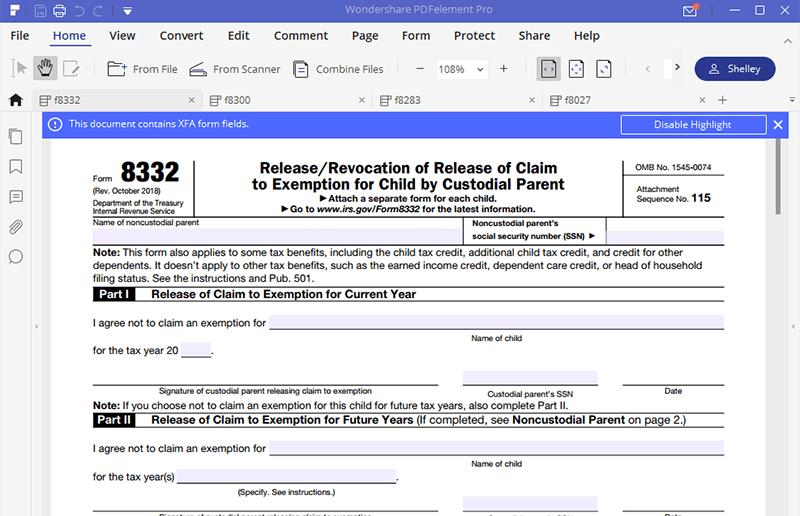

Tax Form 8332 Printable

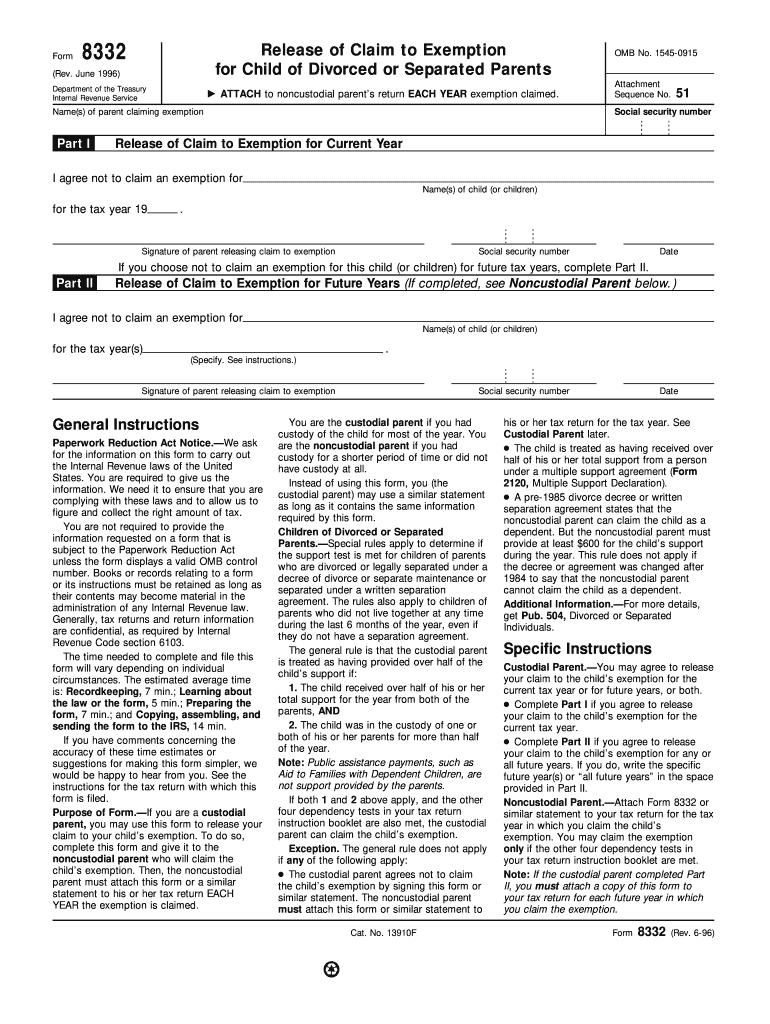

Tax Form 8332 Printable - Web fill online, printable, fillable, blank form 8332 release of claim to child exemption form. Web claim the child tax credit and additional child tax credit for the qualifying child if the custodial parent provides them with form 8332, release/revocation of release of claim to. Web what is the 8332 form? Complete, edit or print tax forms instantly. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Of the claim of exemption for a child or children, which is commonly called the. The release can be revoked, but the revocation is only. Avoid divorce agreement provisions that cannot be enforced (such as requiring one spouse to sign a form 8332 every year). Ad download or email irs 8332 & more fillable forms, register and subscribe now!

