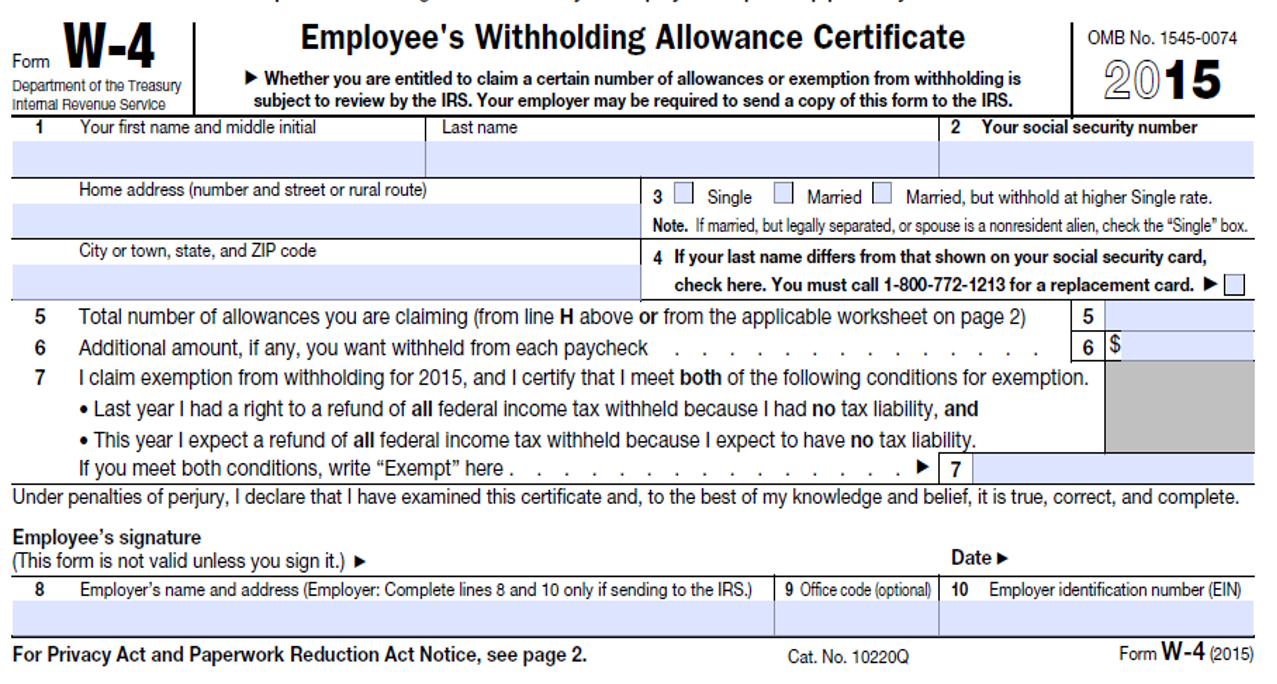

Fill Free fillable Form W4 2015 PDF form

If too little is withheld, you will generally owe tax when you file your tax return. Web for maryland state government employees only. Voluntary withholding request from the irs' website. Web updated august 05, 2023. Use the 2nd page for calculations to.

Federal W 4 Worksheet 2020 Printable & Fillable Online Blank

Then, find the social security office closest to your home and mail or fax us the completed form. If too little is withheld, you will generally owe tax when you file your tax return. Amazon.com has been visited by 1m+ users in the past month Department of the treasury internal revenue service. If too little is withheld, you will generally.

