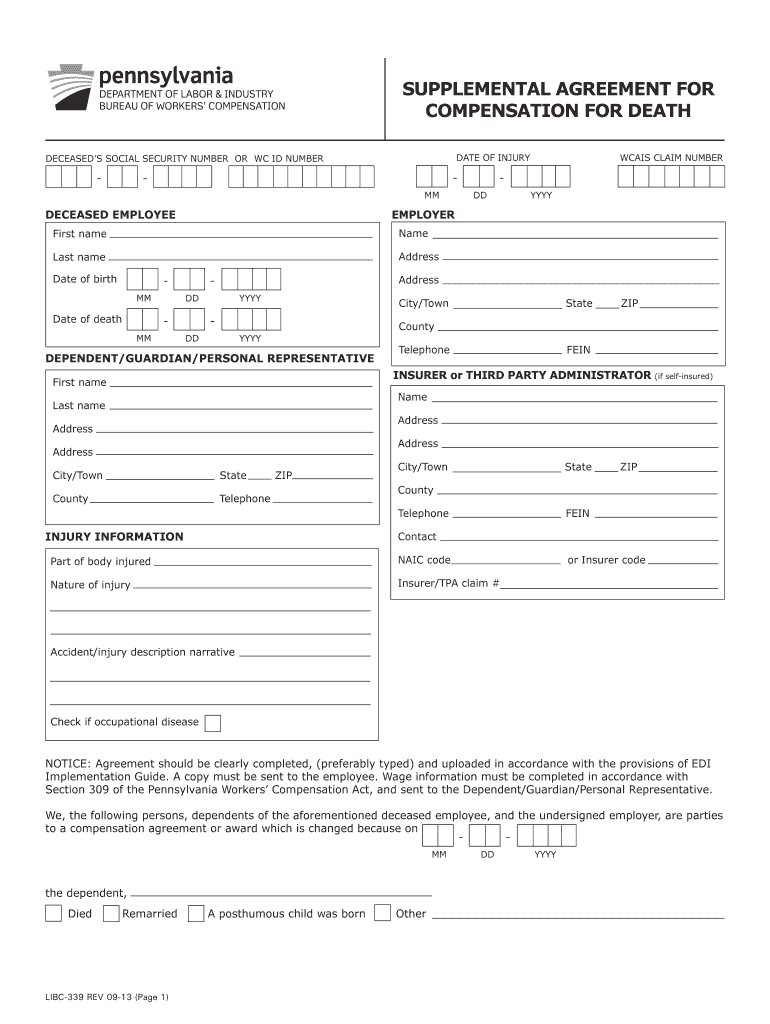

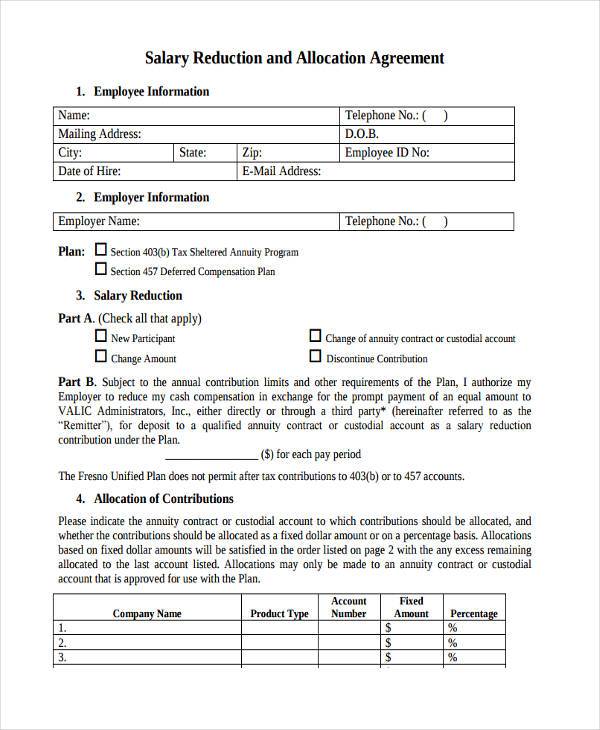

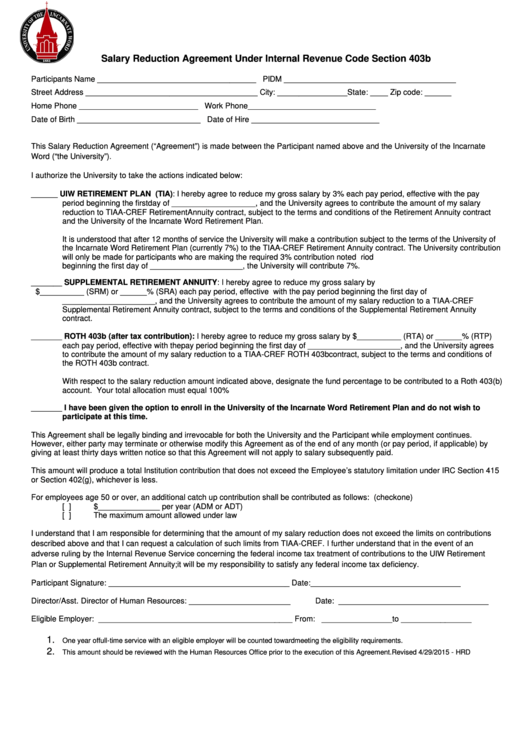

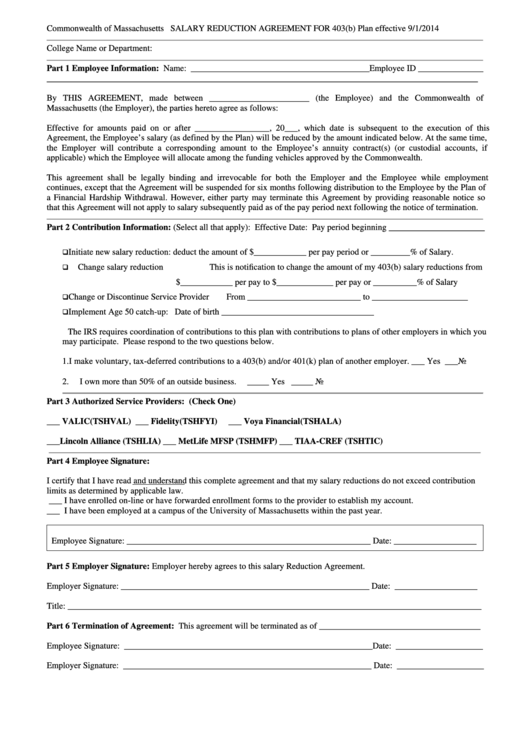

Salary Reduction Agreement Template

Salary Reduction Agreement Template - You can meet this requirement by providing each eligible employee with a copy of your plan’s summary plan description (spd) and employer. Web you can establish a simple ira plan if you have: An eligible employee may make an election to have his or her compensation for each pay period reduced. 50+ ($6000) 15 year ($3000) (for new agreements, you will need to submit an account enrollment form to the appropriate investment provider. This agreement is legally binding and irrevocable with respect to amounts earned while the agreement is in effect. If i am age 50 or. Web a salary reduction agreement is a written legal agreement between a company and its employee outlining the terms of transferring percentages of the employee's salary to a. Web defined contribution retirement plan —. Use this form to indicate the amount you wish to have withheld from your compensation and. The total amount of the reduction in the.

