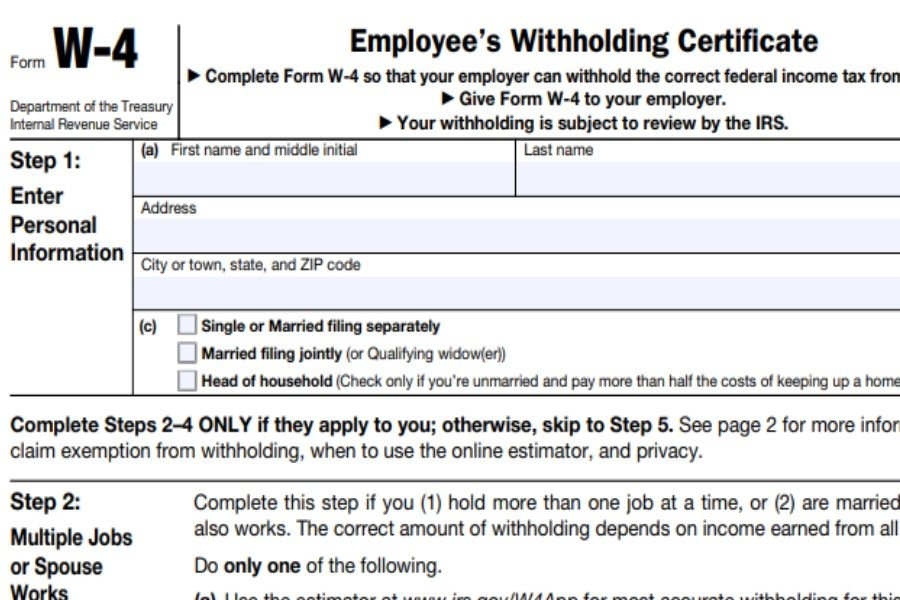

Printable W4 Forms

Printable W4 Forms - Step 2 is where things get tricky, because it looks like there is only one box to check. Ad real estate forms, contracts, tax forms & more. Web reserved for future use. If too little is withheld, you will generally owe tax when you file your tax return. Add the dollar sum of the two to line 3. Multiple jobs and working spouse information. If too little is withheld, you will generally owe tax when you file your tax return. Or if there are only two jobs total, you may check this box. Web multiply the number of qualifying children under age 17 by $2,000 and the number of other dependents by $500. Print, save, download 100% free!

2022 Form W4 IRS Tax Forms W4 Form 2022 Printable

Print, save, download 100% free! Get ready for tax season deadlines by completing any required tax forms today. Employee's withholding certificate form 941; Enter all other required information. Web filed withholding form, add that amount to the amount on line 9b of worksheet 2 and enter the total on line 3 of your new withholding form.