Employee Withholding Form 2021 W4 Form 2021

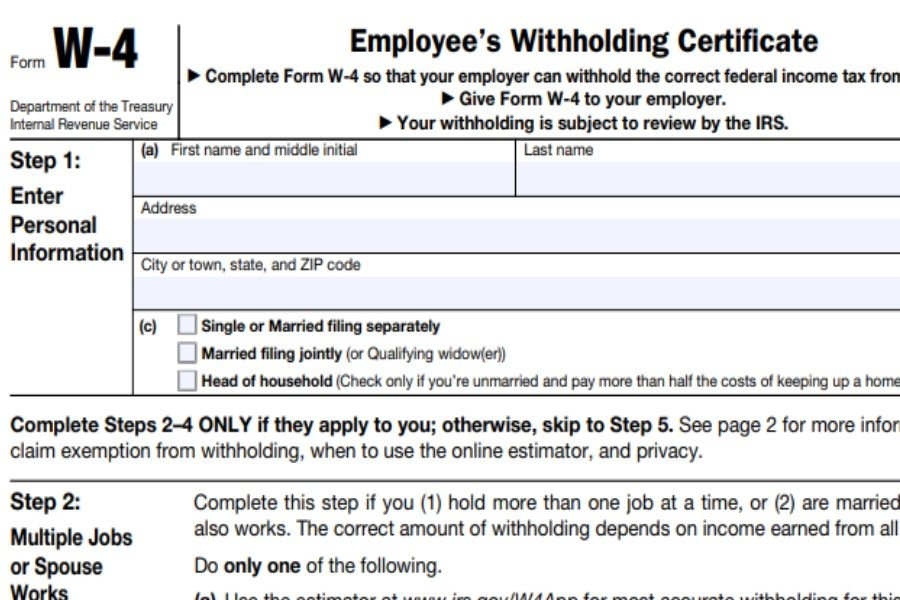

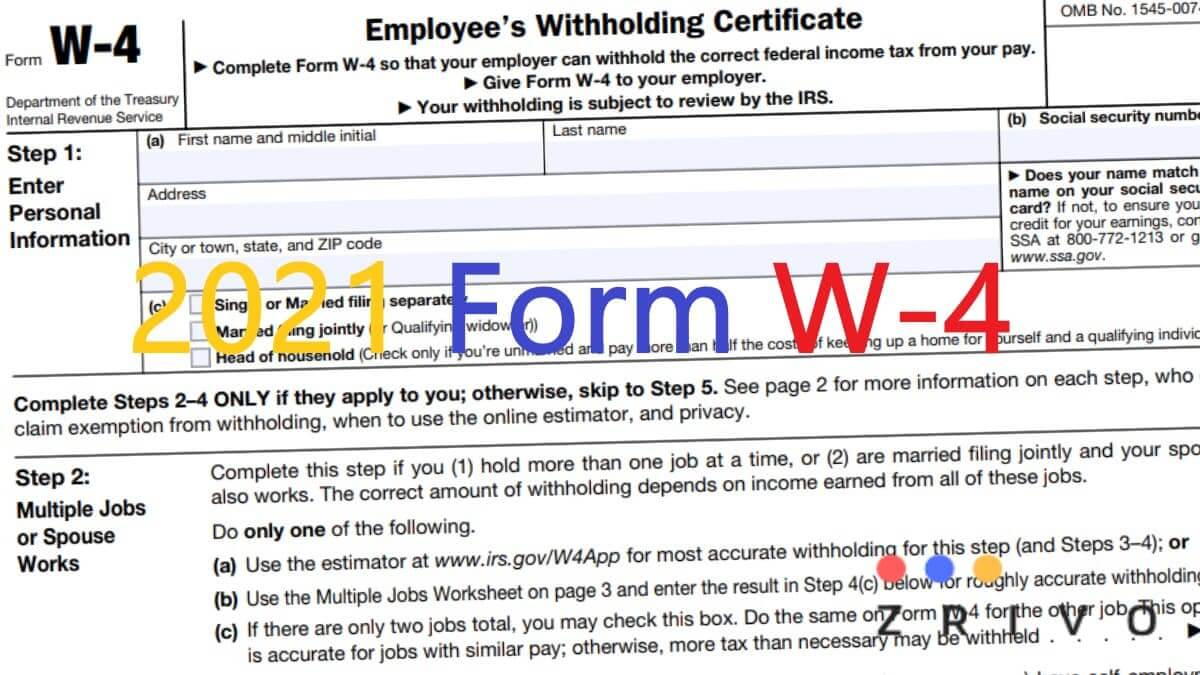

You have to submit only the 1st page that includes the aforementioned 5 steps. Department of the treasury internal revenue service. If too little is withheld, you will generally owe tax when you file your tax return. Web up to $40 cash back how to fill out w4 form 2022: One difference from prior forms is the expected filing.

Printable W 4 Forms Employee 2021 2022 W4 Form

Department of the treasury internal revenue service. When will my new withholding form go into effect if the change is for the current year, your employer must withhold on the basis of your new. One difference from prior forms is the expected filing. Employers engaged in a trade or business who pay compensation. You have to submit only the 1st.

Fillable Federal W 4 Form Printable Forms Free Online

If too little is withheld, you will generally owe tax when you file your tax return. Web up to $40 cash back how to fill out w4 form 2022: You have to submit only the 1st page that includes the aforementioned 5 steps. Department of the treasury internal revenue service. Web the form has steps 1 through 5 to guide.

Free Printable W 4 Forms 2022 W4 Form

Web updated august 05, 2023. What is this form for. Use the 2nd page for calculations to. Employee's withholding certificate form 941; When will my new withholding form go into effect if the change is for the current year, your employer must withhold on the basis of your new.

