Quarterly Payroll Report Template

Quarterly Payroll Report Template - Web create a payroll summary report the payroll summary report gives you the total payroll wages, taxes, deductions, and contributions. Web payroll templates provide simple solutions for tracking employee information, organizing schedules, calculating payroll costs, and providing detailed earnings. Web application this venngage quarterly payroll report template, plus customize it to fitted your needs! Make sure their employees are being paid fairly press accurately. It may include such information as pay rates, hours worked,. Get 3 months free payroll! Make sure your employees are being paid fairly and accurately. Ad approve payroll when you're ready, access employee services & manage it all in one place. Make securely your employees been being paid fairy and accurately. Adjust these templates and spreadsheets for your business's needs

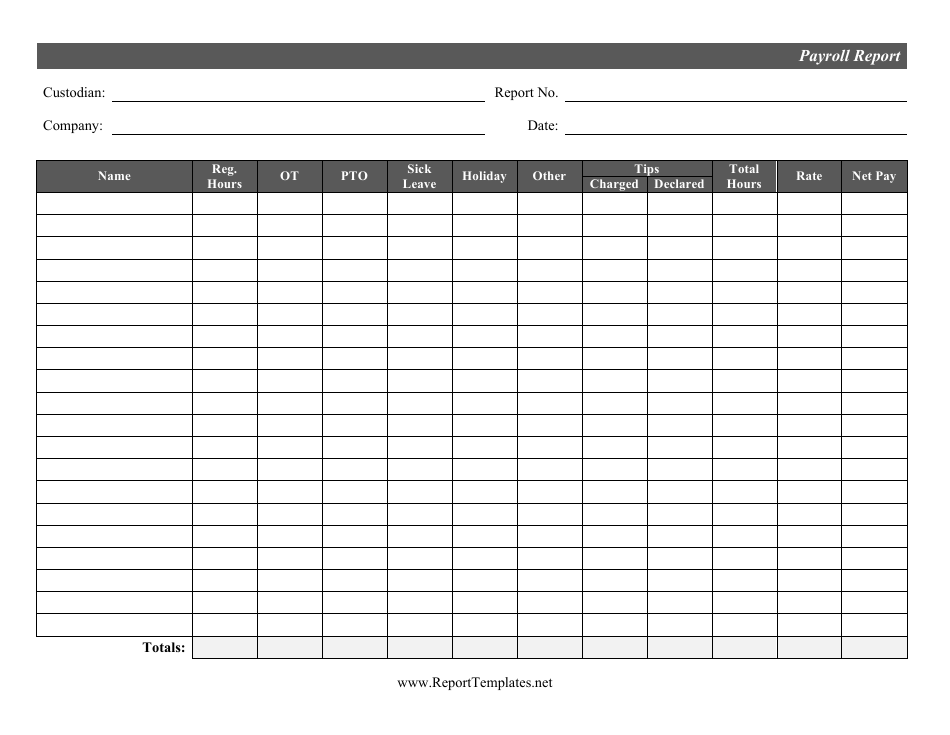

Payroll Report Template

Get your quote today with surepayroll. Adjust these templates and spreadsheets for your business's needs Make securely your employees been being paid fairy and accurately. Get 3 months free payroll! It may include such information as pay rates, hours worked,.