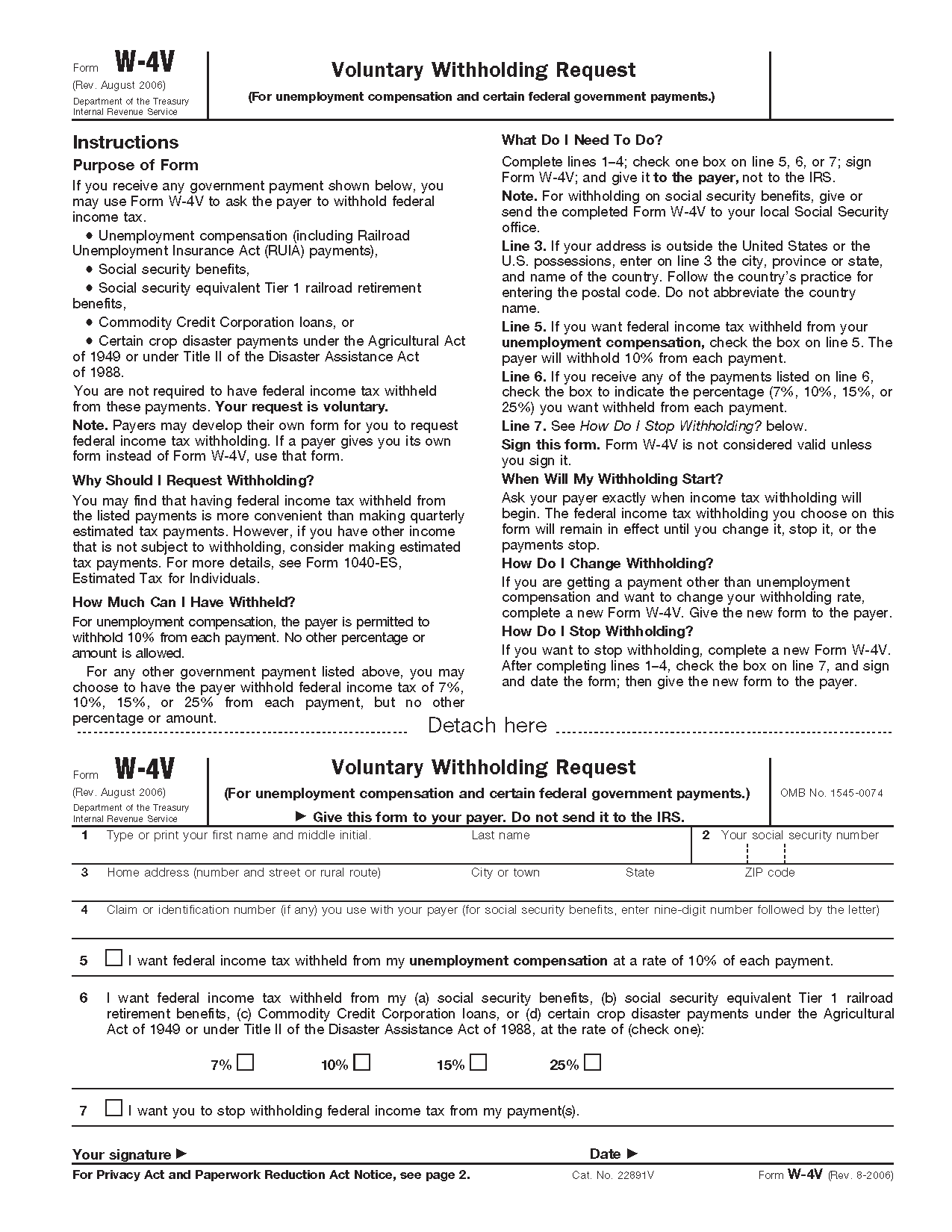

W4V 2021 2022 W4 Form

Print, save, download 100% free! Web reserved for future use. Employee's withholding certificate form 941; Multiple jobs and working spouse information. Add the dollar sum of the two to line 3.