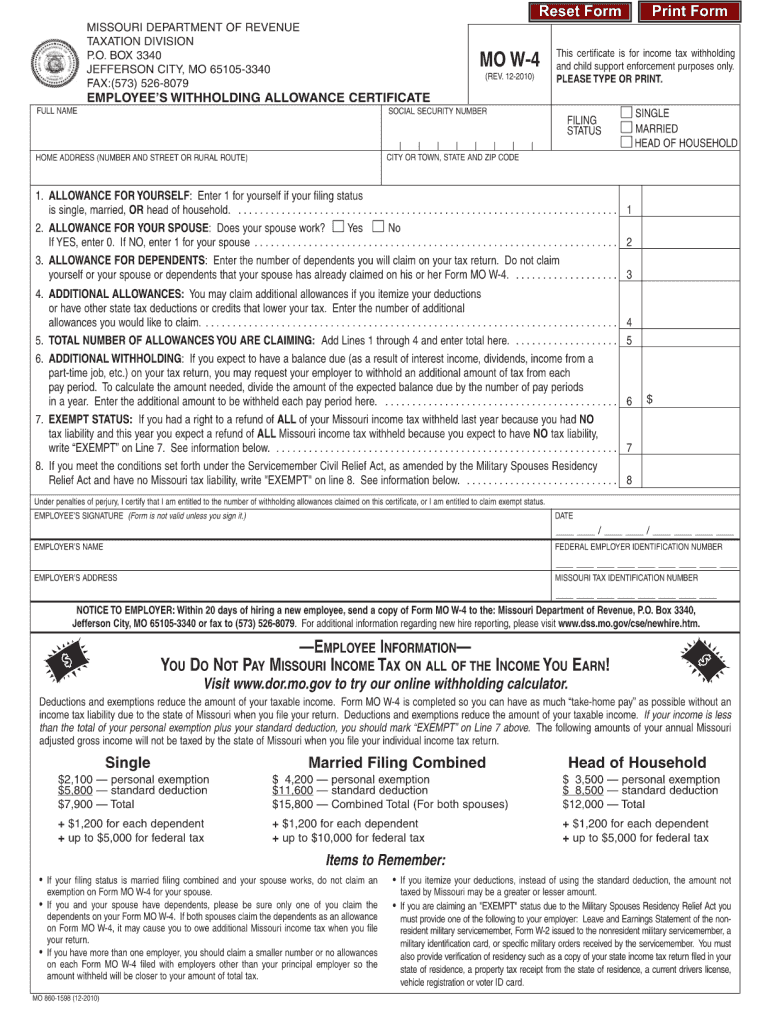

Mo W4 Form 2021 W4 Form 2021

Amazon.com has been visited by 1m+ users in the past month What is this form for. Begin by entering your personal information, including your full name, address, and social security number. When will my new withholding form go into effect if the change is for the current year, your employer must withhold on the basis of your new. Department of.

Form W4 2017 (IRS Tax) Fill Out Online & Download [+ Free Template]

Then, find the social security office closest to your home and mail or fax us the completed form. Web the form has steps 1 through 5 to guide employees through it. Department of the treasury internal revenue service. Voluntary withholding request from the irs' website. Your withholding is subject to review by the.

Free Printable W 4 Form Free Printable

If too little is withheld, you will generally owe tax when you file your tax return. When will my new withholding form go into effect if the change is for the current year, your employer must withhold on the basis of your new. One difference from prior forms is the expected filing. Voluntary withholding request from the irs' website. Use.

Employers engaged in a trade or business who pay compensation. Web the form has steps 1 through 5 to guide employees through it. Voluntary withholding request from the irs' website. Your withholding is subject to review by the. Then, find the social security office closest to your home and mail or fax us the completed form. Department of the treasury internal revenue service. Web exemption on form ct‑w4. When will my new withholding form go into effect if the change is for the current year, your employer must withhold on the basis of your new. What is this form for. If too little is withheld, you will generally owe tax when you file your tax return. One difference from prior forms is the expected filing. Begin by entering your personal information, including your full name, address, and social security number. Employee's withholding certificate form 941; If too little is withheld, you will generally owe tax when you file your tax return. Web for maryland state government employees only. Department of the treasury internal revenue service. Amazon.com has been visited by 1m+ users in the past month Use the 2nd page for calculations to. If too little is withheld, you will generally owe tax when you file your tax return. Withholding certificate for nonperiodic payments and eligible rollover distributions.

![Form W4 2017 (IRS Tax) Fill Out Online & Download [+ Free Template]](https://www.pandadoc.com/app/uploads/form-w-4.png)