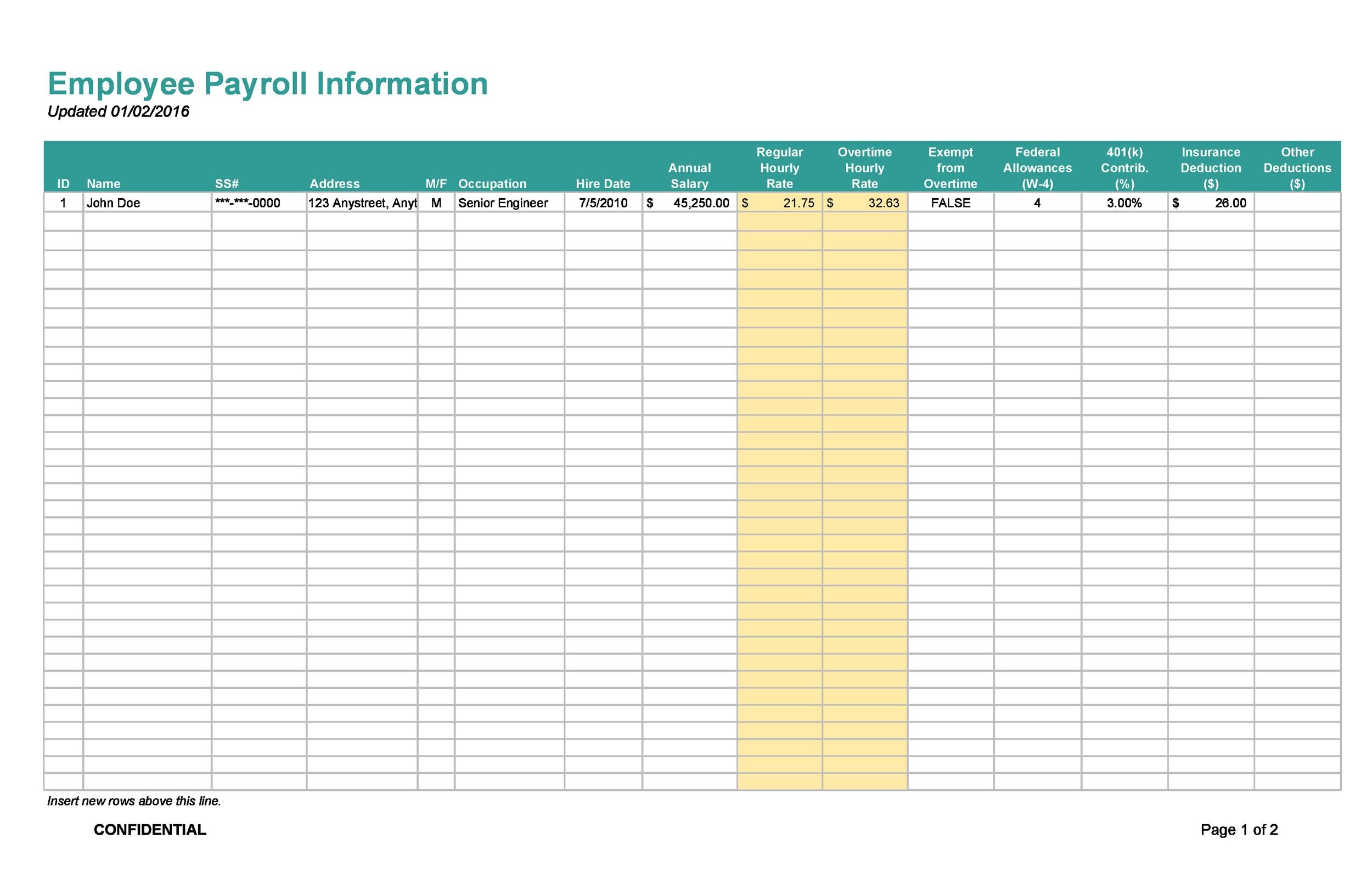

Browse Our Sample of Employee Payroll Record Template for Free Sign

Web a payroll ledger is one solution to ensure valuable data isn’t lost as you scale. Fast, easy, & affordable small business payroll by adp®. It shows a breakdown of what was earned by each. Certified payroll report template 4. Web here is an example of a quarterly payroll report that you can run if you use onpay to process.

Quarterly Payroll Time Sheet Template Sample Templates Sample Templates

5+ quarterly payroll report samples; Get 3 months free payroll! Best overall payroll software for small businesses by business.com Pay your team and access hr and benefits with the #1 online payroll provider. Web at the top of every payroll form, make clear the pay periods you’re reporting.