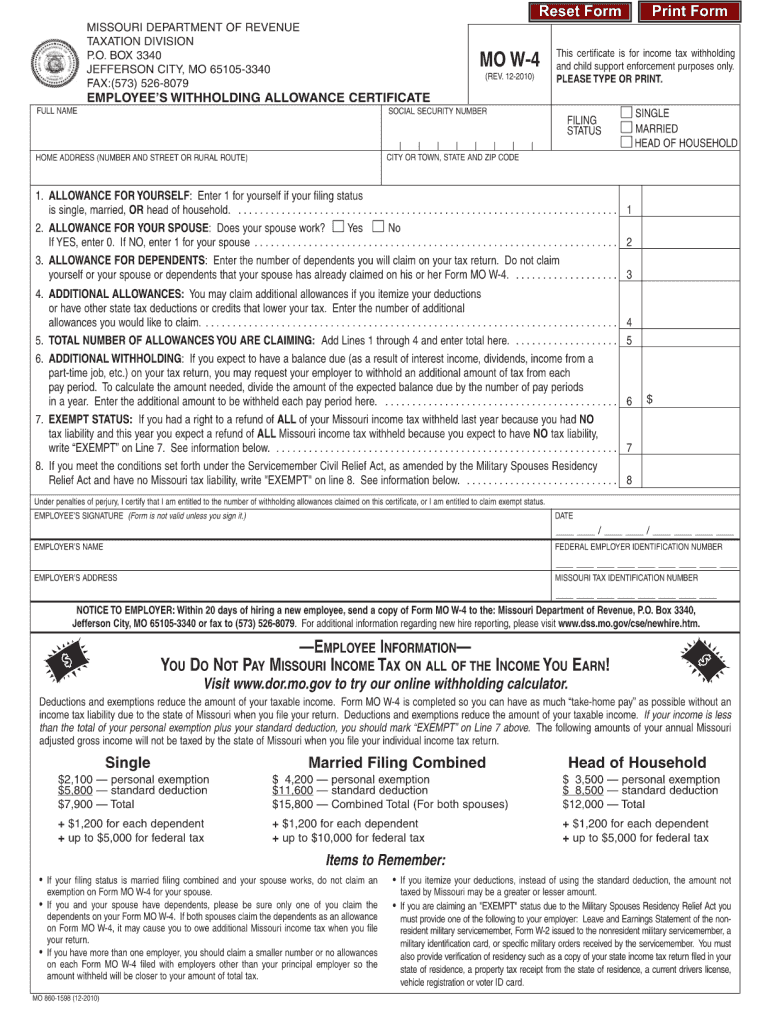

Mo W4 Form 2021 W4 Form 2021

Print, save, download 100% free! If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. Create, edit, and print your business and legal documents quickly and easily! Complete, edit or print tax forms instantly.

Il W 4 2020 2022 W4 Form

Employee's withholding certificate form 941; Employers engaged in a trade or business who pay. If too little is withheld, you will generally owe tax when you file your tax return. In this video you’ll learn: Web filed withholding form, add that amount to the amount on line 9b of worksheet 2 and enter the total on line 3 of your.