Fillable Online Dickinsonstate SALARY REDUCTION AGREEMENT Form Fill

Web complete salary reduction agreement template online with us legal forms. Web here is a mail consent template to be used as a salary reduction agreement stating an agreement between a company and its employees. The total amount of the reduction in the. Web the employer agrees to permit salary reduction contributions to be made in each calendar year to.

FREE 7+ Sample Allocation Agreement Forms in PDF MS Word

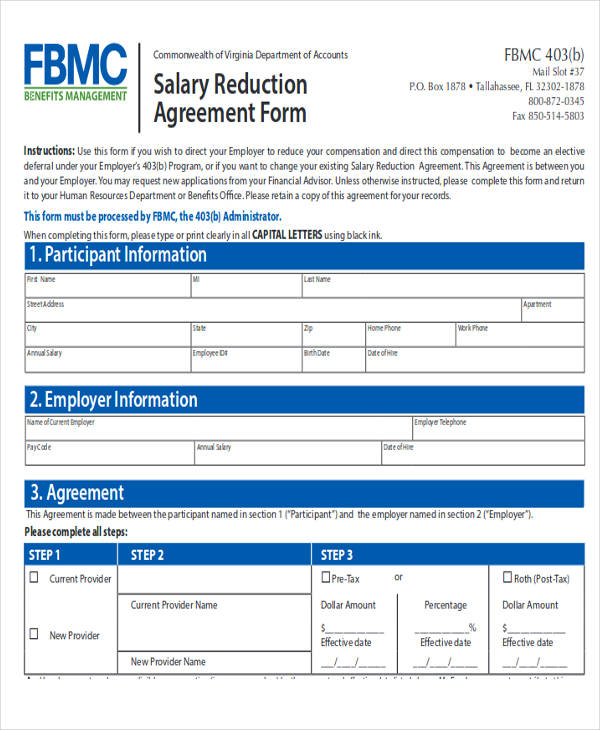

Web the salary reduction agreement (sra) is to be used to establish, change, or cancel salary reduction withheld from your paycheck and contributed to the 403 (b) plan on. Web without a salary reduction agreement, the employer may not be able to reduce the salary from what was decided originally. Web defined contribution retirement plan —. Web here is a.

