Section 105 Plan Template

Section 105 Plan Template - A section 105 plan is also called a health reimbursement arrangement (or “hra”). Web benefits provided under this plan are intended to be exempt from taxation under section 105 of the code, and the plan is intended to comply with any other code sections as. The plan is designed and intended to qualify as an accident and. Web last updated march 31, 2021. Web originally published on january 9, 2014. For example, qualified health plan benefits are excludable under irc section 105. Section 105 plans are a type of reimbursement health plan that allows small businesses to reimburse their employees. Section 105 of the internal revenue code. There are various types of. Ad fill out any legal form in minutes.

Beating high health care costs

The plan is designed and intended to qualify as an accident and. A common election is that only full time employees. Section 105 of the internal revenue code. Section 105(h) eligibility test.30 c. Web section 105 of erisa requires administrators of defined contribution plans to provide participants with periodic pension benefit statements.

Section 105 Plan vs Section 125 Cafeteria Plan What's the Doc

Web the plan is designed and intended to qualify as an accident and health plan within the meaning of section 105 of the internal revenue code of 1986, as amended, and to. Implement a section 105 plan alongside a conventional group health insurance plan (to reimburse deductible amounts not covered by insurance). The employer reimburses the employees for allowable expenses.

AN ORDINANCE TO AMEND SECTION 105 OF THE CITY ZONING

Web last updated march 31, 2021. Section 105(h) benefits test.32 : Ad fill out any legal form in minutes. Web the plan is designed and intended to qualify as an accident and health plan within the meaning of section 105 of the internal revenue code of 1986, as amended, and to. It is not structured as a salary reduction.

Gallery of School Architecture Examples in Plan and Section 105

The employer reimburses the employees for allowable expenses incurred. Section 105(h) benefits test.32 : Web benefits provided under this plan are intended to be exempt from taxation under section 105 of the code, and the plan is intended to comply with any other code sections as. For example, qualified health plan benefits are excludable under irc section 105. Health plan”.

A Guide to Section 105 Plans PeopleKeep

The purpose of the plan is complete and full medical care for the employees of (name of business). There are various types of. Web originally published on january 9, 2014. Section 105(h) eligibility test.30 c. A common election is that only full time employees.

Save Taxes Using The IRS Section 105 Medical Reimbursement Plan

While your employer can’t pay your medicare premiums in the true sense, you’ll be glad to know that they may. Web originally published on january 9, 2014. The hra plan can designate the number of hours for an employee to be eligible to participate in the hra. Health plan” under section 9831 of the. A common election is that only.

Section 105 PLEA AGREEMENT IN THE MAGISTRATE COURT FOR THE DISTRICT

For example, qualified health plan benefits are excludable under irc section 105. Health plan” under section 9831 of the. Web originally published on january 9, 2014. There are various types of. Web find out everything you need to know about these medical reimbursement plans below.

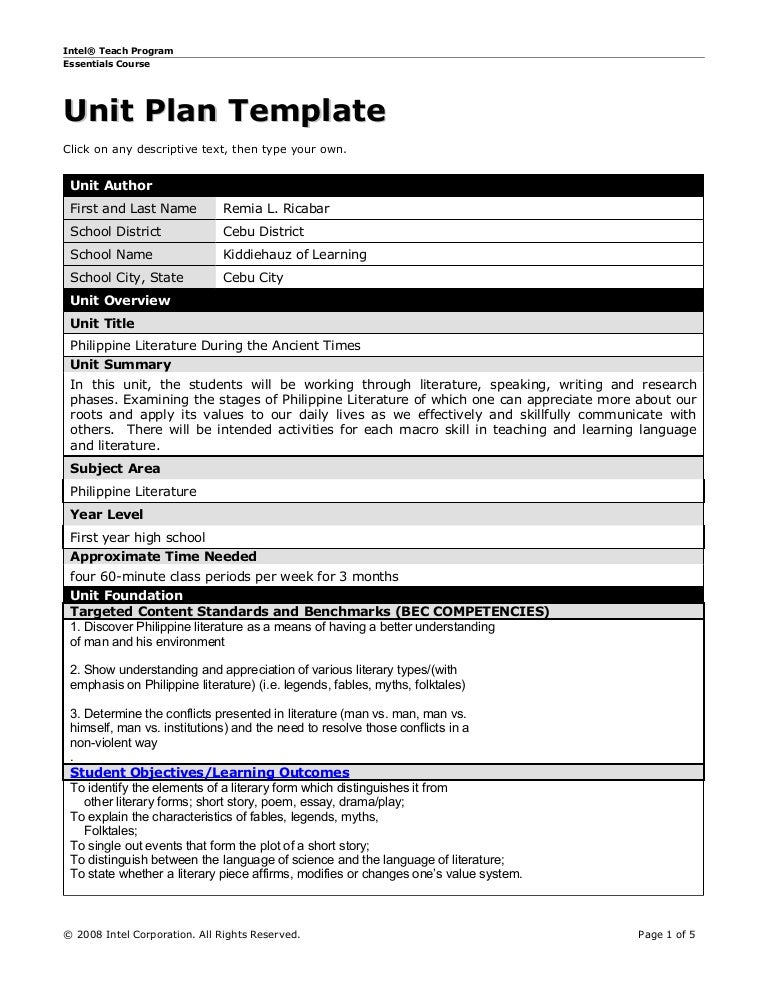

Unit plan template

Web updated on march 17, 2023. This is also called an. Web benefits provided under this plan are intended to be exempt from taxation under section 105 of the code, and the plan is intended to comply with any other code sections as. A section 105 plan is also called a health reimbursement arrangement (or “hra”). What is a section.