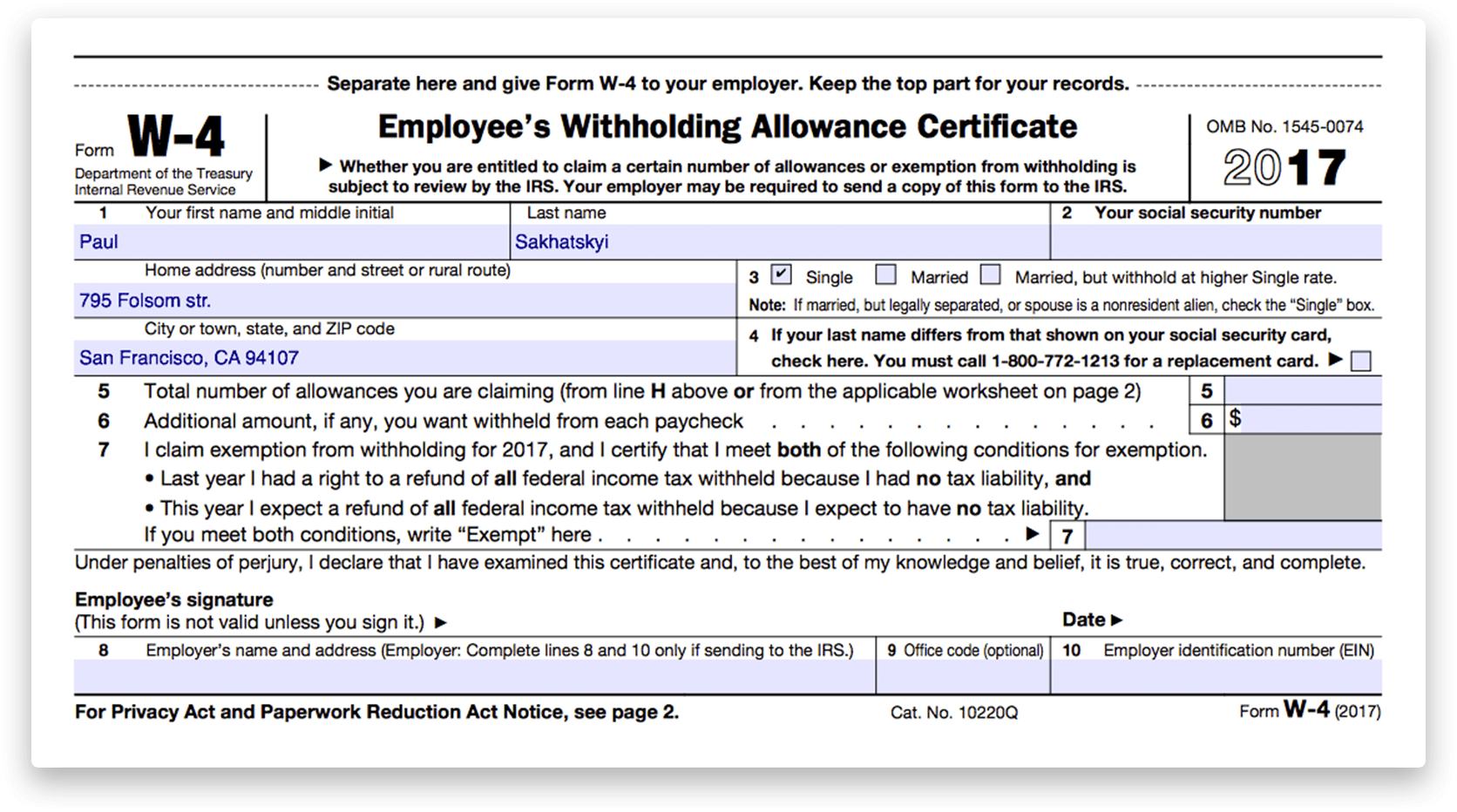

How to fill out 2018 IRS Form W4 PDF Expert

Employee's withholding certificate form 941; Web filed withholding form, add that amount to the amount on line 9b of worksheet 2 and enter the total on line 3 of your new withholding form. Or if there are only two jobs total, you may check this box. Multiple jobs and working spouse information. In this video you’ll learn:

Federal W 4 Worksheet 2020 Printable & Fillable Online Blank

Step 2 is where things get tricky, because it looks like there is only one box to check. Add the dollar sum of the two to line 3. Web reserved for future use. Web filed withholding form, add that amount to the amount on line 9b of worksheet 2 and enter the total on line 3 of your new withholding.