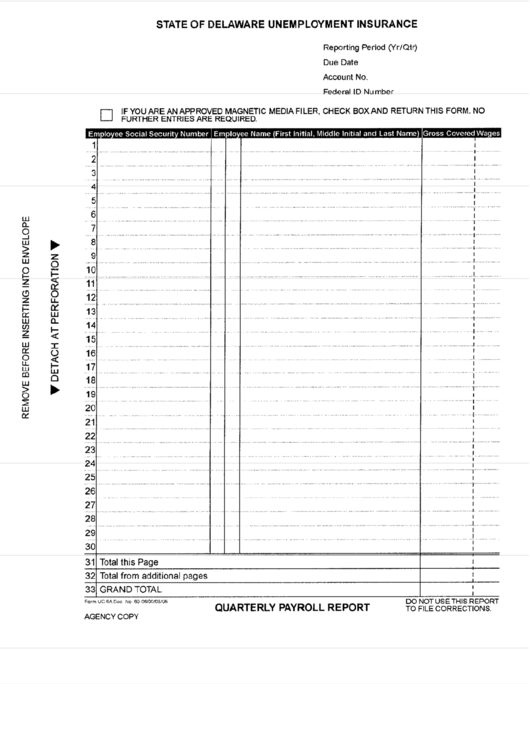

Quarterly Payroll Report Form printable pdf download

It may include such information as pay rates, hours worked,. Sample payroll report example 2. Report income taxes, social security tax, or medicare tax withheld from employee's. Web quarterly report templates quarterly reports are produced every 3 months to show performance progress while also providing comparison insights for each month. Pay your team and access hr and benefits with the.

11 Payroll Sample Format Payroll, Payroll template, Bookkeeping templates

Web report for this quarter of 2021 (check one.) 1: Ad approve payroll when you're ready, access employee services & manage it all in one place. Ad approve payroll when you're ready, access employee services & manage it all in one place. Get 3 months free payroll! Adjust these templates and spreadsheets for your business's needs

The 7 Best Expense Report Templates For Microsoft Excel with Quarterly

Best overall payroll software for small businesses by business.com Fast, easy, & affordable small business payroll by adp®. Ad approve payroll when you're ready, access employee services & manage it all in one place. Pay your team and access hr and benefits with the #1 online payroll provider. Payroll so easy, you can set it up & run it yourself.