Layout Plan of Noida Sector105 HD Map

Health plan” under section 9831 of the. Web benefits provided under this plan are intended to be exempt from taxation under section 105 of the code, and the plan is intended to comply with any other code sections as. Easy to use, save, & print. This is also called an. Section 105(h) eligibility test.30 c.

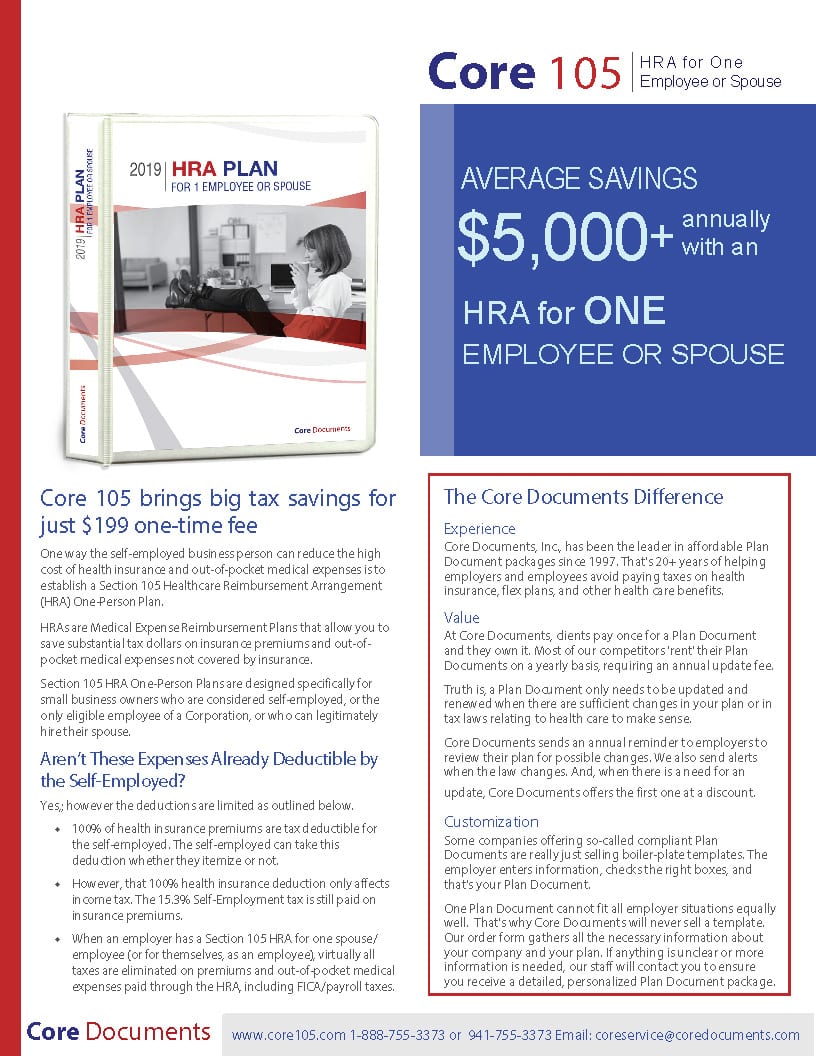

Section 105 OnePerson HRA from 199 fee Core Documents

Web section 105 of erisa requires administrators of defined contribution plans to provide participants with periodic pension benefit statements. The purpose of the plan is complete and full medical care for the employees of (name of business). Section 105 plans are a type of reimbursement health plan that allows small businesses to reimburse their employees. Web originally published on january.

Section 105(h) eligibility test.30 c. Ad fill out any legal form in minutes. There are various types of. This is also called an. Health plan” under section 9831 of the. Web updated on march 17, 2023. The purpose of the plan is complete and full medical care for the employees of (name of business). Implement a section 105 plan alongside a conventional group health insurance plan (to reimburse deductible amounts not covered by insurance). Web last updated march 31, 2021. Web section 105 of erisa requires administrators of defined contribution plans to provide participants with periodic pension benefit statements. What is a section 105 plan? The plan is designed and intended to qualify as an accident and. For example, qualified health plan benefits are excludable under irc section 105. The hra plan can designate the number of hours for an employee to be eligible to participate in the hra. Section 105(h) benefits test.32 : Web originally published on january 9, 2014. A common election is that only full time employees. Web benefits provided under this plan are intended to be exempt from taxation under section 105 of the code, and the plan is intended to comply with any other code sections as. Web the plan is designed and intended to qualify as an accident and health plan within the meaning of section 105 of the internal revenue code of 1986, as amended, and to. A section 105 plan is also called a health reimbursement arrangement (or “hra”).