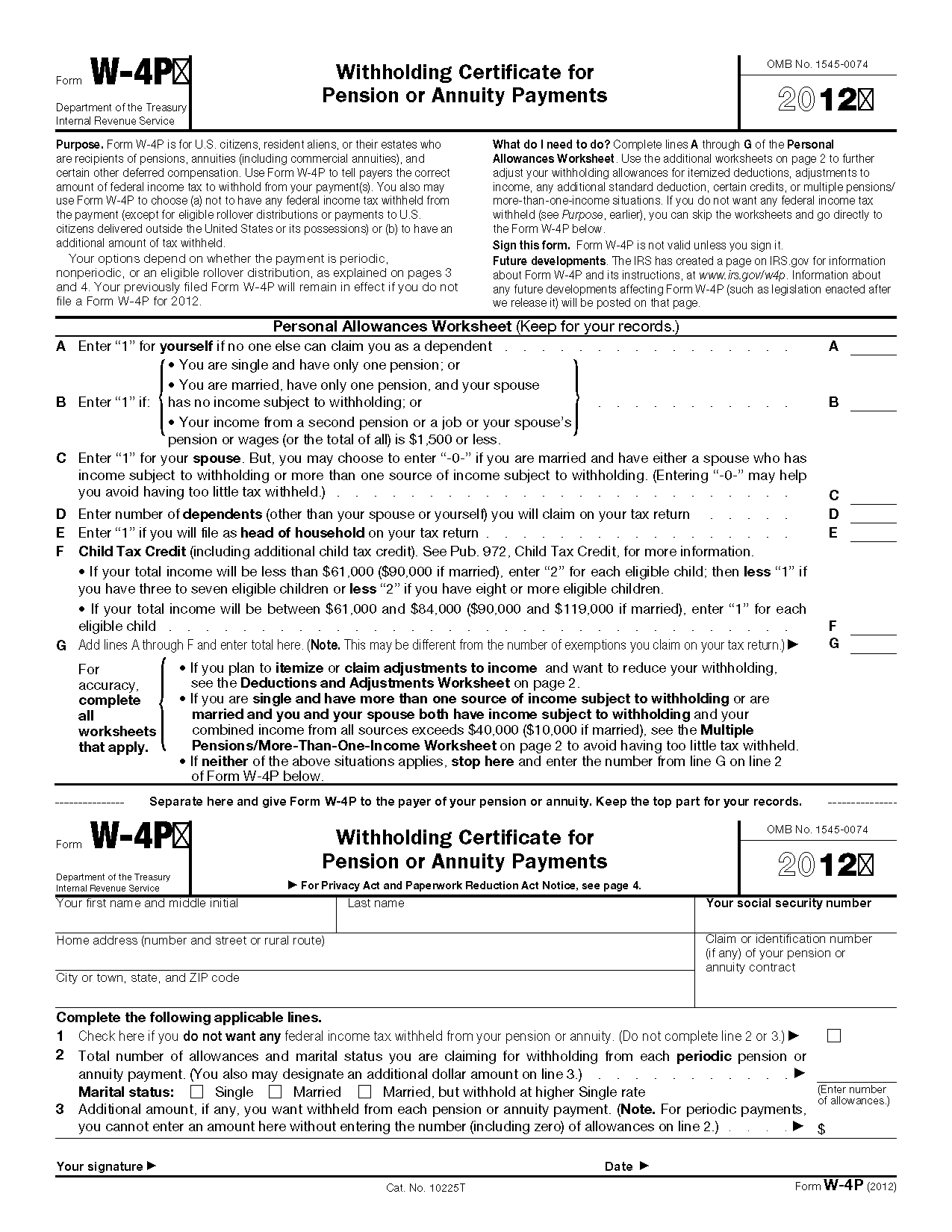

Irs Form W4p Printable Printable Forms Free Online

Web updated august 05, 2023. If too little is withheld, you will generally owe tax when you file your tax return. Web reserved for future use. In this video you’ll learn: Employers engaged in a trade or business who pay.

W4 Form 2023 Printable Employee's Withholding Certificate

Consider completing a new form. Web filed withholding form, add that amount to the amount on line 9b of worksheet 2 and enter the total on line 3 of your new withholding form. Print, save, download 100% free! Web multiply the number of qualifying children under age 17 by $2,000 and the number of other dependents by $500. If too.

Employee Withholding Form 2021 W4 Form 2021

Employee's withholding certificate form 941; You can do everything online on the site and also benefit from other features of. Create, edit, and print your business and legal documents quickly and easily! Step 2 is where things get tricky, because it looks like there is only one box to check. Employers engaged in a trade or business who pay.

IRS W4 Federal Tax Form 2018 2019 Printable & Fillable Online

In this video you’ll learn: If too little is withheld, you will generally owe tax when you file your tax return. Multiple jobs and working spouse information. Web updated august 05, 2023. Add the dollar sum of the two to line 3.

Create, edit, and print your business and legal documents quickly and easily! Use the multiple jobs worksheet on page 3 and enter the result in step 4(c) below; Employee's withholding certificate form 941; If too little is withheld, you will generally owe tax when you file your tax return. Step 2 is where things get tricky, because it looks like there is only one box to check. Get ready for tax season deadlines by completing any required tax forms today. Print, save, download 100% free! Employers engaged in a trade or business who pay. Ad real estate forms, contracts, tax forms & more. If too little is withheld, you will generally owe tax when you file your tax return. Enter all other required information. Ad access irs tax forms. Web reserved for future use. Complete, edit or print tax forms instantly. You can do everything online on the site and also benefit from other features of. Web multiply the number of qualifying children under age 17 by $2,000 and the number of other dependents by $500. Or if there are only two jobs total, you may check this box. Add the dollar sum of the two to line 3. Web updated august 05, 2023. Web filed withholding form, add that amount to the amount on line 9b of worksheet 2 and enter the total on line 3 of your new withholding form.