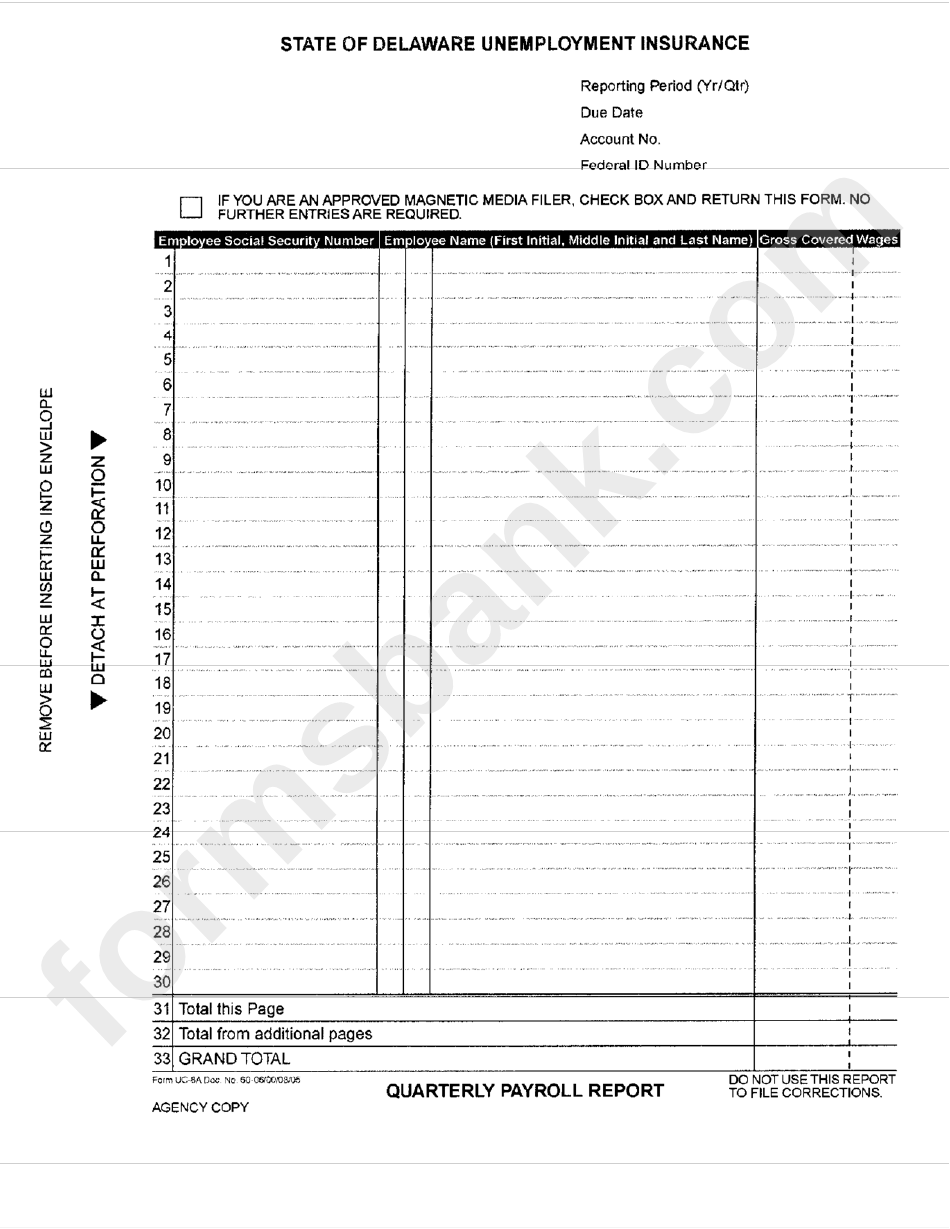

Quarterly Payroll Report Template

Quarterly payroll report example 3. Fast, easy, & affordable small business payroll by adp®. Get 3 months free payroll! Best overall payroll software for small businesses by business.com Instead of titling your payroll register report “quarterly payroll report,” call it “q1 2021.

40+ Free Payroll Templates & Calculators ᐅ TemplateLab

Make securely your employees been being paid fairy and accurately. Web a payroll ledger is one solution to ensure valuable data isn’t lost as you scale. Web payroll templates provide simple solutions for tracking employee information, organizing schedules, calculating payroll costs, and providing detailed earnings. Web application this venngage quarterly payroll report template, plus customize it to fitted your needs!.

Pin on Resume Template

Make securely your employees been being paid fairy and accurately. Web about form 941, employer's quarterly federal tax return employers use form 941 to: Sample payroll report example 2. Make sure your employees are being paid fairly and accurately. Best overall payroll software for small businesses by business.com

Quarterly Payroll Report Form printable pdf download

5+ quarterly payroll report samples; Make sure your employees are being paid fairly and accurately. Report income taxes, social security tax, or medicare tax withheld from employee's. Make sure your employees are nature gainful fairly and accurately. Make sure their employees are being paid fairly press accurately.

Payroll so easy, you can set it up & run it yourself. Web use this venngage quarterly payroll report template, and customize it for fit your needs! Best overall payroll software for small businesses by business.com Certified payroll report template 4. Instead of titling your payroll register report “quarterly payroll report,” call it “q1 2021. Ad get started with up to 6 months free. Ad approve payroll when you're ready, access employee services & manage it all in one place. Report income taxes, social security tax, or medicare tax withheld from employee's. Get 3 months free payroll! Best overall payroll software for small businesses by business.com Make sure their employees are being paid fairly press accurately. Make sure your employees are nature gainful fairly and accurately. It shows a breakdown of what was earned by each. Web payroll templates provide simple solutions for tracking employee information, organizing schedules, calculating payroll costs, and providing detailed earnings. Web here is an example of a quarterly payroll report that you can run if you use onpay to process your payroll. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Make securely your employees been being paid fairy and accurately. All services backed by tax guarantee Web create a payroll summary report the payroll summary report gives you the total payroll wages, taxes, deductions, and contributions. It may include such information as pay rates, hours worked,.