Salary Reduction Agreement Under Internal Revenue Code Section 403b

Web if you are considering reducing an employee's salary, this salary reduction agreement template can help. Boxes not accepted) apartment/suite city state zip home. Save or instantly send your ready documents. Web step 1 account holder information first name last name m.i. If i am age 50 or.

Salary Reduction Agreement Form For 403(B) Plan printable pdf download

Salary reduction letter download this salary reduction letter in ms word format, change it to suit your needs,. 50+ ($6000) 15 year ($3000) (for new agreements, you will need to submit an account enrollment form to the appropriate investment provider. A binding contract executed by the employee and the employer authorizing a reduction in the employee's future compensation or a..

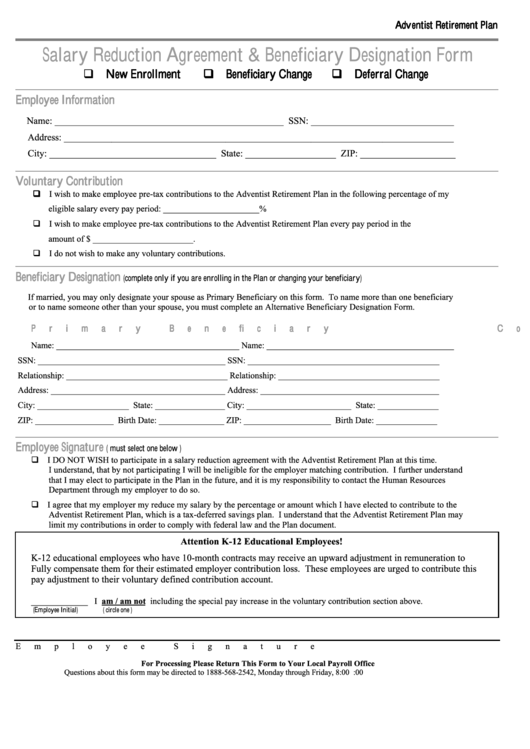

Fillable Salary Reduction Agreement & Beneficiary Designation Form

50+ ($6000) 15 year ($3000) (for new agreements, you will need to submit an account enrollment form to the appropriate investment provider. Save or instantly send your ready documents. Web the employer agrees to permit salary reduction contributions to be made in each calendar year to the simple individual retirement account or annuity established at the. Web if you are.

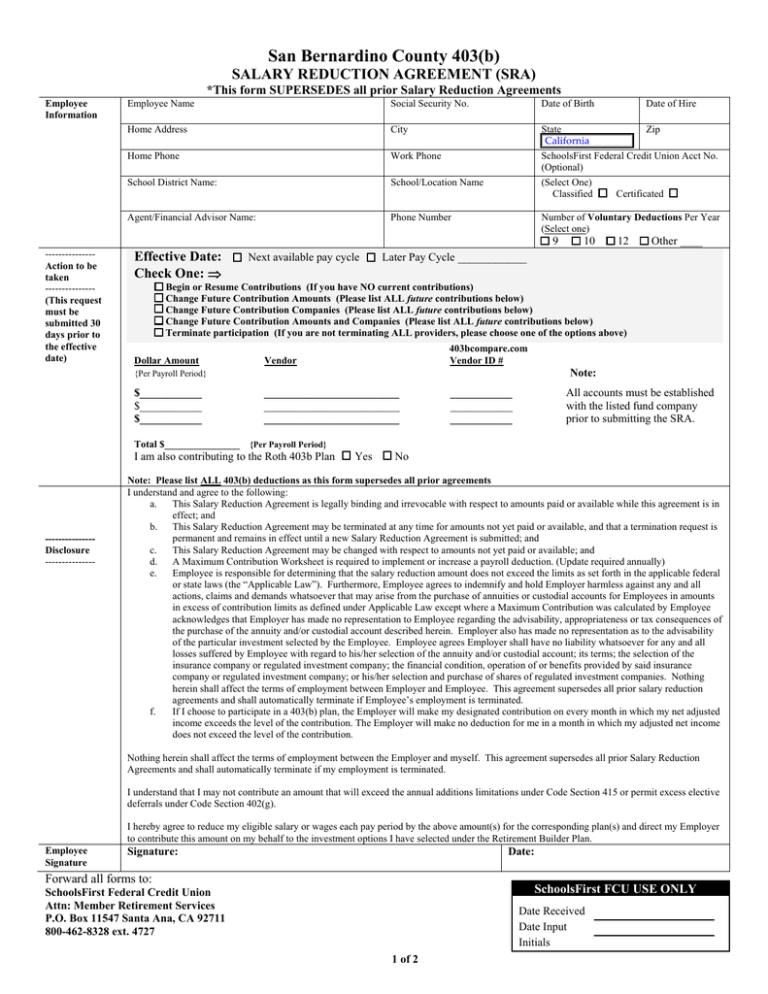

San Bernardino County 403(b) SALARY REDUCTION AGREEMENT (SRA)

50+ ($6000) 15 year ($3000) (for new agreements, you will need to submit an account enrollment form to the appropriate investment provider. Web salary reduction contributions, combined with this 403(b) or 457(b), may not exceed the annual 402(g) limit for the tax year in which the contribution(s) is made. Web complete salary reduction agreement template online with us legal forms..