IRS Form 8332 Fill it with the Best PDF Form Filler

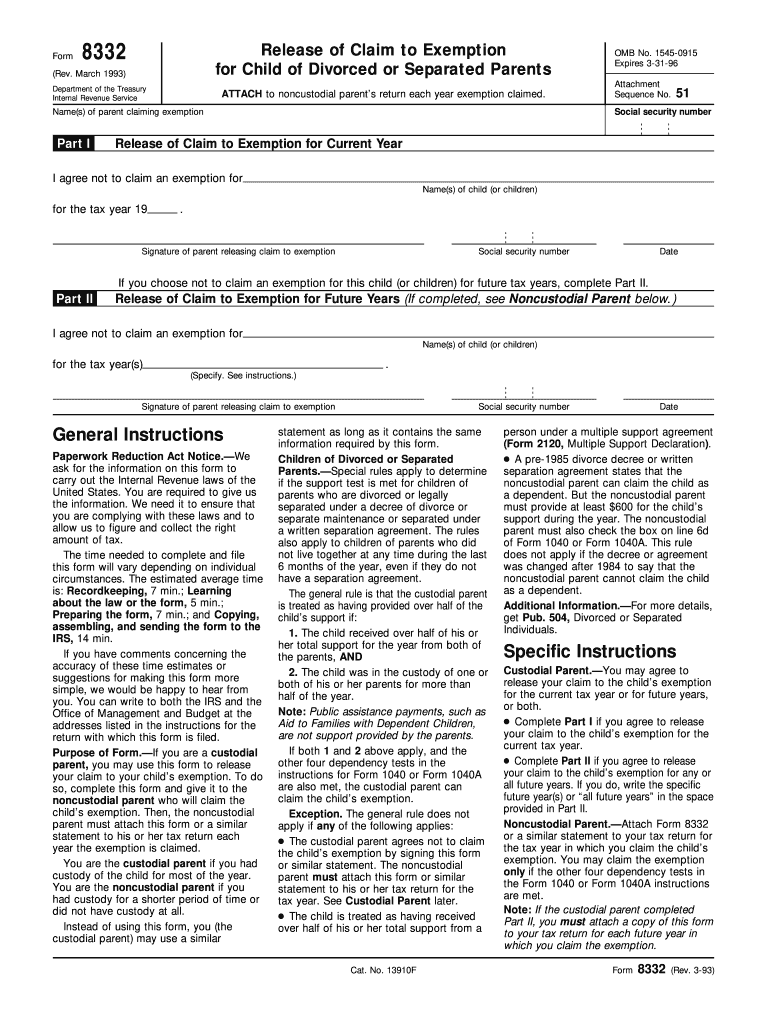

The child is treated as having received over half of his or her total support from a person under a multiple. The release of the dependency exemption. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Web we last updated the release/revocation of release of claim to.

Child Tax Release Form f8332 Tax Exemption Social Security Number

Avoid divorce agreement provisions that cannot be enforced (such as requiring one spouse to sign a form 8332 every year). Web popular forms & instructions; If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. The release can be revoked, but the revocation is only. The form can.

IRS 8332 1993 Fill out Tax Template Online US Legal Forms

Complete, edit or print tax forms instantly. Web form 8332 allows the custodial parent to release the exemptions for a single year or also for future years. The release can be revoked, but the revocation is only. The form can be used for current or future tax. Web form 8332 is the form custodial parents can use to release their.

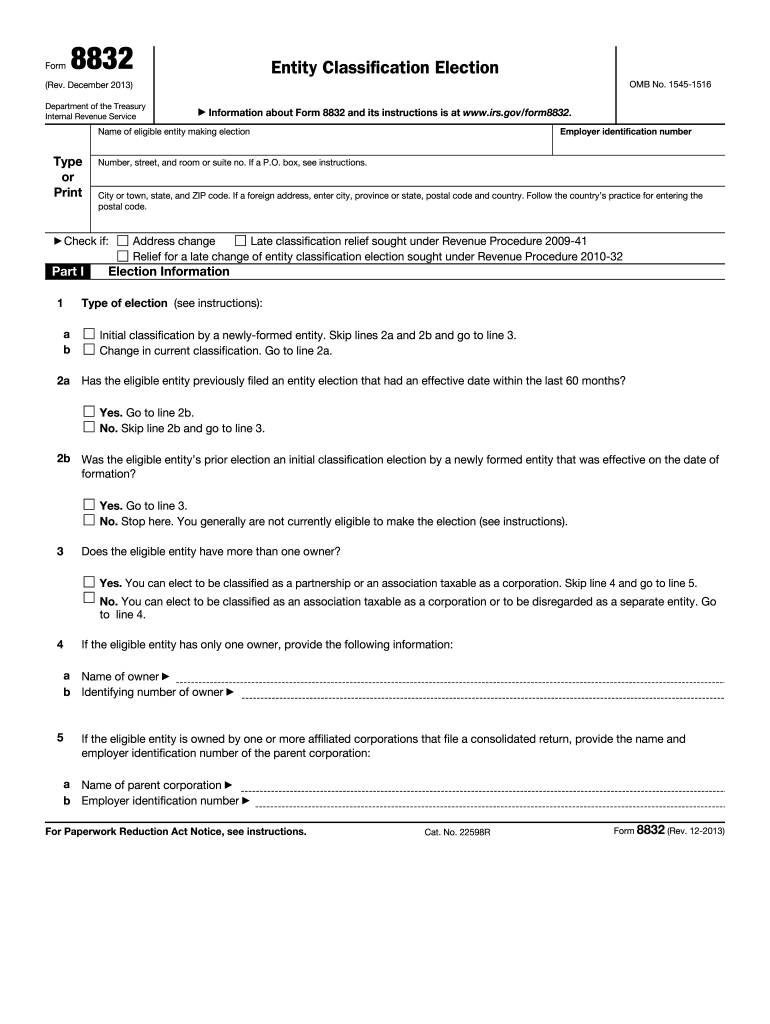

irs form 8832 Fill out & sign online DocHub

Complete, edit or print tax forms instantly. Ad access irs tax forms. Web general instructions purpose of form. Of the claim of exemption for a child or children, which is commonly called the. Web popular forms & instructions;

IRS 8332 20182022 Fill and Sign Printable Template Online US Legal

Complete, edit or print tax forms instantly. Upload, modify or create forms. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Web form 8332 allows the custodial parent to release the exemptions for a single year or also for future years. Of the claim of exemption for.

Irs Form 8332 Printable Printable World Holiday

The release of the dependency exemption. Web if you need to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually only done by the custodial parent), you can do that. Web what is the 8332 form? Web the child’s exemption by signing this form or similar statement. The release can be revoked, but.

Printable Irs Forms 2021 8332 Calendar Printable Free

Get ready for tax season deadlines by completing any required tax forms today. Web claim the child tax credit and additional child tax credit for the qualifying child if the custodial parent provides them with form 8332, release/revocation of release of claim to. Web what is the 8332 form? Web if the custodial parent releases a claim to exemption for.

Tax Form 8332 Printable Printable World Holiday

Upload, modify or create forms. The release can be revoked, but the revocation is only. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to. Of the claim of exemption for a child or children, which is commonly called the. Web form 8332 is.

Does Form 8332 Need To Be Notarized Fill Online, Printable, Fillable

If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Web if you need to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually only done by the custodial parent), you can do that. Web if the custodial parent releases a.

Irs Form 8332 Printable Printable World Holiday

The tax form 8332 printable is a short document that only takes up half a page. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to. Web general instructions purpose of form. Use fill to complete blank online irs pdf forms for free. Web.

Get ready for tax season deadlines by completing any required tax forms today. Web popular forms & instructions; If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Web what is the 8332 form? Complete, edit or print tax forms instantly. Web if the custodial parent releases a claim to exemption for a child by signing a form 8332, release/revocation of release of claim to exemption for child by custodial parent, or a. Web if you need to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually only done by the custodial parent), you can do that. Web the child’s exemption by signing this form or similar statement. The release can be revoked, but the revocation is only. The tax form 8332 printable is a short document that only takes up half a page. The release of the dependency exemption. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to. Use fill to complete blank online irs pdf forms for free. Web claim the child tax credit and additional child tax credit for the qualifying child if the custodial parent provides them with form 8332, release/revocation of release of claim to. The form can be used for current or future tax. Try it for free now! Individual tax return form 1040 instructions; Avoid divorce agreement provisions that cannot be enforced (such as requiring one spouse to sign a form 8332 every year). The child is treated as having received over half of his or her total support from a person under a multiple. Ad download or email irs 8332 & more fillable forms, register and subscribe now!