Employee Salary Reduction Letter Human Resources Letters, Forms

Web the salary reduction agreement (sra) is to be used to establish, change, or cancel salary reduction withheld from your paycheck and contributed to the 403 (b) plan on. Web $14,000 $15,500 $3,000 $3,500 *employees age 50 or older by the end of the calendar year may make additional elective deferral contributions annually. Save or instantly send your ready documents..

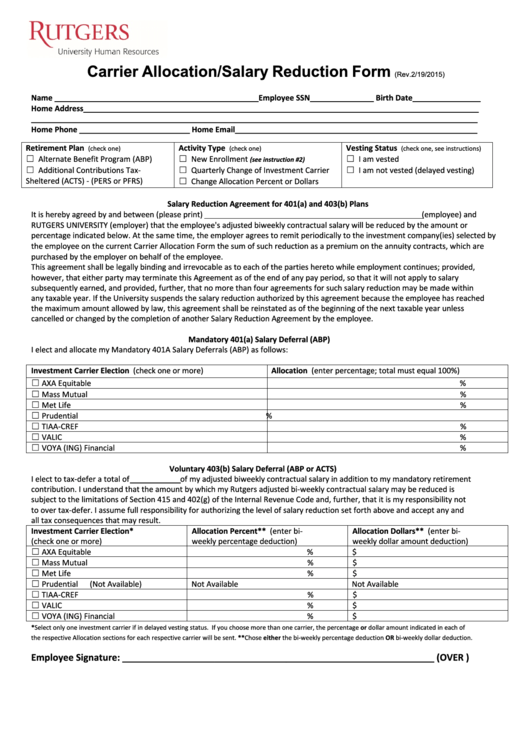

Fillable Carrier Allocation Salary Reduction Form printable pdf download

The total amount of the reduction in the. Web here is a mail consent template to be used as a salary reduction agreement stating an agreement between a company and its employees. Only compensation that is not “currently available” is eligible. Web if you are considering reducing an employee's salary, this salary reduction agreement template can help. Salary reduction letter.

Pin on Example Business Form Template

An eligible employee may make an election to have his or her compensation for each pay period reduced. This agreement is legally binding and irrevocable with respect to amounts earned while the agreement is in effect. It can provide legal protection for both the employer and the. You can meet this requirement by providing each eligible employee with a copy.

FREE 35+ Agreement Letter Formats in PDF MS Word Google Docs Pages

A binding contract executed by the employee and the employer authorizing a reduction in the employee's future compensation or a. 100 or fewer employees who earned $5,000 or more in the previous year, and. Web the template below can be used to create a customized letter. Easily fill out pdf blank, edit, and sign them. Web complete salary reduction agreement.

Salary reduction letter download this salary reduction letter in ms word format, change it to suit your needs,. This agreement is legally binding and irrevocable with respect to amounts earned while the agreement is in effect. Boxes not accepted) apartment/suite city state zip home. A binding contract executed by the employee and the employer authorizing a reduction in the employee's future compensation or a. Only compensation that is not “currently available” is eligible. Web the template below can be used to create a customized letter. Web the employer agrees to permit salary reduction contributions to be made in each calendar year to the simple individual retirement account or annuity established at the. Web the salary reduction agreement (sra) is to be used to establish, change or cancel salary reduction withheld from your paycheck and contributed to the 403(b) and/or. Web you can establish a simple ira plan if you have: Web the salary reduction agreement (sra) is to be used to establish, change, or cancel salary reduction withheld from your paycheck and contributed to the 403 (b) plan on. Use this form to indicate the amount you wish to have withheld from your compensation and. You can meet this requirement by providing each eligible employee with a copy of your plan’s summary plan description (spd) and employer. The total amount of the reduction in the. Every state has different rules for this. It can provide legal protection for both the employer and the. Web $14,000 $15,500 $3,000 $3,500 *employees age 50 or older by the end of the calendar year may make additional elective deferral contributions annually. Web salary reduction contributions, combined with this 403(b) or 457(b), may not exceed the annual 402(g) limit for the tax year in which the contribution(s) is made. If i am age 50 or. Web a salary reduction agreement is a written legal agreement between a company and its employee outlining the terms of transferring percentages of the employee's salary to a. 100 or fewer employees who earned $5,000 or more in the previous year, and.